MicroStrategy Faces Potential Billions in Tax Liabilities Over Bitcoin Holdings

MicroStrategy, the business intelligence firm led by outspoken Bitcoin proponent Michael Saylor, may face billions in tax liabilities due to its extensive Bitcoin portfolio, currently valued at $47 billion, according to a report by the Wall Street Journal.

With $18 billion in unrealized gains, the company’s case is drawing attention amid shifting U.S. tax policies that could significantly impact corporate cryptocurrency strategies and reshape how firms manage crypto investments.

Tax Implications of MicroStrategy’s Bitcoin Strategy

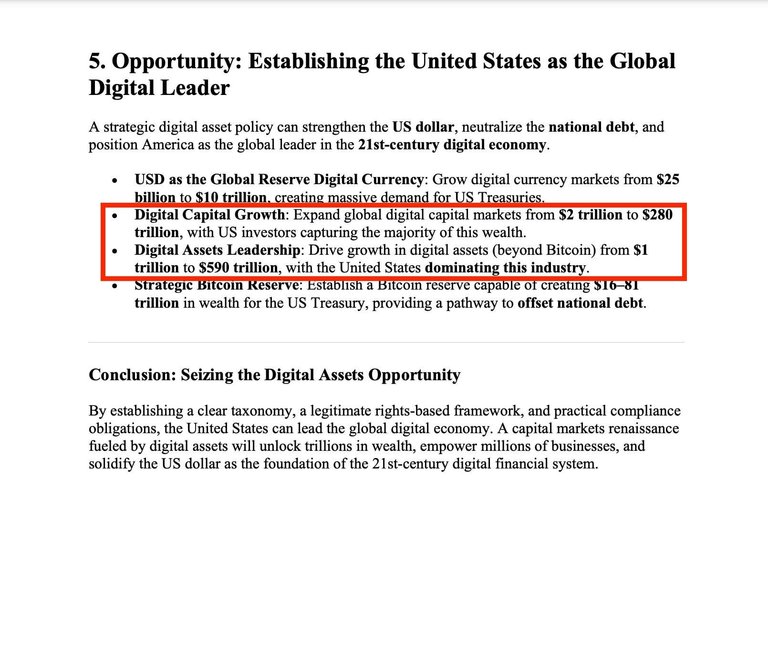

The U.S. Corporate Alternative Minimum Tax (CAMT), introduced through the Inflation Reduction Act, imposes a 15% tax on adjusted GAAP earnings for corporations generating over $1 billion annually. Notably, the tax includes unrealized gains—profits from asset appreciation even if those assets remain unsold.

For MicroStrategy, this tax framework means its Bitcoin holdings, which have appreciated significantly, could result in billions of dollars in tax liabilities starting in 2026.

Key points:

- MicroStrategy’s reported $18 billion in unrealized gains could become taxable under CAMT.

- The company is negotiating with the Internal Revenue Service (IRS) for potential exemptions but has yet to receive a definitive response.

- If enforced, this tax could serve as a precedent, significantly influencing how other corporations approach cryptocurrency investments.

This potential tax liability represents a stark challenge to MicroStrategy’s Bitcoin-centric strategy, which has been a cornerstone of its business model.

MicroStrategy’s Bold Bitcoin Accumulation Strategy

MicroStrategy’s Bitcoin acquisition strategy has been marked by aggressive accumulation and funding through stock and debt offerings. On January 21, the company expanded its Bitcoin portfolio by purchasing 11,000 BTC for $1.1 billion, bringing its total holdings to 461,000 BTC, valued at approximately $29.3 billion.

Key statistics:

- The company’s average cost per Bitcoin now stands at $63,610.

- Despite significant unrealized losses due to market volatility, MicroStrategy’s long-term view on Bitcoin remains unchanged.

Regulatory Scrutiny and Corporate Precedent

MicroStrategy’s case highlights the growing regulatory pressure on cryptocurrency holdings. As the IRS and lawmakers refine taxation policies, the company’s situation could establish a critical precedent for other corporations holding large crypto portfolios.

Potential implications include:

- Wider Corporate Impact: Should CAMT’s unrealized gains provision be enforced, companies like Tesla and Block, which also hold significant Bitcoin reserves, may face similar tax liabilities.

- Increased Risk of Crypto Holdings: Regulatory uncertainty could deter firms from adopting Bitcoin or other cryptocurrencies as treasury assets.

- Shift in Corporate Crypto Strategies: Companies may opt for alternative strategies, such as derivative-based exposure, to mitigate tax risks.

A Double-Edged Sword

While MicroStrategy’s bold Bitcoin strategy has positioned the company as a pioneer in the crypto space, it also exposes the firm to unique risks:

- The firm’s high average purchase price ($63,610 per BTC) has led to unrealized losses, given Bitcoin’s current market price.

- Potential tax liabilities could constrain the company’s ability to continue its Bitcoin acquisition strategy.

Broader Implications for Cryptocurrency Adoption

MicroStrategy’s situation reflects broader tensions in the crypto space, where innovation often clashes with regulatory uncertainty. The resolution of its tax negotiations with the IRS may influence not only corporate crypto adoption but also the broader regulatory landscape:

- A favorable ruling or exemption could encourage more corporations to adopt Bitcoin.

- Conversely, strict enforcement of CAMT could slow adoption and force companies to rethink their crypto strategies.

Conclusion

As one of the largest institutional Bitcoin holders, MicroStrategy has become a bellwether for corporate cryptocurrency strategies. However, its potential billion-dollar tax liabilities highlight the risks of large-scale crypto adoption in an evolving regulatory environment.

The resolution of these tax challenges, coupled with the company’s relentless Bitcoin accumulation, will shape both MicroStrategy’s future and the broader corporate approach to cryptocurrency investment. Whether this gamble will pay off or lead to regulatory setbacks remains a pivotal question for the industry.

Governments around the world have been talking about taxing unrealised gains, while keeping remarkably quiet about tax rebates for unrealised losses.

If implemented, it makes tax calculations mind-numbingly complex as you're adjusting for long periods into the past and future. More importantly, it is a massive disincentive to investment, and if implemented on real estate becomes a massive transfer of wealth to the government as people are forced to sell their houses to pay tax bills based on money they may (or may not) receive in several decades time.

Congratulations @mikezillo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThis post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

https://www.reddit.com/r/CryptoCurrency/comments/1iakpgl/microstrategy_faces_potential_billions_in_tax/

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.