Inflation and real state

Hello!

If you take a look at what inflation is doing to the world you will find that most people think they are smart. Some of their investments are appreciating in nominal terms but not in real terms. What this means is that they see their $ value increase while the real value of their dollars discounting inflation is not increasing.

The best example is people in real state. There are some places that maybe can outpace inflation like first line beach real state. However, almost all the regular houses that middle class people buy are not.

I’m included in this pack, the apartment that I bought last year has appreciated in value a few thousand dollars, however that’s nothing else that inflation having it’s own effect. I know it because the real state builder is selling the same apartments as me at a higher price. They just have more costs associated with building the apartment and they just have to increase the price. They are not winning more money than before, they are just trying to not be diluted by inflation.

So far people like Luke Mikic from twitter think that Real state is like a shitcoin. In his own words:

Real estate investing is a shitcoin that can’t outperform the 7% hurdle rate of fiats annual debasement.

Meanwhile Germany...

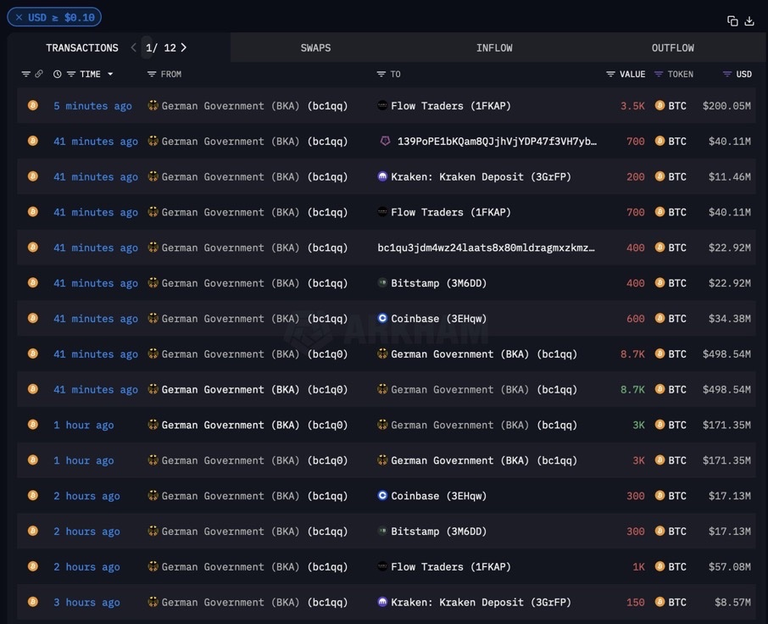

Selling another 8,000 Bitcoin. The biggest mistake of the 21st century!

8,000 less coins for their balance to be exactly 0. Funny how bankrupt governments are selling the hardest asset.

See here the last transactions:

I hope you had a great day.

Stay safe out there! A lot of volatility lately!

Posted Using InLeo Alpha

Real estate values may rise nominally, but not always in real terms due to inflation's impact. It's a challenge many face no doubt

A nemesis of crypto will be having a large amount of crypto in the hands of a single government.