The Token Hunter - Crypto Alpha Opportunities on Ethereum and Layer-2 Blockchains

Looking for airdrops makes me feel ALIVE! Finding the best opportunities makes me feel AliveAndThriving!

There are many rumors about airdrops and many protocols that are yet to launch their governance tokens. I found an amazing Twitter thread from OlimpioCrypto, where he shares some big alpha signals.

Before we start: Airdrops, on their current form, will not last forever. Mercenary sybiloors who come, farm, dump are unsustainable. I strongly discourage this: it only hurts protocols, and you will get excluded Engage and perform regular operations. Get to know the protocol!

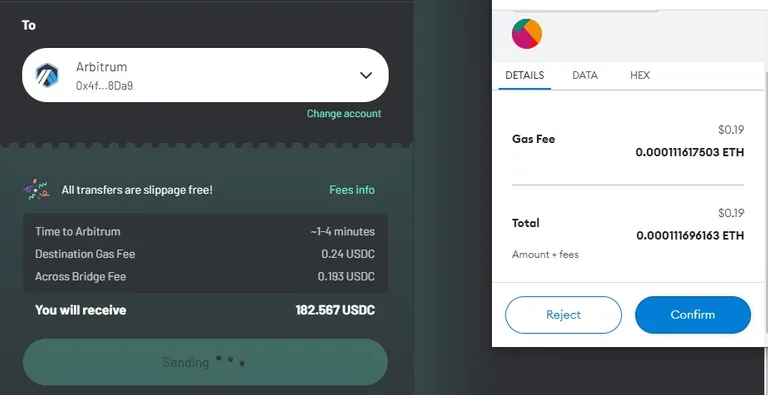

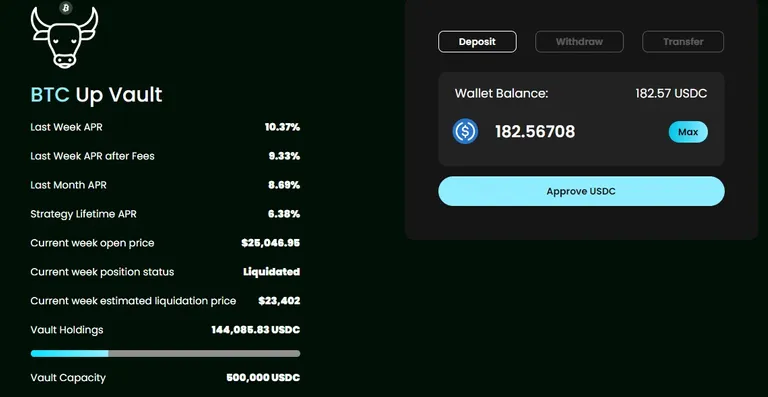

The DeFi experiment started on Optimism, where the USDC was staked on PoolTogether. I withdrew $183 and used Across Protocol to bridge the USDC to Arbitrum, where the journey for ticking boxes for eventual airdrops starts. We will explore 5 no-token protocols that could potentially make an airdrop (ChainHopDEX, overnight_fi, lifiprotocol, aztecnetwork, VovoFinance) and Across Protocol for the already announced $ACX tokens

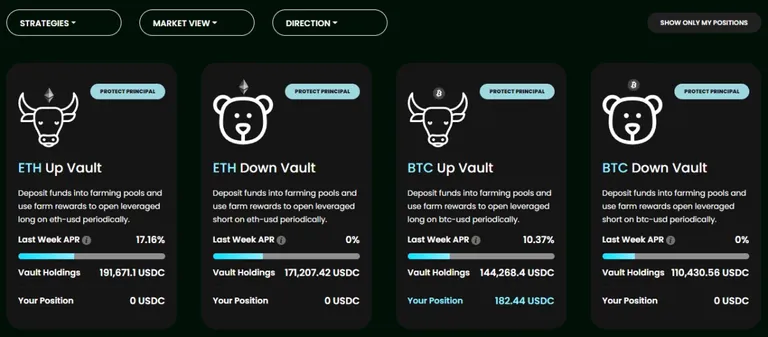

The quest for future airdrops started on Vovo, a protocol that allows speculating on ETH and BTC prices with leverage. The available options are "BTCUP", "ETHDOWN" strategies where you deposit USDC and you speculate on price.

Vovo Finance is on Arbitrum and I used the bridged USDC to deposit them into the BTC Up vault, which had 10.37% APR last week. Took them out after one day and moved to the next step of the airdrop hunt.

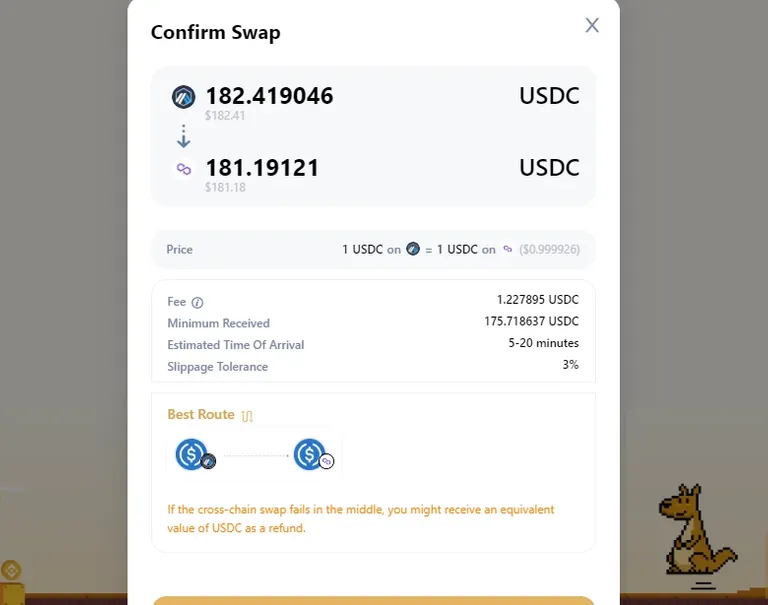

I used ChainHopDEX to bridge the USDC from Arbitrum to Polygon. Chain Hop supports several blockchains and Layer2, with a swap option included in the transfer dashboard. You can bridge a token into another chain, or swap it for something else before it reaches the new destination.

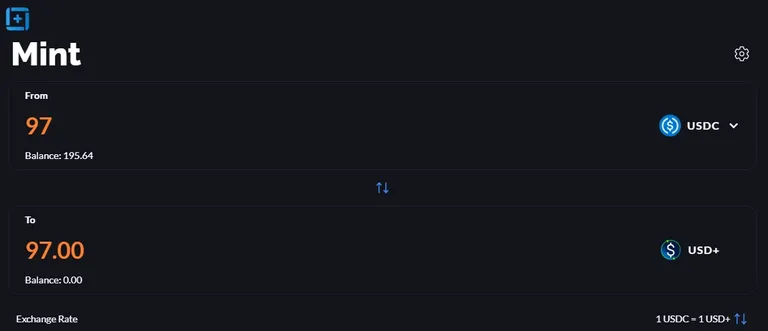

I moved to fine DeFi, as I minted USD+ on @overnight_fi. The USD+ stablecoin is backed 1-1 backed with USDC and gains interest at approximately 9% APY. The interest rate comes from the USD+ investments on DeFi strategies that makes it work as a risk fund.

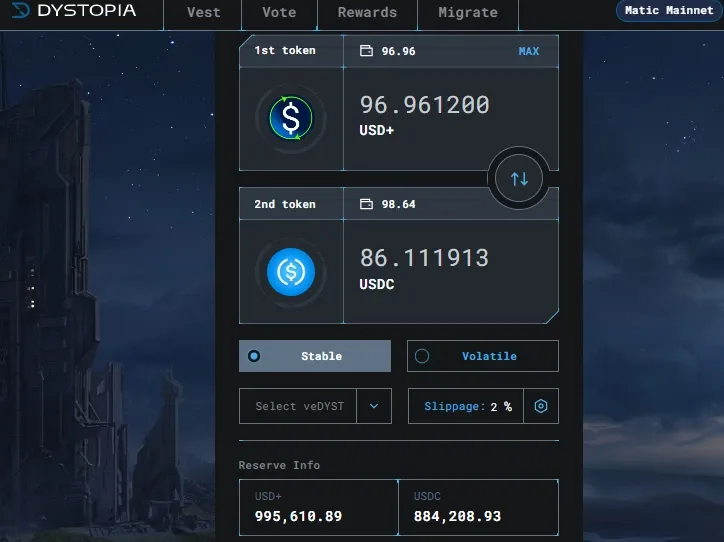

Overnight Finance is on Polygon, and I used the USDC sent with ChainHop to mint half into USD+. The next step was to create USD+/ USDC LP for the farms powered by Dystopia. Free Matic for gas can be obtained from the http://matic.supply faucet.

I enjoyed Overnight Finance the most, as the interface was straight forward and easy to use. Created the USDC/USD+ LP and stake it in a pool that has already nearly 2,000,000 TVL.

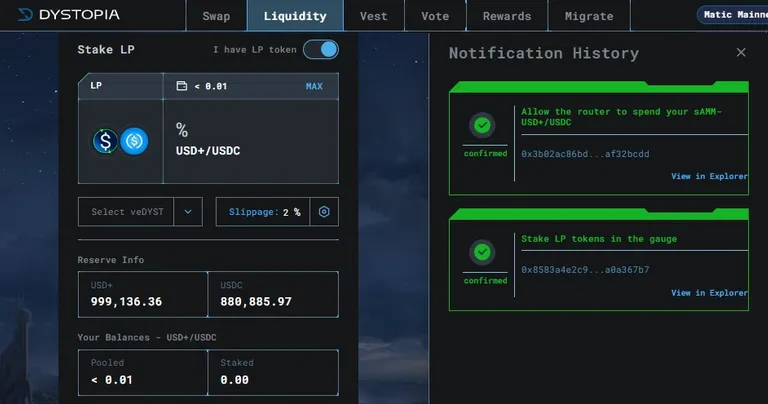

Once the LP was created, I ticked the "I have LP token" button and pooled "MAX" in few seconds. The notification history gives extra points to Dystopia, as the process is made clear and visual even for the DeFi beginners.

Two days later I removed the LP and moved to the next step of the Airdrop Hunt. Time to head over to another bridge, and hope they will announce a token drop soon.

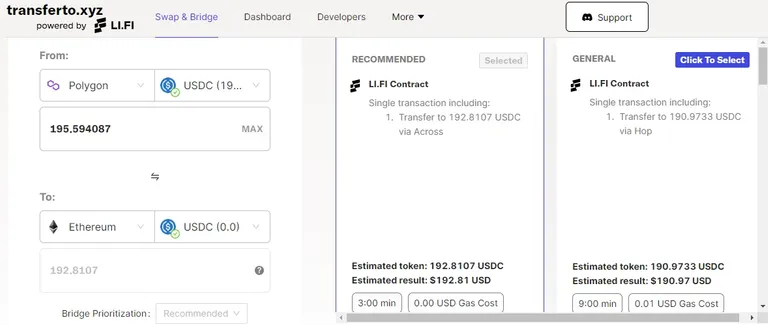

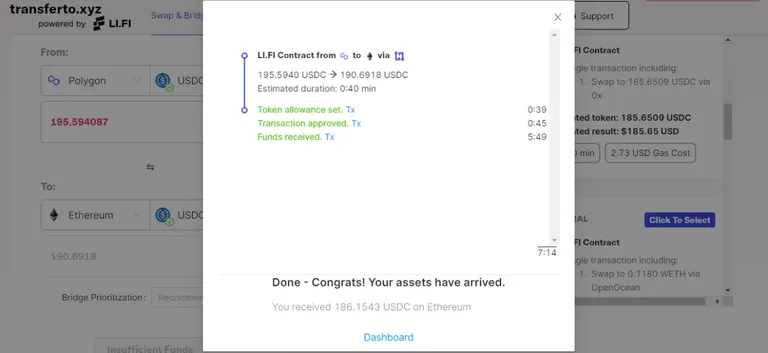

I used tranferto.xyz by lifiprotocol to bridge the USDC from Polygon to Ethereum Mainnet. LI FI is a bridge aggregator, combining and analyzing all the bridging options to identify the cheapest path for the transfer. As I said above, Across Protocol is the cheapest, fastest and most secure bridge ... and was the recommended LI.FI route.

Therefore, I used http://transferto.xyz from LiFi to bridge USDC from Polygon to Ethereum and come one step closer to the end of the adventure. It took only 7 minutes even if the estimate duration was 40 minutes.

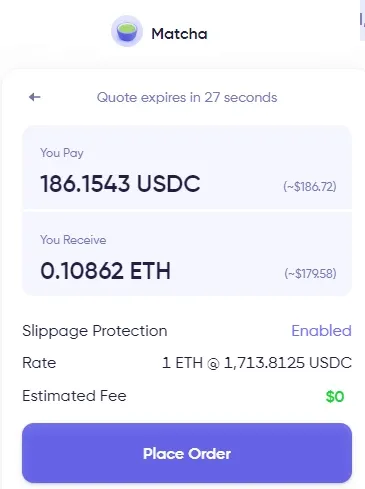

We are nearly at the end, using Matcha to swap USDC into ETH. The matchaxyz Dapp finds the best prices across exchanges and combines them into one trade. This is a tool that I must remember to use more often.

Matcha helped me to swap 186.15 USDC into 0.108 ETH with an estimated fee of zero dollars. The fee was not zero, as I paid approximately 7 dollars for the swap. If you are doing DeFi on layer-2 this may look expensive but trust me it was a good deal on mainnet.

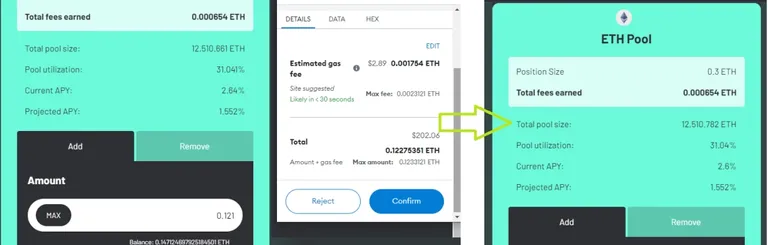

I am sharing a personal Alpha signal! The Across Protocol ETH Pool that rewards the LP providers with both ETH from fees and $ACX tokens from the planned distribution. I already had 0.179 ETH staked in the pool, and earned some fees in the 2 weeks of staking.

I used the ETH swapped on http://matcha.xyz and add it into the ETH Pool to upgrade my position size. I now have 0.3 ETH and will earn more ETH from fees plus some extra $ACX tokens. Read the full Across Strategy in my $ACX article

I lost few USDC while staking and bridging on multiple chains, and time will tell if the hunt for airdrops was successful or not. If one of the protocols I used above will mint their own tokens, then I hope I completed the airdrop criteria before the snapshot. Patience is a virtue, and hunting for airdrops is an art.

Residual Income:

DeFi bounty at CakeDeFi with $30 DFI for new user

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN