Fear and Greed Index Moves Forward

Fear and Greed Index Moves Forward

It’s almost a signal in itself, When people start complaining about the price of crypto currency you know that perhaps it’s time to start looking at throwing a few bucks into the mix. I was awaiting for the “Crypto is dead” media line’s but we probably won’t ever hear that again from media due to the fact Wall Street is heavily invested in Digital assets and they won’t like negative news for their investors.

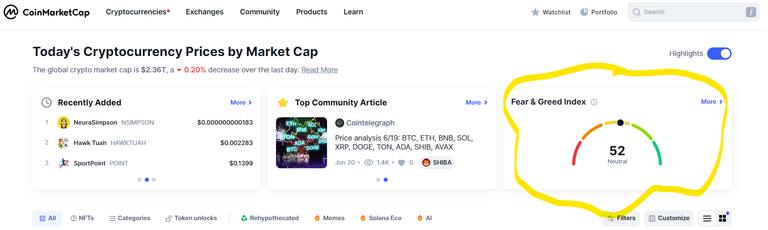

The crypto currency market jumped up a few notches in the latest Coinmarketcap fear and greed index as Bitcoin and Ethereum, two of the largest digital assets continue to make headlines with significant developments. Bitcoin is seeing recovery while Ethereum is seeing optimism around its newly approved exchange-traded fund (ETF).

Bitcoin's New Support Position

Bitcoin (BTC) is on the verge of moving back up towards its ATH currently trading close to USD 65,000 which appears to be it’s new support line. Analysts are optimistic that BTC could break through its USD 73,650 resistance level. driven by a bullish continuation pattern observed since February. The next major hurdle to get out of it’s current mess is crucial. a breach here could propel Bitcoin to new heights. However, the typically sluggish Q3 might temper these expectations potentially leading to a bit of stagnation.

But once Miners complete their sell offs and profit taking with many having their tax periods come to an end on June 30 and having to report back on income to their nation’s tax departments. We’ll probably see things return to normal for Bitcoin, there will be a need to drive prices higher due to the halving causing rewards to lesson. Supply and demand factors will most likely see Bitcoin needing to increase it’s value in order to make profit.

Ethereum ETF Boost, Yet to be Seen

Ethereum (ETH) is also in the spotlight largely due to the recent approval of a spot ETF by the SEC. and the U.S Securities and Exchange Commission’s recent decision to stop persuing it as a security. This move has not yet fully reflected in Ethereum’s price but analysts predict that this ETF could set the stage for a substantial rally and potentially mirroring Bitcoin's previous post-ETF surge earlier this year. However, Ethereum faces immediate resistance with some market watchers cautioning that it might not lead to an explosive price increase as widely anticipated.

Altcoins are on the move with Several altcoins are showing promising trends this month:

Bitget Token (BGB): BGB has experienced a 16% rally, bringing it close to its ATH of $1.38. Technical indicators suggest that if it breaches the 1.33 resistance.

Toncoin (TON): TON has been performing exceptionally well having recently set a new ATH. It is poised to continue its upward trajectory provided it can establish the USD 6.5 as a support level.

Binance Coin (BNB): BNB has been struggling to reach its previous ATH from May 2021. Currently trading at USD 584 it remains about 14% shy of its ATH. Market sentiment remains cautious due to the past regulatory focus on Binance.

Market Sentiment Looking Positive

Despite these positive signals we see the broader market sentiment remaining mixed which is common when prices take a dip but there are some external factors that could influence the crypto market's movement. As inflation continues to impact nations around the world differently household income is drying up. So investment is slow, we might be at a point where Crypto now moves slowly towards larger market caps. But that is yet to be seen.

As June 2024 progresses the crypto currency market is well positioned for growth with Bitcoin's potential to reclaim its all time high. The impact of Ethereum's ETF are yet to be seen but they are developments that could shape market trends.

While altcoins like BGB, TON, and BNB are showing significant activity the overall market remains sensitive to regulatory and economic factors. With many nations citizens now having to choose between paying the mortgage, utilities or food. With disposable incomes now lower than 2021 it is a matter of time before things realign and we see some big price movements as we did in previous years. But the current Fear and Greed index showing a move towards greed while being still neutral provides some positive hope for the sector.

I am interested to hear your thoughts, feel free to pop a comment below and let me know!

image sources provided supplemented by Canva pro subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.