Why do we make bad financial choices?

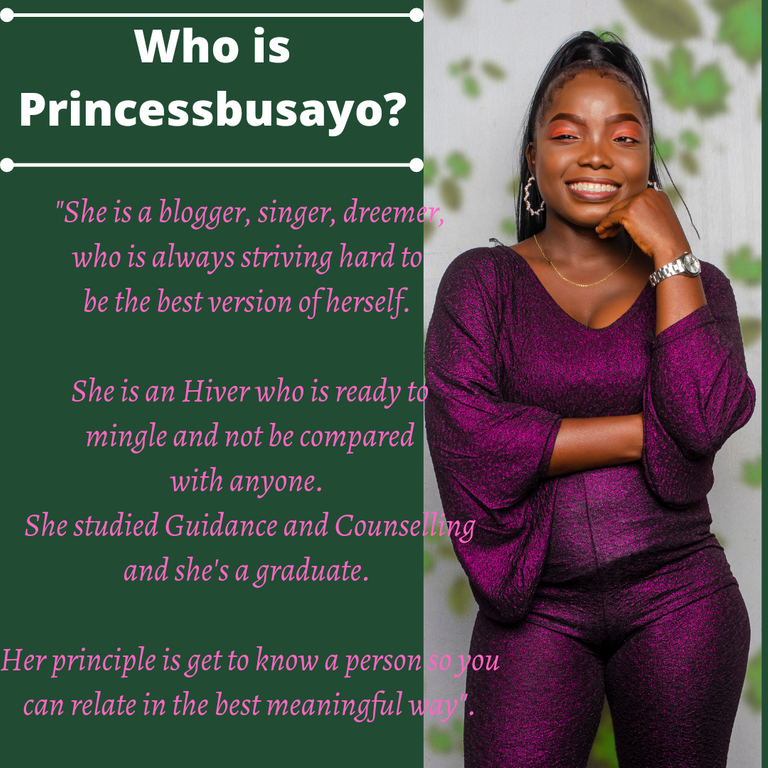

Karolina from Pexels and designed on Canva

First things first, the world we are in, is uncertain. We do not know what tomorrow might be and many times we are caught unaware, unprepared, and unplanned. Being financially stable or balanced is more important than ever and this factor is bound to the decisions we make.

We tend to make bad choices due to different factors like not having complete knowledge, impulsivity or stress, but it is essential to consider the causes of making bad financial choices and the way to fix them as best as we can.

The need to save

As the world is so uncertain, which means anything can happen or go wrong, we could need some extra amount of money at any point. Most people don't save and this is one very big mistake they are making. There is a need to save by putting money away regularly to have an emergency fund and be sure that you get to make the right choices for your health and well-being if something goes wrong.

Savings is important just as we have been reading from different authors. Though, saving is less fun than spending impulsively, without a doubt, pays off better in a long term.

Learn from people with similar goals

In today's world, many of us are introduced to other people's lifestyles more than ever. However, it is crucial to be more than careful with the lessons we get or take from their lives. We should not make our choices by going with other people whose goals are different from ours or picking a lifestyle so distinct it might as well be strange to us.

This is why it is important to take note of who your role models are before you make any financial choices and whether these role models adhere to what you want in life.

For example, an influencer who travels a lot and spends a lot of tickets and lodging in the most expensive hotel and other things added to their lifestyles, but that is not the best aspiration to have for someone more of a home bird or one aspiring to have more stability in their lives.

Do proper research

We are frequently uninformed about financial matters and we fail to learn more about them by ourselves. We might feel that the topic itself is boring or too hard to understand. But this is a bad mindset that could be dangerous to us.

When money is concerned, it is expedient for us to do our research on it so we aren't making any bad choices or so that we aren't being scammed along the way.

For example, some people will come to us, explaining some investments to us and saying if we put in a small amount of money, we would get double of it within a limited time.

If we fail to do our research and go on to say yes, we would be deceived even before we open our eyes widely. Don't believe everything they say to you, but do your research to see if the business is legitimate or not.

Spend less than you earn

To say the fact, many people have bigger expenses than their income. Do not spend what you do not have, instead focus on budgeting and develop a firm understanding of how much you have and how much you can use.

Don't buy expensive things just to show off. There are people in this category but they are making a big mistake if they do not realize it on time. They buy things just to show off and oppress other people, thereby forgetting that being financially stable is paramount to every individual to be free from poverty in life.

For some, the urge to be appreciated and admired has made them buy stuff they do not use. Little do they know that they will not get there through material things.

The pleasure of such an experience is not worth the consequences, and we might end up buying and paying a lot more than what we expect for such a choice.

So, focus on buying quality things and what you know will serve you well, not just those things that look good in pictures.

Thanks for your time on my blog.

Hey, @princessbusayo, I am glad to see your post on Leofinance. Welcome to the community ☺️☺️

I agree with everything you said, we need to learn to save because we do not know what tomorrow holds. And the way to do is to live below our means so we can have something extra to put away.

Thanks for sharing, babe. ❤️

Yea, don't mind me. I have always been procrastinating posting in this community but I pushed myself today and definitely would keep stopping by often too.

You are right! It's important we save so we aren't caught unaware when things we do not expect would happen definitely happen but knowing we are saving will surely save us on the long run and this is why we need to cut down on our expenses for the sake of saving for emergency fund.

Thanks so much for reading! I really appreciate it 💕💕

This was one of the argument I had with a friend some days ago..

"Experience is the best teacher"

And I was like, you don't have to experience something's before you have idea on what they are. You can learn from other people achievement or mistake, but he was adamant that you can only learn through experience. I'm with him in that their are some things that can only be learnt through experience but even before you learn it via your experience, you would have learnt some lessons from others already

So many people are adamant and would want to go their own ways even when people are directing them on the right path. Truly, experience is the best teacher but the question is, are they willing to learn from the experience? Some would rather try it to see how it turns out without learning from the mistakes of others. They think trying it might bring luck but this doesn't happen sometimes.

So, better open your eyes and make your own findings to see if it's worth it or not.

Yes o.. Make your own finding before you do the mistake that would cost one everything

Thank you 😊

What am interesting topic, you just went straight to the point, always make proper research before spending money on a project and spend less than you earn, i was a victim of the second part, i kept working stressful daily without having a tangible savings for a while due to high expenses, high cost of things in the country doesn't even help matter, the moment I decided that no matter what, i just save a particular amount, it has not been easy, but thankfully, it has been working and my savings is better now.

Many of us have made mistakes in the past and seeing ourselves improving in the aspect of savings, we are thanking ourselves for taking such step. Though, it's not easy especially when you aren't earning much that to remove part to save would definitely affect others but there is always a way to something if we are truly determined. We just need to take that bold step and we would see the outcome later in the future.

Thanks for stopping by 👋👏

Hi @princessbusayo, your post has been upvoted by @bdcommunity courtesy of @rem-steem!

Support us by voting as a Hive Witness and/or by delegating HIVE POWER.

JOIN US ON

Thank you so much, @bdcommunity 💕

Material possessions should be put the last priority.. There are more important stuff to consider when budgeting. That's why it's better to list things you really want to buy when going shopping

Budgeting is really important and necessary if one would want to actually monitor how they spend so they don't end up spending more than their income. Thanks so much 🤗

These are simply truth and great reminders for us to evaluate how we are doing in our finances and decisions.

Great to see you in the lion's den PB :)

!LADY

Hehehe! I think I would want to be a Lion fully because I love this community and would be a part. Thank you ma.

That's great and see you around then PB :)

What a great lesson to learn from this write-up, that aspect of show off/oppression really do surprise me with some people I don't know who they are trying to oppress, life is about you alone don't compare yourself with anyone. I have seen people that have showed off by purchasing things that are not relevant instead for them to save, and at the end of the day they end up selling those things at very ridiculous amount when they have urgent need to take care off. On this note, I agreed with you that we should try to spend less than what we earn, because if we spend more than our income then we will be in debt, no wonder some civil servants are living on loan because they have spent more than their income, imagine someone collecting hundred thousand naira (#100,000) at the end of the month as the basic salary and he/she want to use a care of four million naira (#4,000 000) I think there is no way such person will not be in debt at the end of the day. Thanks for sharing, you are the best blogger I have ever known just keep it up..

When we spend more than we earn, definitely we are calling debt into our lives. Why living your life to oppress people? These types end up buying irrelevant stuff and at the end of the day, they start to beg for urgent 2k. Shame on them!

Cut your coat according to your size...

But they won't hear. They love to spend extravagantly, forgetting that the future is always waiting for them and they will realize how foolish they have been.

Thanks so much for stopping by sir.

You welcome 👍

Hey princess 💕❤️🎉🥳🥳

I can sight the updated profile pic 😜, you remember? Lolz 😂👍👍

Wow...I can see you have joined the finance train 🚃 🚃 🚃 🚂🚂, abeg... make me too enter this train oo 😂😂, datz a good one and I love your topic and the content. Infact talk to me personally 🤦

Savings is indeed less fun but it's very vital. I wish some expenses can just rest from my end so that I can do the needful 👍

Thanks for sharing 👍

Hahahaha 😂😂😂 I remembered and I love that I get to update my pics since the first day I got here 😂😂

Yea, I finally did because I love anything about finances especially savings and investment and how to go about it. You sure should join the train too ma 😊

Savings is important but it's difficult when there are too much expenses. I think the best is to have different streams of income where one can be able to save from other sources.

Thanks for showing up ma

Different streams of income is needed and that, I am striving for 👌

✌️ May God help us all.

It is important that we save, however, I want to make a case for those who cannot--low income earners. There are several factors that can contribute to one's ability to save and one of those factors is cost of living which is rarely spoken about. someone who earns $1000 monthly might not have enough to safe after paying rent, in most likely an expensive where he is only likely to get work. My advise to such people who be to increase their earning capacity over time so they can have some surplus money to save.

Exactly my point to someone here too. When you know what you earn presently won't be able to help you save, considering the income that comes in and your expenses at the end of everything, it is important to increase your earning capacity by finding more streams of income and from there, you will have something to save with.

Thanks so much, Nonso 👏

You are welcome

I made my mistakes in the past, but was able to mitigate mosts---- Not my crypto mistakes but I guess in crypto you need to make sure you get more wins than losses and always DYOR

Always DYOR.... It is important so you don't end up regretting. Thank you 😊

Thank you for this. I often wonder why people choose to go crazy over what influencers are doing trying to emulate their lifestyle yet knowing their pocket is narrow. Savings is life saving, I remember when I was so broke that I has no money. It was my savings I fall back on, what if I had no savings, that period would have been frustrating. I wish people would follow your advice and do more research before jumping in to an opportunity.

Lately, I saw a post where, someone said that savings is useless as the money stays in bank not even accumulating interest but rather money should be invested into business that bring back returns thereby increasing our monetary value, what is your view on this?

First of all, I am sorry for replying late.

Though, the person might be right in his own perspective. Let's see it this way;

There are two kinds of saving which are; short and long term. If the money you are saving is for a short term which is term as emergencies, then, you can save perhaps in the bank but to me, I wouldn't advice that because I don't even save in the bank. There are app like cowrywise that gives interest daily. Banks doesn't give but will deduct again.

Then for the long term saving, then this should go for investment where you accrue more interest at the end of the stipulated time.

Just like me, I save in Hbd which gives me interest at the end of the month and it's helping me. Also, for emergency, I use a digital bank since I will still withdraw when I need it anytime.

Hope I have been able to explain this @geelocks?

Wow, thank you for you explanation. I get it now. I also stop saving in the bank, the bank charges these days is crazy.

So crazy. Instead of adding interest, they keep charging us unnecessarily. I'm glad I could explain.

We really need to save up no one knows the future and what will happen.

Reading from @dreemport

Exactly. We save for emergencies. Thank you, Sommylove

Indeed 🙏

You are welcome 😁😁