A good time to invest in BP...?

It's no use crying over split milk, or oil. BP has leaked more shareholder value than any other oil company over the past six months.

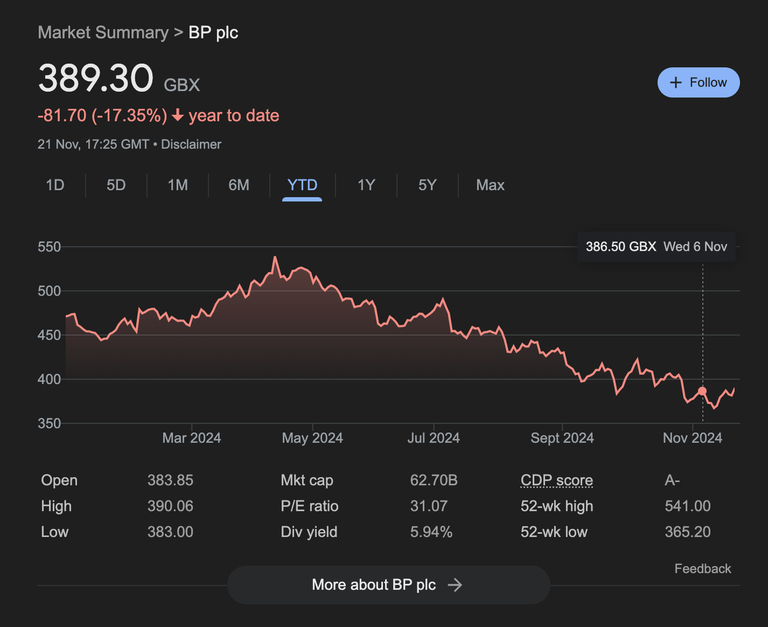

Anyone who bought back in spring 2024 would have lost 25% of their investment.

So what's been occuring....?

BP is one of the grand old names of the FTSE 100 so it's maybe surprising to see it on such a steady and persistent decline for so long.

Analysts have put this down to something of an identity crisis, which is illustrated by

former CEO Benard Looney setting the arbitrary target of reducing oil and gas production by 25% by 2030, and it seems the markets have reacted.

I mean it would seem that investors haven't been too certain about what BP is focussing on... it is traditionally an oil and gas company, but it's now piling 30% of its capital into renewables...

Or maybe...?

"BP has been increasing its investment in renewables, but has also been scaling back its renewable energy ambitions:

Investment growth

In 2022, BP invested 30% of its capital expenditure in transition growth engines (TGEs), which includes renewables, bioenergy, hydrogen, and EV charging. This is up from 3% in 2019. BP plans to increase its investment in TGEs to around 50% by 2030.

So it's going to scale back it's investment in renewables, but also increase it to 50%, so what are they committed to DECREASING the size of the company...?

I mean this TERRIBLE Communications.

And possibly this is what has spooked investors... If you're only middling and oil and gas, and only middling at renewables, then you are not very investible.

And then there's the fact that I don't quite trust an oil company to lead the way in renewables investment, it seems like it's almost hedging its bets rather than embracing the shift to a renewable energy base....?

Or maybe BP has got it right...?

I mean transitioning is difficult, we are talking about a once in a century shift in the energy base for our entire global population.

Is it any surprise that a company would be cautious...? And YES this means less focus on expanding exploration of the cheap but polluting stuff, but now it's committed such a huge amount of capital to renewables maybe this puts it in a better position to compete going forwards, especially with the UK government looking to invest heavily in Green Tech, and this is a British company, after all.

It might just be a good time to invest in BP...?!?

Posted Using InLeo Alpha

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 650000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPIt doesn't look bad at all at this prices, perhaps A little bit lower would be better.

Also the Dividend Yield seems at top now which is a good Buy indicator...the only problem with this kind of industry is that is very cyclical and seems in declining trend in the daily since 2012 so, if you buy it for the long run, ie 5 years, perhaps is not a good decision, if you buy for the mid term (2 years), you may get a good rise...

Interesting thanks for the input!

These companies have lobbied to delay the energy transition so I have little sympathy for them. They have tried to greenwash themselves. I am not expecting the necessary action from the COP.

I get that investors are focused on profits, but we're zooming towards catastrophe. I've tried to have an ethical dimension to my own investments. I know I'm not typical.

It's just a matter of trying to find the ethical investments that pay, some green firms, could maybe do quite weill?!?

Wrong, buy strength not weakness.

Exxon Mobile is a better choice as an oil company.

Fully agree

Maybe short term, but I would have thought long term, as in decades, the companies which set themselves up for green tech are likely to do better. Maybe?

Don't think so, Shell is already scaling back its green energy.

At the moment the markets are bullish so this can be a good opportunity to buy and profit.

Have a look at Ashtead and Diploma, two good FSTE performers with increasing earnings and a good long term track record. Ashtead is one of those companies I have watched for years, and for many of those years I said to myself.. "too late, you missed it", similar to my Apple story...but nevertheless it keeps performing, so a couple of years ago I started accumulating, it has not been a disappointment.

Diploma I know from the industry I work in ( Life Science Consumables), they are a multi faceted company, kind of a mini conglomerate focusing on key certain sectors that are more or less the "picks and shovels" of Industry and Science.

I dabbled with BP a few yrs ago, mainly attracted by the yield at the time, but the share never really performed for me , so I ditched it at a small profit and decided to go for companies with a better track record and more prospects, I saw BP as a stale giant, bumbling along rather disappointingly.

A nice speculative Tech play that is debt free, growing earnings and profit is BOKU, they are in the e-payments sector.

And my current favourite, TRAINLINE, I have used their app for years ( I don't/can't drive) and found it seamless, easy and it saves me on train fares, so if the product works for me, Mr. Low Tech Average, I reckoned it was good. Again, growing in all the right ways and ofc, NFA, but it looks set for a nice breakout from current consolidations levels

OK thanks for the tips, I'll explore!

Am not into dip but one should study the market closely before investing. From the graph it sure wasnt a good idea to buy at that time