Dividend Based Investing - How to Identify a Good Dividend Stock Part 2 of 5

Dividend Investing

Dividend investing is an easy way to earn passive income. A $10,000 investment in a stock with a 5% dividend yield will provide you with $500 in yearly dividend income – all without you doing anything! So this is like an easy way to FIRE, which also stands for Financial Independence Retirement Early.

In fact, the best dividend stocks can boost your total returns over time through a combination of dividend payouts and stock price appreciation. Think of, an enhanced compounding effect!

But not all dividend stocks are a good investment. For example, a stock with a very high dividend yield might turn out to be a dividend trap.

Criteria for Choosing Dividend Stocks

So now, there are 5 indicators that helps us identify a good dividend stock

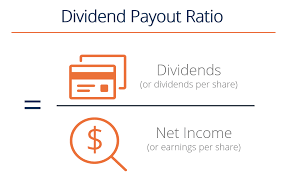

Dividend Payout Ratio

he dividend payout ratio is the percentage of a company’s earnings used to make dividend payments. It’s calculated by dividing the dividend per share by the earnings per share (EPS).

The payout ratio gives an indication of whether a company is using too little or too much of its cash resources for dividends. Generally speaking, a ratio of 50% or more would be considered high since more than half of the company’s profits are being returned to shareholders as dividends.

But a payout ratio that is too high (75% or more) may mean that the dividend is unsustainable. The company may cut or suspend dividends if it runs into cash flow problems.

Ultimately, payout ratios can vary by sectors, so there are no hard-and-fast rules when it comes to determining a “good” payout ratio.

Source of potential text plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud.

Guide: Why and How People Abuse and Plagiarise

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.