Precious Metals Rise as Recession Looms

Precious Metals Rise as Recession Looms

Another day in an unstable paradise as Feds look likely to continue to raise interest rates to curb so called inflation or more so so claw back all the money they printed throughout the pandemic.

A war now between Russia and Ukrain that continues to put pressure on global stability and cause rising energy costs.

Many European nations didn't or haven't done enough to secure their energy and now the people pay the ultimate price.

Dow Jones and the broader investment market is on a downward trend which is have a chronic impact on crypto currencies also.

The CPI news wasn't any better and there doesn't seem to be much of a focus on how to get out of the current position without the continued lifting of interest rates.

All things are beginning to point towards a recession and for those who experienced the 2008 economic crisis this one is going to be a lot harder than what we have previously experienced. Undoubtedly it's going to hurt for a lot of people mainly the working class.

Where's the money going?

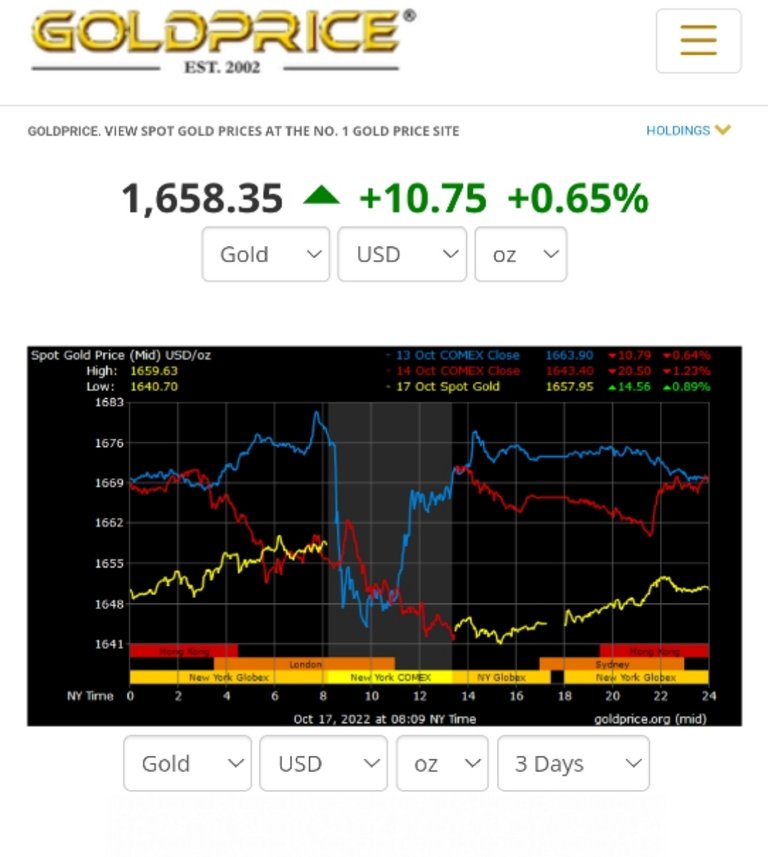

A key indicator for an incoming recession is the way the current investment market is trending. With shares and crypto dropping we're seeing some great movement in the price of Precious Metals.

This is a key indicator that people are putting their cash into items that are a store of value to beat inflation and ensure their money isn't devalued.

The growth we're seeing in Precious Metals isn't anything to write home about yet but it is seeing some significant growth.

As its pretty clear that the Feds will continue to raise interest rates I'm tipping that Precious Metals will continue to grow in value.

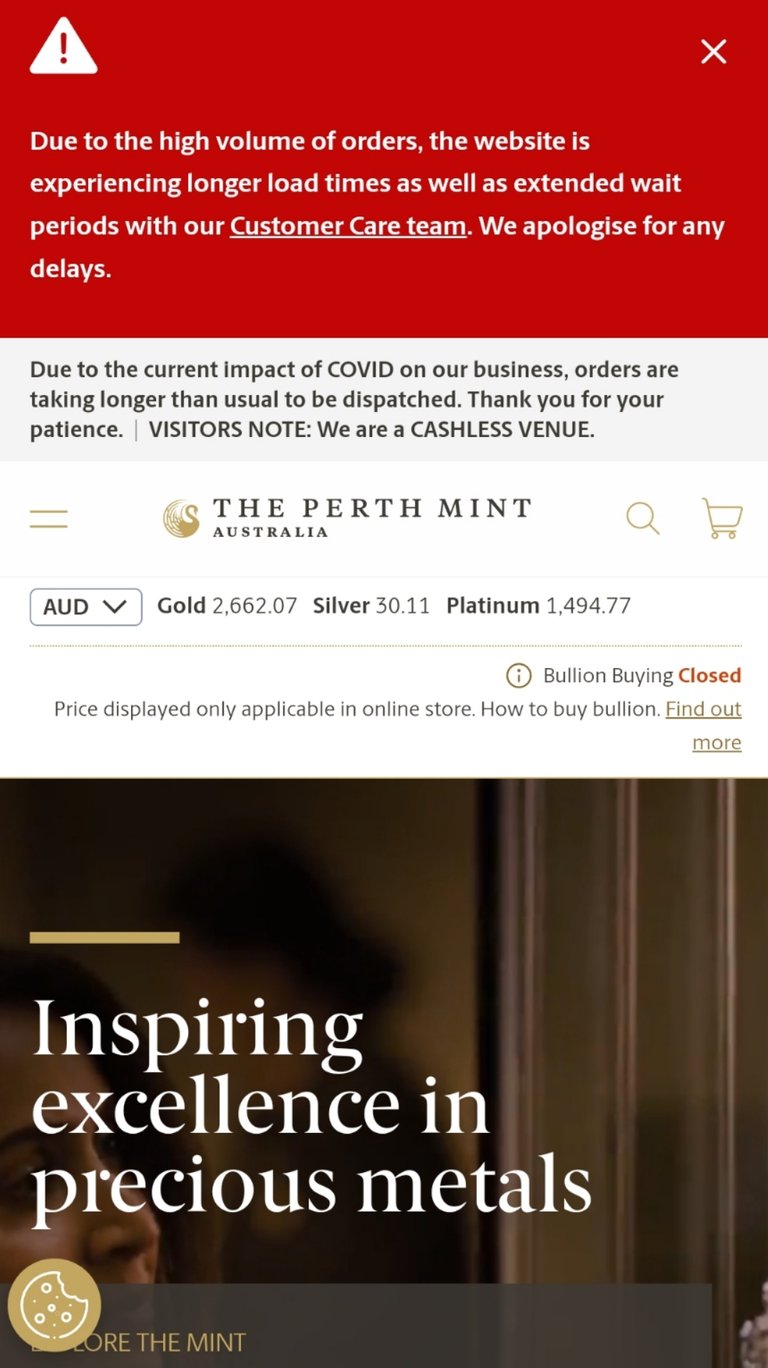

High Volume

One thing we can see is the pick up of trading with Volume now starting to impact supply with the Perth Mint putting out a warning that due to high trade volumes there will be delays.

I think we are now just starting to see the world duck for cover and ensure their savings aren't depleted through CPI and interest rates.

Although long term deposit accounts and savings accounts are now offering nice returns inflation continues to reduce the value of cash.

I'll be looking into purchasing more Precious metals in the coming weeks to add to my collected and safe guard my future.

What are your thoughts on the current economic environment? Are we headed for a recession that will cause wide spread devaluation of nations cash or do you think the Feds will act early and stop increasing interest rates?

Image sources provided supplemented by Canva pro subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Remember to only invest what you can afford to lose and investing in any product is a risky decision that may result in total loss.

Posted Using LeoFinance Beta

Very thoughtful

The key if one have funds is to invest more in precious metals

https://twitter.com/1291387911238086664/status/1582153342733934593

The rewards earned on this comment will go directly to the people( @melbourneswest ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I mean I don't know if we can call it great but precious metals have been holding fairly strong

Lots of action in this space and I think it will continue to climb as economic pressures continue to mount.

It doesn’t hurt to make precious metals part of your portfolio.

!discovery 29

This post was shared and voted inside the discord by the curators team of discovery-it

Join our community! hive-193212

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

People are scared and commodities are safer for people during those situations. It doesn't help that the economic factors are all pointing towards a recession globally.

Posted Using LeoFinance Beta

Precious metals have proven to be a great hedge when compared to other currencies. Holding it part of one's portfolio is a smart move

The real flight to gold and silver has yet to get warmed up.

Inflation playing a major role in the drop of these metals