Moody’s changes French Credit outlook from stable to negative

European shitshow

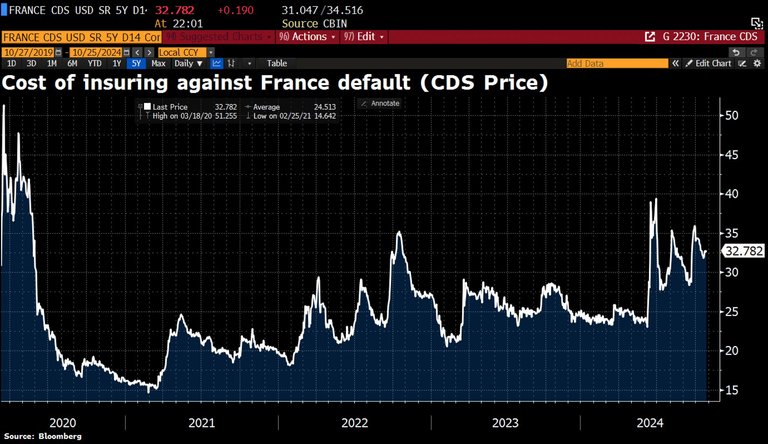

Today a very important move was made against France’s economy by rating bureau Moody’s. They revised the French credit outlook from stable to negative. Which made the insurance premiums against French bonds defaulting spike. The premiums haven’t been this high since the Corona crisis. The reason cited by Moody’s is fiscal deterioration. And of course the already high debt/GDP ratio (almost 120 %).

This of course isn’t going to sink France, but it is going to make them pay a higher interest rate on the refinancing of their loans.

And this could spread to other countries of the European Union. Like Belgium, that also has a very high debt/GDP ratio. Or Germany that is economically in very bad shape at the moment.

Retaliation from Israël?

Other people speek of a payback from Israël to France for the decision of not sending them any weapons anymore. This may seem far fetched, but the tentacles of Israël reach very far. So I would not rule it out completely. Fact is that France is in serious debt, like many Western countries. So, the decision by Moody’s should not come as a surprise.

Sincerely,

Pele23

Posted Using InLeo Alpha