Europe’s Emergence as a Cryptocurrency Trading Powerhouse: Key Insights from CoinWire’s Study

Europe's Leading Role in Cryptocurrency Trading

According to a study by CoinWire, Europe is well-positioned to become a major force in cryptocurrency trading. The report estimates that global crypto transaction volumes will exceed $108 trillion by the end of the year, marking a nearly 90% increase from 2022. This highlights the explosive growth in the crypto trading sector.

Current and Projected Trading Volumes

While the United States leads in trading volume per country, expected to surpass $2 trillion in 2024, Europe is emerging as the overall leader. Europe accounts for 37.32% of global crypto transactions. This share is projected to nearly triple from $15 trillion in 2022 to $40.5 trillion this year.

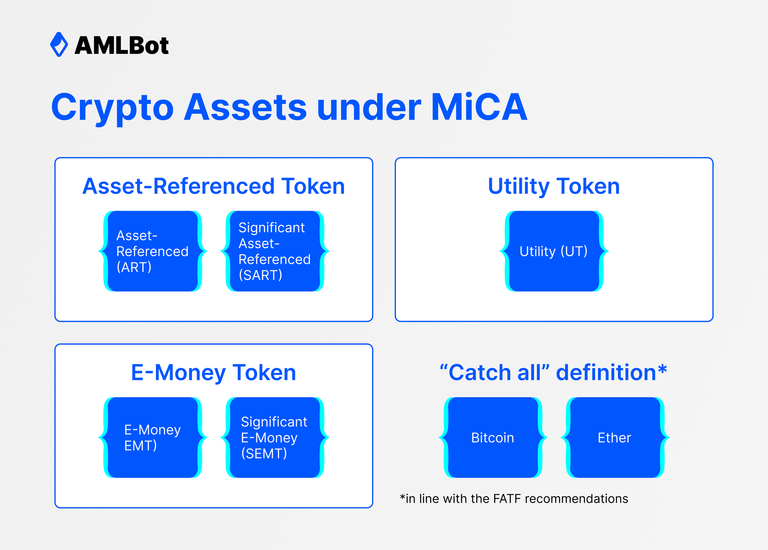

Regulatory Frameworks Bolstering Confidence

Europe's dominance can be attributed to evolving regulatory frameworks that instill confidence in investors. A significant regulation is the Markets in Crypto Assets (MiCA) framework, launched in 2020 and signed by EU officials in October 2023. MiCA aims to enhance transparency and security in the crypto sector within the Eurozone. Regulations for RWA and stablecoins under MiCA took effect on June 30, with full implementation expected by December 30, 2024.

Tech-Savvy Investors Driving Innovation

Europe’s tech-savvy population is continuously seeking investment opportunities in cryptocurrencies. The favorable conditions in Europe are fostering innovation and investment, creating an environment where digital assets can thrive.

Country-Specific Insights

- Russia: Leading Europe with over $633 billion in crypto transactions, placing it among the top five countries globally. Limited access to international financial services drives many Russians to use crypto for cross-border transactions.

- United Kingdom: With $624 billion in transactions, it ranks second in Europe and sixth globally. London's status as a crypto-ready city is bolstered by its robust financial services and favorable government policies.

- France: Ranked fourth in Europe, with French investors typically allocating 15% of their salaries to digital assets.

- Slovenia: Stands out for the highest per capita monthly spending on crypto in Europe, averaging $2,609, which is double the national average salary.

- Ukraine: Economic hardships make crypto assets a crucial alternative to fiat currency, with citizens spending nearly three times the average monthly rent on cryptocurrencies.

Global Dynamics in Crypto Trading

While Europe experiences rapid growth, other regions are also accelerating:

- Asia: Expected to reach $39.3 trillion in transaction volume this year, up from $27.1 trillion in 2022.

- Africa: Projected to see transaction volumes hit $10.8 trillion in 2024, driven by Nigeria and South Africa.

- South America: Anticipated to triple its volume from $2.29 trillion in 2022 to $7.82 trillion in 2024.

North America's Decline

Contrasting with Europe’s rise, North America is seeing a decline in trading volumes. After peaking at $13.6 trillion in 2023, the volume is expected to drop to $7.7 trillion this year from $10.3 trillion in 2022, likely due to stricter or unclear regulations.

Market Evolution and Key Developments

CoinEx Research's latest report offers insights into the evolving crypto market. Bitcoin’s price ranged between $60,800 and $71,700 in June, with consistent inflows into Spot ETFs totaling around $666 million, indicating market stabilization amid global economic uncertainties.

The market sentiment is influenced by the anticipated approval of Spot ETFs on Ethereum. However, declining gas prices and on-chain activity raise concerns about Ethereum’s future. Efforts to address Ethereum’s scalability issues, such as Layer 2 solutions like ZKSync and Blast, are crucial for its long-term viability.

Solana’s recovery after briefly dipping below $138 demonstrates positive market response to growing institutional investor interest. Recently, VanEck and 21Shares filed for a Spot ETF on Solana.

These developments, coupled with expected increases in global trading volumes, paint a dynamic picture of the evolving cryptocurrency market.

Here is your Proof of Brian. I think you meant #ProofOfBrain

Source

Congratulations @mikezillo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP