Appeal filed at last minute in Ripple case...

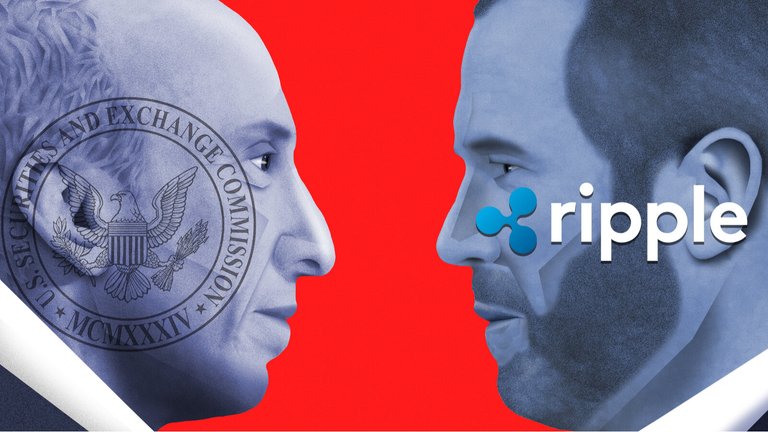

The U.S. Securities and Exchange Commission (SEC) recently filed a Form C (Civil Appeal Pre-Argument Statement) in the ongoing legal case against Ripple. This filing represents a last-minute appeal aiming to overturn the final ruling issued by U.S. District Judge Analisa Torres.

According to Fox Business reporter Eleanor Terrett, the SEC has outlined the reasons for its appeal in the Ripple case. Central to the appeal are Ripple's programmatic sales of XRP on digital asset trading platforms. Additionally, the SEC is contesting the personal sales of XRP made by Ripple executives Bradley Garlinghouse and Christian Larsen.

The original lawsuit filed by the SEC accused Ripple’s executives of violating the Securities Act of 1933 by selling XRP without proper registration. As part of the appeal, the SEC is also seeking to challenge Ripple's distribution of XRP to its employees and others. However, Terrett noted that the appeal does not contest the $125 million civil penalty imposed or Judge Torres’ decision to deny disgorgement (the repayment of unlawfully gained profits).

Uncertainty Around SEC's Appeal Deadline

On October 17, the cryptocurrency community speculated that the SEC might have missed its October 16 deadline to file the appeal. In an interview with Fox Business, Ripple’s chief legal officer, Stuart Alderoty, explained that the SEC had until October 17 to submit Form C. This form would provide more details on the specific aspects of the case the SEC intends to appeal.

Crypto lawyer James “MetaLawMan” Murphy described the SEC’s delay in filing as "unusual." He noted that while the SEC’s Form C was dated October 16, the court-stamped document carried the date of October 17. This raised questions about whether the SEC met the filing deadline, and the Second Circuit Court is expected to clarify this matter soon.

Initially, Terrett expressed skepticism that the SEC would allow such a critical deadline to lapse. However, she later provided an update, quoting a Ripple spokesperson who confirmed that the appeal is moving forward and that the documents would soon be made public.

Background of the Ripple Case and Partial Victory

In July 2023, Ripple secured a partial victory when the court ruled that XRP should not be classified as an unregistered security for retail sales. However, the court also determined that Ripple’s sales of XRP to institutional investors were akin to unregistered securities sales. As a result, in a final judgment issued on August 7, Ripple was ordered to pay $125 million in civil penalties for violating securities laws.

Key Points of the SEC Appeal:

- Programmatic Sales: The SEC is contesting Ripple’s large-scale, automated sales of XRP on public trading platforms, which the regulator views as violations of securities laws.

- Executive Involvement: The SEC's appeal also targets the personal XRP sales made by Ripple’s top executives, Bradley Garlinghouse and Christian Larsen.

- Employee Distributions: The appeal includes Ripple's practice of distributing XRP to employees and other parties, further challenging the legitimacy of these transactions under securities law.

While the SEC has not contested the monetary penalty or the denial of disgorgement, the appeal seeks to overturn critical aspects of the court’s judgment regarding the status of XRP in broader sales practices. If successful, this could have significant implications for the classification and regulation of cryptocurrencies like XRP.