USA States Comparing Tax Rates

Since a lot of people in today's post are talking about the FED raising rates I decided to take a look at some other financial info I learned through the months strolling around the internet. Here in this post lets talk about USA taxes, and specifically which states have the lowest and highest taxes. Also just for reference all charts in this post are directly from taxfoundation.org.

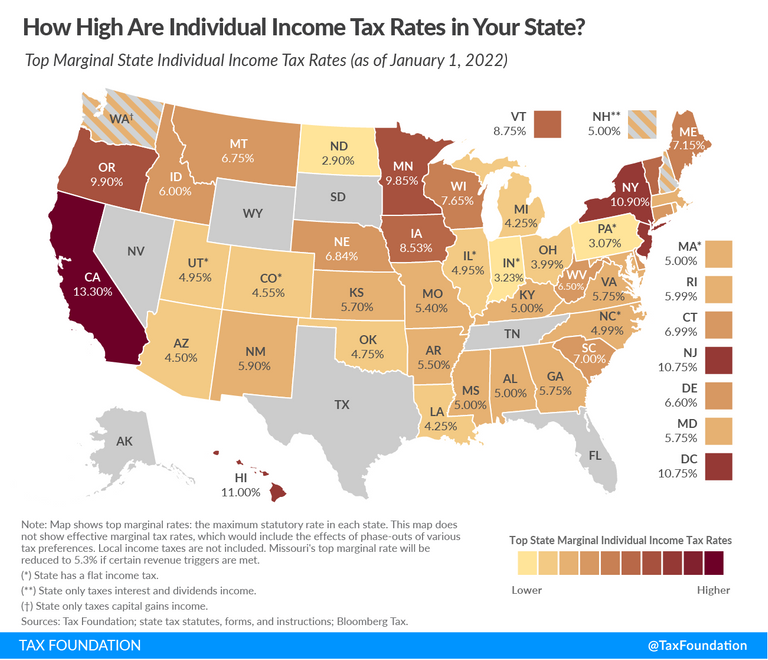

Individual Income Tax Rates

The front page chart of this post shows the going rates of each state with California being the highest tax rate at 13.3%. New York and New Jersey are not that far behind with 10.9% and 10.75% respectively. Some of the lowest rates are in Massachusetts at 5%. Of course the lowest is zero income tax which are shown as grayed out states.

A total of seven states that do not collect income taxes.

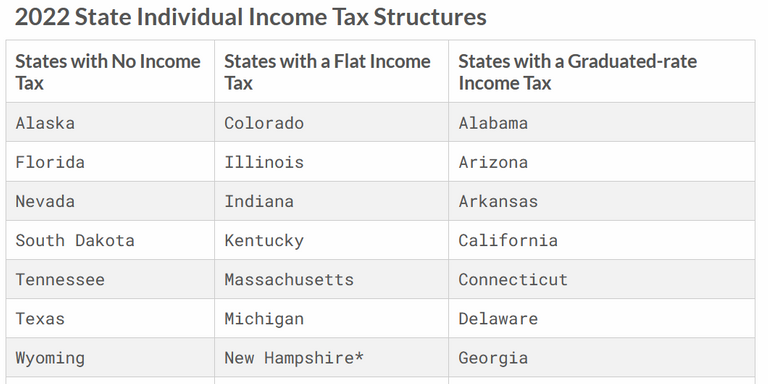

Marriage Penalty

You would think marrying is a good thing when it comes to finances. Two people working and earning income together would bring in more for the family income. Yet some states actually have a penalty for married couples. The penalty varies but is the same for all states that have them which is increasing tax rates for married couples.

Of course couples can file separate tax forms to try and avoid the marriage penalty but they may lose out on the federal tax benefits for married couples as federal taxes have to also be filed as individual. Better just not live in a state that has marriage penalty is my take on this.

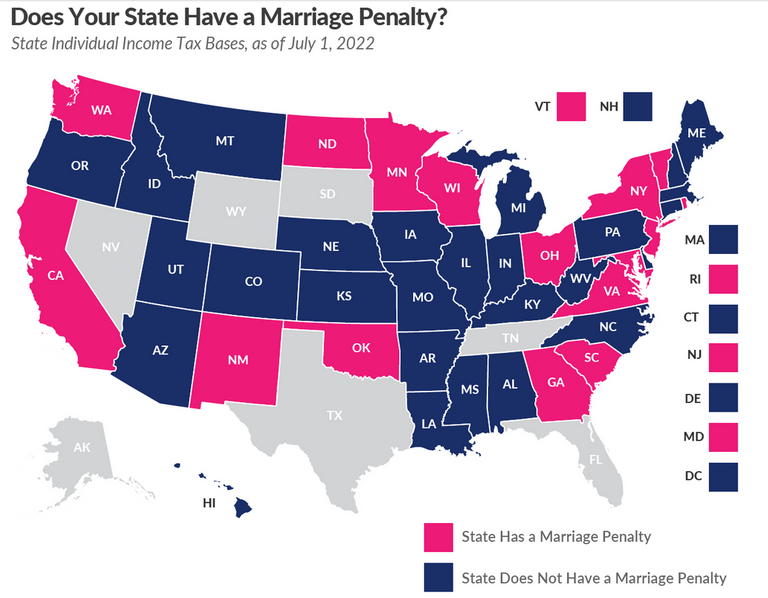

Sales Tax

For those not living in America you may not know this but in majority of the country people pay taxes on money they earn and spend. In a way you can think of it as doubled taxed or not but bottom line a lot of transactions get taxed.

According to taxfoundations.org the states typically with high income tax will also have high sales tax. This is true as California is close to 9% sale tax. However there are multiple states above California such as Wyoming, Oklahoma, Arkansas, Louisiana, and Tennessee to name a few. Less than a handful of states have no sales taxes. Ideally best to live in those states if one purchases a lot or at least live near one of those states so it won't take a long to get to a no sales tax state.

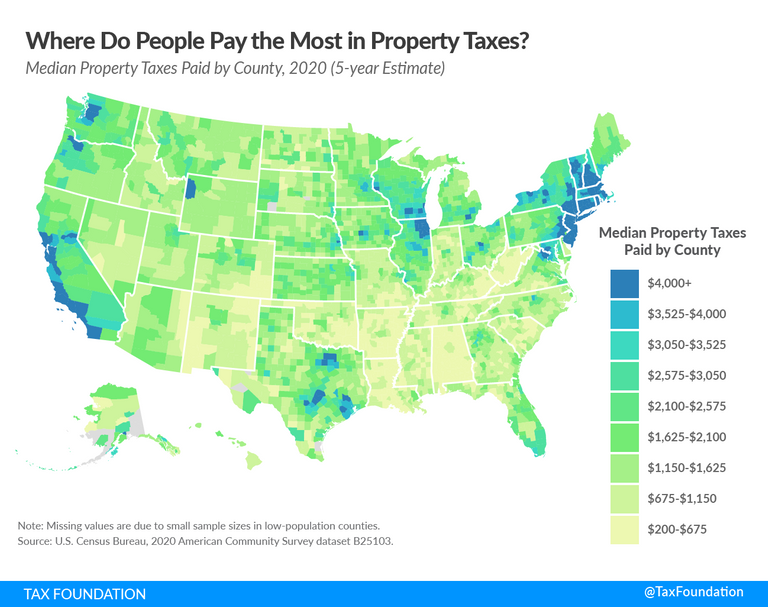

Real Estate Tax

In an average person's life the two biggest expenses they will ever incur is purchase of a car and a house. In the states there are also tax on owning those two big purchases. For housing it is paid every three months for a total of four payments in a year.

So curious where the most expensive real estate taxes are in the country? It is mostly in northeast of the country and west coast in California. These areas technically will be the highest in living costs.

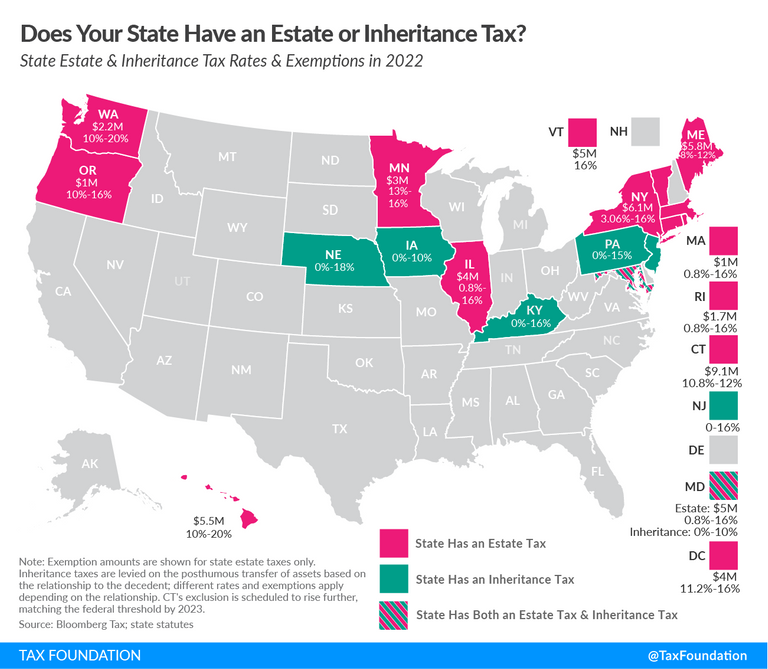

Inheritance Tax

I will close it with inheritance tax. Majority of states do not have an inheritance tax but to those that do things could add up pretty quickly. Boy if you are thinking of passing your legacy on to your kids you would be wondering why have to give away a portion of your hard earned and saved amount toward your home state?

Conclusions

taxfoundations has a ton of data regarding to taxes in the United States. I recommend checking it out to learn more or to find out where your state ranks compare to the rest of the country.

Through this post I only went through state taxes but in addition we have the federal tax on top that is required to be paid on a yearly basis. With a little over three months for this year of 2022 it maybe time to start looking and getting ready for the upcoming tax season for those who live or are USA citizens.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

California looks horrible in all aspects but I guess the only silver lining is that there is no inheritance tax. However, I think it will be happening soon because I heard talks of them trying to take taxes from people living there like a decade ago.

Posted Using LeoFinance Beta

I only visited San Fran and it was two decades ago. One of my best vacation experiences. I don’t think I will go back for a while as I too hearing a lot of bad things going on there. !WINE !PIZZA

Congratulations, @mawit07 You Successfully Shared 0.100 WINEX With @jfang003.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.140

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @mawit07, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that you can use BEER at dCity game to **buy dCity NFT cards** to rule the world.

Du wurdest als Member von @investinthefutur gevotet!

Dazu noch ein kleines !BEER & VOIN-Token

View or trade

BEER.Hey @mawit07, here is a little bit of

BEERfrom @investinthefutur for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thanks for the details, this things are so tough to me.

PIZZA Holders sent $PIZZA tips in this post's comments:

@mawit07(1/5) tipped @jfang003 (x1)

Learn more at https://hive.pizza.