HBD require massive liquidity pool before marketing 20% APR as stable coin

HBD require massive liquidity pool before marketing 20% APR as stable coin

Hive blockchain is offering 20% APR in HBD and HBD is a stable coin that is backed by Hive, it means by offering 1 HBD you can get $1 worth of Hive by converting HBD into hive using the blockchain feature.

So if it really a guarantee of getting $1 in Hive then why stable coin HBD go down to the 95 cents ?

Actually ,I feel that HBD move in some kind of tandem with Hive prices, if Hive prices go down ,so do the HBD price and if Hive price remain stable and go up, they also maintain there peg value of 1 USA

Current Blockchain conversion mechanism for HBD to Hive.

Now , you will be thinking if blockchain is itself giving $1 worth of Hive then users will be taking benefit of it instantly and HBD should no go down below peg because it make sense to get Hive using HBD as it will give discount.

BLockchain converts but it take 3.5 days and I guess it take average of the prices of 3.5 days and it take 5% surcharge for conversion.

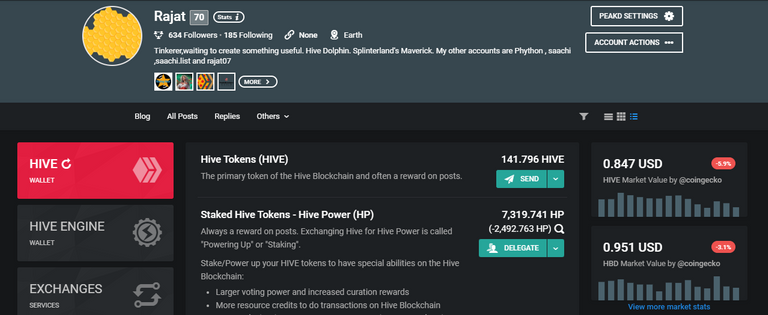

So actually conversion mechanism is slow and it does not give any guarantee of what you will get after 3.5 days and top of it 5% fees to convert it to Hive. If you see above picture, you will see how volatile is market in a single day, so in 3.5 days , you will never knowing where Hive and HBD prices will be and 5% penalty is surely not driving thing too much.

May be some instant transaction or locking value of Hive/HBD received after 3.5 days beforehand might mitigate the issue.

A massive liquidity pool with other stable coin will fix this issue.

If now we look at the pHBD-USDC liquidity pool at Polygon chain at Polycub Farm. pHBD is wrapped HBD in Polygon chain

Look like pHBD is trading above $1 and rarely went below 99 cents, so this make me realize if a massive liquidity pool exist between HBD and other stable coin then only it make HBD more stable to it's peg value and users can instantly swap HBD if it start losing it's peg value and it will help in maintaining it's peg value and also will make sure that no investor will face liquidity problem while entering and exiting from the HBD market.

I think step by Leofinance team by creating pool is a good step but until it do not get more liquidity it is looking like HBD is expected to swing 3-4 % of it's peg value.

Posted Using LeoFinance Beta

Lately it has been more stable than usual. The liquidity pool is essential but it has to increase in size to be effective. I'm sure it would get done.

Posted Using LeoFinance Beta

It require cooperation of many to get that strong liquidity pool and it is really important for HBD too.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

The liquidity is improving every single day, I think that won’t be a problem

More sooner it can be done , it will be more better. let see how much time it will take to reach on million pHBD.

Posted Using LeoFinance Beta

There is a diesel pool for it (BUSD/HBD) but it has really low liquidity. The DHF proposal submitted also didn't really get the support of the large stakeholders so I don't think they care too much about the pHBD/USDC pool.

Posted Using LeoFinance Beta