Get Ready For Altcoin Season

Get Ready For Altcoin Season

Bitcoin’s recent all time high (ATH) has sent shockwaves across the cryptocurrency market propelling total crypto market capitalization past USD 2.9 trillion. This surge marks a significant shift not only for Bitcoin but for the entire crypto ecosystem.

Investors are preparing for a possible altcoin boom once Bitcoin’s profits start trickling down into other assets. The excitement is building as Bitcoin continues to climb triggering waves of fear of missing out (FOMO) across the market.

The Trump Bump

The recent U.S. election saw Donald Trump reclaim the White House along with a strong GOP presence in Congress. His re election ignited speculation that his administration will adopt more crypto friendly policies. Adding fuel to the already blazing crypto rally. With Bitcoin nearing the USD 90,000 mark and investors eyeing USD 100,000, the FOMO factor is undeniable.

Iliya Kalchev, an analyst at Nexo attributes the current bull run not only to post election optimism but also to an influx of institutional investment as large firms embrace Bitcoin.

The rise of Bitcoin ETFs has introduced even more liquidity to the market. Since November 6, USD 3.1 billion has poured into U.S. spot Bitcoin ETFs highlighting the increasing interest among institutional investors. This institutional support brings newfound credibility and a heightened level of security to Bitcoin while also making it an attractive investment option for both retail and corporate investors

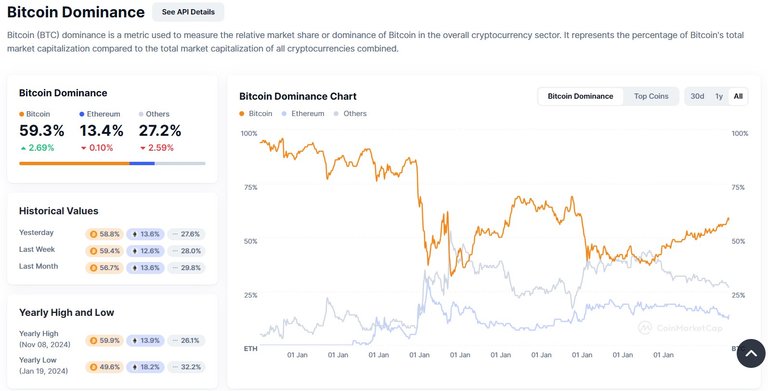

Bitcoin Dominance Grows

As Bitcoin reaches new heights its dominance continues to grown now constituting over 50% of the crypto market’s total value. Unlike previous bull runs in 2017 and 2021 which saw altcoins lead the charge, this rally is driven by Bitcoin’s strength.

As Bitcoin dominance increases investors are beginning to anticipate an altcoin season. This trend suggests that once Bitcoin reaches a saturation point, investors may start reallocating their profits into altcoins like Ethereum, Solana and other prominent tokens. Such a rotation has historically sparked significant rallies across altcoins creating a cycle where assets with smaller market caps experience amplified gains.

With Bitcoin’s huge rise the fear of missing out is driving a broader wave of retail investors into the crypto market. Petr Kozyakov, CEO of Mercuryo, attributes the recent surge to this FOMO driven momentum, as Bitcoin’s path toward USD 100,000 draws more participants. As retail investors join the frenzy, the liquidity and demand for Bitcoin continues to expand pulling up the entire market cap and paving the way for a ripple effect on altcoins.

The FOMO wave could spell a massive capital influx into altcoins once Bitcoin stabilizes or consolidates. Historically, this transfer of profits from Bitcoin to altcoins has ignited bull runs in assets with smaller market caps, offering higher returns due to their volatility and growth potential.

Elon Musk The Adviser

Elon Musk’s vocal support for cryptocurrencies particularly Bitcoin and Dogecoin has also played a significant role in the market’s bullish sentiment. As a high profile advocate for crypto and a key supporter of Trump’s re-election, Musk has influenced market confidence and inspired additional capital flows into the market. Dogecoin, for instance surged in the wake of Musk’s backing showing the power that influential figures have in this sector.

With Musk positioned for an advisory role in the Trump administration his influence on potential pro crypto policies has raised hopes for an altcoin season as favourable conditions could attract more capital into alternative assets. Investors are now closely watching how Musk’s involvement and policy developments may affect the broader market.

What we could Expect from an Altcoin Season Like Never Before

With Bitcoin hitting ATHs and institutional adoption growing market analysts suggest that this next altcoin season could surpass previous ones in both scale and speed. Many altcoins today have developed robust ecosystems and use cases beyond mere speculation, attracting institutional interest and offering significant utility.

Coins like Ethereum, for instance, continue to be favoured for decentralized finance (DeFi) applications while others such as Solana appeal to developers with high performance blockchain platforms.

For investors, the anticipated altcoin season presents an opportunity to explore projects that offer substantial utility and innovation in areas such as DeFi, NFTs, and Web3. With Bitcoin absorbing much of the initial market inflows, smaller altcoins are positioned for accelerated growth once profits are rotated. As investors take Bitcoin gains and channel them into promising projects, altcoins with strong fundamentals and high potential could lead this new wave.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

I have a feeling this cycle will replicate the 2017 one rather than the 2021 one which was kind of a fad to be honest.