Mainstream begins to gain faith in Bitcoin

Mainstream begins to gain faith in Bitcoin

Bitcoin has become a household name and has for quite sometime and for a large portion of that time Bitcoin has been called a "scam" "fake" "not worth anything" yet for even longer Bitcoin has continued to outperform and exceed peoples expectations.

It's no surprise that former Australian Senator turned Crypto Enthusiast Cory Bernardi has come out once again supporting Bitcoin and his early statements of Bitcoin Demand are getting stronger haven't been wrong.

Cory Bernardi recently interviewed Fred Schebesta whom was an Australian early investor of Bitcoin and at the current age of 39 he has been ranked 26th on the Australian Financial Review's young rich list.

Schebesta now owns one of Sydney's most expensive seaside properties and continues to live a lavish lifestyle. Although he hasn't completely exited the tech sector Schebesta has cofounded Finder which is an online e-commerce website that helps shoppers find the best deals available to them.

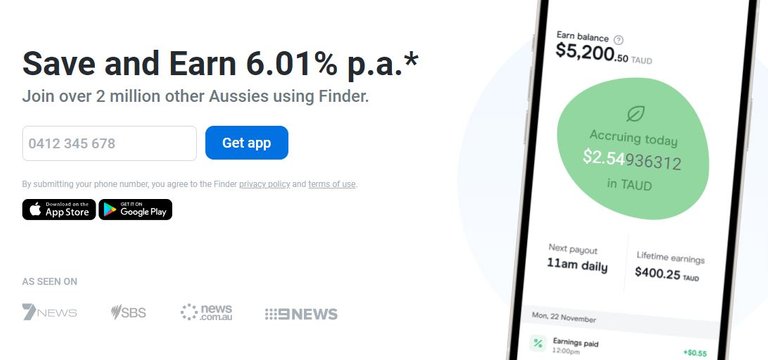

More recently Schebesta has delved more into his own crypto platform creating TrueAUD which is a stable coin pegged to the Australian dollar built on the Ethereum blockchain and managed by US-based company Trust Token

Aussie Decentralised Finance

TrueAUD has developed its own dApp which enables users to purchase TrueAUD and stake their tokens for compounding APY which is paid out once daily or compounded. At current the APY is 4.00% for amounts below 10,000 and amounts above are paid out at 6.00% which is significantly higher than mainstream banks are offering.

In the interview Bernardi and Schebesta discuss how Bitcoin is becoming mainstream with comparisons to fiat currencies and cryptocurrencies.

Bernardi talks to the British pound and that how over the past few hundred years the GBP has lost 99.5% of its value through inflation, something Bernardi believe Bitcoin can not do due to it's decentralised nature.

Furthermore, many younger people are exiting the current financial system in pursuit of a decentralised world stating that despite Bitcoin's lack of use cases it is being exactly what it needs to be a form of gold and so long as everyone sees value in it it will continue to succeed.

Punters Choose Bitcoin over Ethereum

This comes as Vitalik recently announced he has lost Billions on the value of his token and no longer belongs to the exclusive Billionaires club. Some have stated that Vitalik has a large supple of UST and Luna however, Vitalik is also calling for smaller investors to be made whole by weighing in on the debate and stating that Terra (Luna) Network should compensate smaller users up to the max of $250,000 dollars. Vitalki went on to call Algostable coins propaganda as they were not collateralised.

This comes at a time that the market is in a downward trend and it has put punters offside with some alleging that if Vitalik doesn't move fast to secure another rally than Ethereum may lose 80% of its value and fall to around $US420 dollars leaving Bitcoin as the more dominate crypto.

What are your thoughts, will Ethereum succumbed or will it continue to be a challenger and and grow. Let me know in the comments section below

Image sources provided and supplemented by Canva, This is not financial advice and readers are advised to undertake their own research or seek professional financial services

Posted Using LeoFinance Beta

I don’t think Ethereum will ever see those type of prices again lol. But you know....they say never say never.

Posted Using LeoFinance Beta

Ethereum is a rusted on and popular blockchain, I don't think so either and if it did it wouldn't be for long.

Posted Using LeoFinance Beta

https://twitter.com/ValloneSimon/status/1528867793307070464

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

So Finder Earn pays out 6.01% on that collateralised AUD stablecoin.

Do you know where that yield comes from?

Like what is Finder doing with the money they are being given to be able to pay that rate?

Posted Using LeoFinance Beta

I am quite concerned about it as there isn't any information. Might be a pyramid scheme.

Posted Using LeoFinance Beta

Haha, bloody Finder...

Posted Using LeoFinance Beta

I think ETH will still be successful but as a chain for bankers. After all, they aren't going to care about the small amount they pay in fees because they are trading large amounts. Most of the other people who think it's too expensive will just move elsewhere.

Posted Using LeoFinance Beta

I'm beginning to think this. It looks like the high fees contribute to the security of the network. Lots of bankers are building on it.

Posted Using LeoFinance Beta

I think a lot of it is going to depend on if they can eventually move ETH to POS. People have been waiting for that for years. Seeing the success of other chains with low fees could be telling of how ETH will perform.

Posted Using LeoFinance Beta

I'm starting to think PoS is a bad idea in it's current for on other blockchains. When things go south they go south real fast and it's the loyal investors that are hurt the most while the speculators get out free.

Posted Using LeoFinance Beta

Maybe so. I hadn't thought of it that way.

I think that, unless ETH does something spectacular about transaction fees issue, its days as No. 2 cryptocurrency (or, at least, serious challenger to BTC) might be numbered. Even if it survives bear market relatively unscathed, it will stop being "sexy" for cryptoinvestors who would fall in love in another Big Thing or true ETH Killer when the next bull run starts.

Posted Using LeoFinance Beta