Importance of financial goals

Having the right financial goals will really have an effective way in determining how successful a person can be in life.

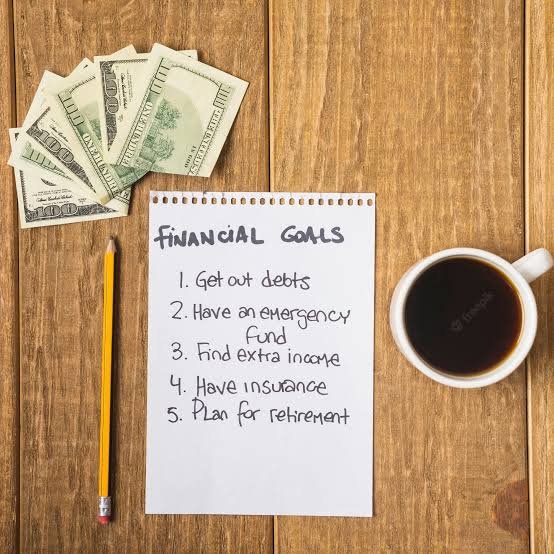

Financial goals are essential for a person's overall well-being and financial stability. They serve as a roadmap that guides an individual towards financial freedom and security. Here are some reasons why having financial goals is important:

Financial goals give people a clear direction on what they want to achieve financially. This helps to prioritize spending, save money and make smart investment decisions. When a person knows what they are working towards, it becomes easier to make informed decisions that will help them achieve their goals.

Financial goals provide a sense of motivation to save and invest. People are more likely to stick to their goals when they have a clear objective in mind. A goal-oriented person is more likely to make positive changes in their spending habits and make an effort to increase their income.

Setting financial goals can help people better manage their expenses. When people know what they are saving for, it becomes easier to avoid unnecessary spending and make smart decisions about their money. This, in turn, helps them to reach their financial goals faster and with less stress.

Financial goals encourage people to save money. When people have a clear objective, it becomes easier to put aside money each month towards their goals. This habit of saving can help to create a safety net for unexpected expenses and provide financial security in the future.

Setting financial goals requires people to become more informed about their finances. They need to know their income, expenses, and debts to create a plan that is achievable. This process of self-education can help people to become more financially literate, which will benefit them in the long-term.

Having financial goals helps people to achieve financial stability. This means that they have enough savings and assets to support themselves and their families without relying on credit or loans. Financial stability provides peace of mind and reduces the stress associated with financial uncertainty.

Financial goals help people to achieve financial independence, which means that they can support themselves and their families without relying on anyone else. Financial independence provides freedom and allows people to make choices about their life without being limited by financial constraints.

Having financial goals is essential for a person's overall financial well-being. It provides a sense of direction, motivation, helps to manage expenses, increases savings, increases financial literacy, improves financial stability, and enables financial independence. By setting financial goals, people can take control of their finances, achieve financial security, and live a more fulfilling life.

Posted Using LeoFinance Beta