Bitcoin's Endurance: Will It Last or Face Potential Hurdles?

Since its inception, Bitcoin has seen tremendous growth, but this rise has led to ongoing debates among experts about its long-term viability. The central question remains: Is Bitcoin destined to endure, or could it eventually be halted? To explore the potential vulnerabilities of Bitcoin, OpenAI's ChatGPT-4 was consulted, revealing key insights into the challenges the cryptocurrency might face.

The Strength of Decentralization

The AI highlights that Bitcoin's primary strength lies in its decentralization. Unlike traditional currencies controlled by central banks or governments, Bitcoin operates on a peer-to-peer network without a central authority. This decentralized structure makes it resilient to control or shutdown by any single entity. While completely stopping Bitcoin is nearly impossible, certain factors could impede its usage and growth.

Regulatory Challenges

One of the significant challenges for Bitcoin could come from regulation. Governments could impose strict regulations on cryptocurrencies, targeting exchanges, wallets, and users. The AI model notes that such regulations could make accessing and using Bitcoin more difficult in certain jurisdictions, thereby hindering its adoption. For instance, countries like China have already implemented severe restrictions on crypto assets, including bans on Bitcoin mining and trading.

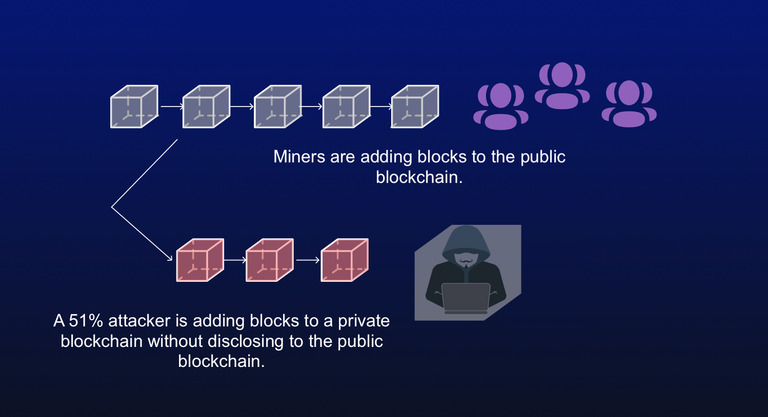

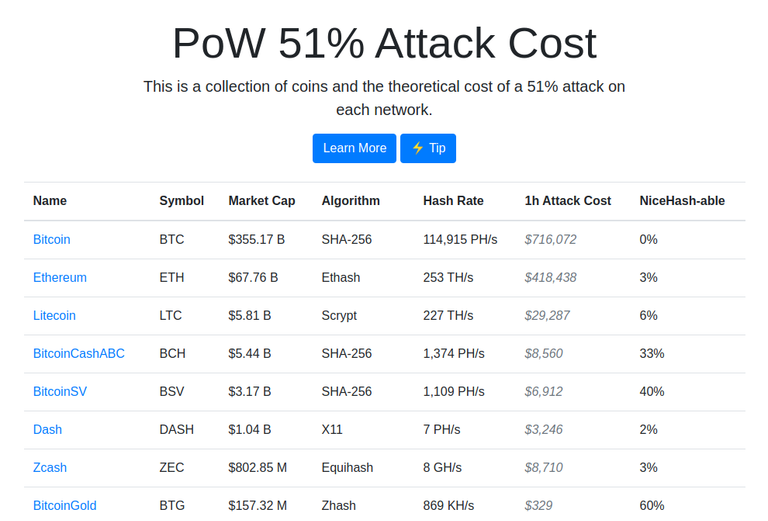

The 51% Attack and Technical Risks

Another theoretical risk identified by the AI is a "51% attack," where a single entity could potentially gain control of more than half of the network's mining power. Although such an attack on Bitcoin would be extremely difficult and costly due to the vastness of its network, the risk, however small, is worth considering. Bitcoin's decentralized nature generally offers strong defense against such threats, but the possibility remains.

Technical flaws or vulnerabilities could also threaten Bitcoin's future. Despite ongoing development and checks to prevent such issues, the risk of unforeseen technological problems persists. Market dynamics and competition from other cryptocurrencies could also impact Bitcoin's position. The AI noted that price volatility might deter investors and users, and the emergence of more efficient crypto projects could challenge Bitcoin's market dominance. If Bitcoin becomes less attractive compared to other currencies or technologies, its influence might wane.

Market Adoption and Longevity

Another critical factor is adoption. The AI emphasizes that Bitcoin's success depends on continued use by businesses and individuals. If Bitcoin starts to appear less practical or appealing compared to other options, its popularity could decline. Despite these concerns, Bitcoin continues to receive support, especially with the entry of institutional investors through BTC Spot ETFs. Additionally, governments like El Salvador have even adopted it as legal tender.

Current Market Analysis

As of this morning, Bitcoin is trading at $63,639, showing a slight decrease of 0.43%. On a weekly chart, it remains in the green with an 8.68% gain, but it shows a 5.48% loss on the monthly chart. After holding firm over the weekend, the crypto asset is now attempting to break through the $65,000 resistance, considered a crucial threshold for aiming at a new all-time high. A breakthrough at this level could reignite bullish momentum, potentially driving BTC's price toward $66,782 or even higher.

However, if Bitcoin fails to breach the $65,000 resistance, a retracement could occur. In the event of a downturn, the first immediate support is at $62,654, followed by $60,712 and $58,900, levels where buying pressure may increase. Traders are closely watching these levels as a breakout could signal a shift in market sentiment.