Coinbase Introduces COIN50: A Crypto Index Analogous to the S&P 500

Coinbase, the leading U.S.-based cryptocurrency exchange, has launched the Coinbase 50 Index (COIN50), a benchmark similar to the S&P 500, but specifically for the cryptocurrency market. Initially composed of 50 digital assets, COIN50 aims to provide a comprehensive view of the crypto market’s top-performing tokens, with plans to expand as the market evolves.

Key Criteria for COIN50 Inclusion

According to Coinbase, digital assets included in COIN50 must meet essential criteria such as robust token economics, strong blockchain architecture, and high security standards. To ensure the index is fully investable, stablecoins and privacy coins, like Monero, are excluded.

The COIN50 also uses a market-cap-weighted approach developed in partnership with Coinbase Asset Management and Market Vector Indexes, which balances the representation of each asset by its market size.

Responding to Demand for Diversified Crypto Exposure

Coinbase created COIN50 to meet the rising demand for efficient, diversified exposure to the expanding digital asset class. According to Coinbase’s statement, traditional finance indices like the S&P 500 have long offered investors a simple, reliable method for broad market exposure and performance benchmarking. With COIN50, the cryptocurrency market is now gaining a similar tool.

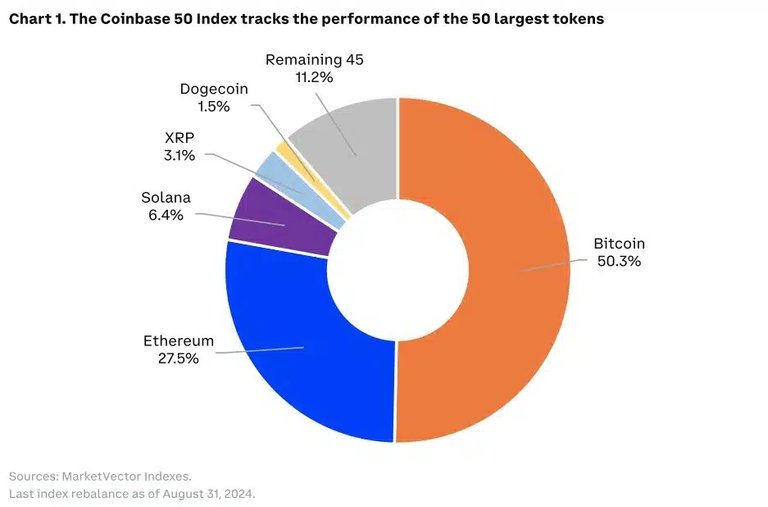

This index will enable crypto investors to track the broader market’s performance and measure the returns of various assets against a comprehensive benchmark. As expected, Bitcoin (BTC) and Ethereum (ETH) hold the largest shares in COIN50, weighted at 51.26% and 26.35%, respectively.

Establishing a Benchmark for Crypto Markets

Coinbase’s Head of Institutional Investment Products, Greg Tusar, stated that the COIN50 aims to create a benchmark reflective of the broad crypto asset landscape, rather than focusing on a single dominant asset. This mirrors the way the S&P 500 gauges U.S. stock market performance, giving investors a fuller view of market trends and reducing reliance on Bitcoin alone, whose market dominance may decrease over time.

Coinbase Research Head David Duong compared COIN50’s launch to the early days of the S&P 500, which started as the S&P 90. Currently, COIN50 covers around 80% of the crypto market cap and undergoes rebalancing every quarter.

Future Plans: Expanding the Index

Coinbase’s launch of COIN50 is seen as the first step in a broader initiative. The crypto market is growing and maturing rapidly, and Coinbase intends to create a more extensive index in the future to capture the full scope of this unique, evolving market. According to Coinbase, this foundation allows the index to grow along with the sector, remaining an essential tool for price discovery and a comprehensive benchmark for the crypto economy.

International Expansion and Trading Options

Currently, the COIN50 service is available to eligible users outside the U.S., UK, and Canada. Investors can trade COIN50 assets via the COIN50 perpetual futures contract (COIN50-PERP), offering up to 20x leverage on Coinbase International Exchange for institutional clients and on Coinbase Advanced for retail traders. Additionally, Coinbase is actively exploring further ways to enable users to gain exposure to COIN50.

Geographical expansion may be limited due to regulatory factors, but Coinbase is considering opportunities to broaden access within its existing jurisdictions, potentially offering users more routes for investment.

Market Impact and Rising Popularity of Coinbase

The COIN50 launch coincides with a bullish trend in the cryptocurrency market. Bitcoin has neared $90,000, while total crypto market capitalization has reached $3 trillion. Simultaneously, Coinbase shares have surged by 75% in the past month, and the Coinbase app ranks 18th among the most downloaded apps across app stores.

Coinbase’s development of COIN50 signals its commitment to expanding tools for market transparency and efficient access, aiming to serve as a benchmark and trusted gateway for institutional and retail investors navigating the cryptocurrency landscape.

It's a shame the UK is outside the area covered, but I'm not surprised. Despite saying they support crypto, the reality is that the only blockchain the government, civil servants and Bank of England are actually in favour of is a centrally (and rigidly) controlled CBDC.

A more interesting question is whether we can persuade Coinbase to start trading HIVE with a view to getting it into the index. Might be tough because we don't have a single CEO and conventional corporate structure.