From Downfall of Luna to Celsius and Beyond. Why?

Yesterday Celsius made a public announcement in regards to locking up users funds as the current volitale crypto market is making it impossible to handle the price changes.

Rumors are ETH free falling from stETH losing peg is major reason Celsius is locking up users assets. The staked ETH was to earn more ETH and be ready for the move toward ETH 2.0. However right around this past couple of days there has been heavy selling of ETH and creating a void in liquidity for stETH which is causing a rapid price decline.

Celsius is rumored to have a lot of ETH staked into stETH and with the liquidity dropping they are having significant difficulties to handle customer withdraws. The company stopping its withdraws is cascading as of today Binance has stopped all BTC withdraws.

Domino Effect

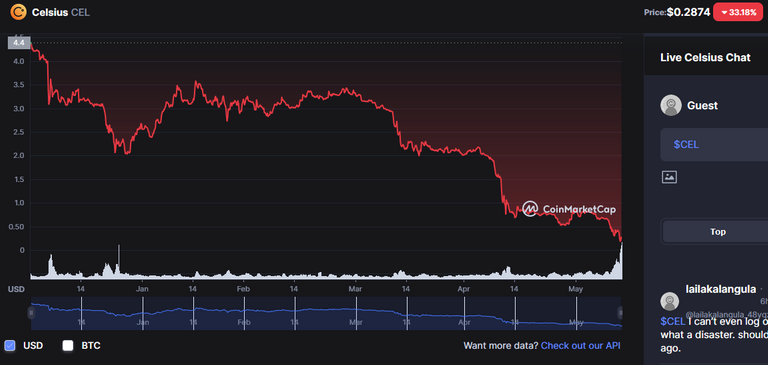

Luna in May lost peg and now Celsius has trouble handling its assets. Celsius had a portion invested in Luna / UST so in a way the crash of Luna / UST is effecting Celsius. FUD spread on Celsius news and its native token free falling.

On top prior to Celsius announcement there were already signs of problems in other parts of the crypto space, such as OSMO hack and Optimism hack. In the end the damage caused by Luna may the entire market very vulnerable to any and all additional shocks.

Conclusions

All this maybe old news since its being discussed across the web as crypto prices falling and so is the stock market. However I leave with this additional news illustrating how the domino effect can cascade into the stock markets due to crypto prices free falling.

Pension funds such as that illustrated in snap shots above is illustrating how financial institutions that invested in crypto maybe in some heavy loses at current market conditions. Even with doing their own due diligence and believing public company such as Celsius would not mean assets invested will go to zero but currently it is proven to be wrong assumptions.

If true and institutions lack liquidity while stock and crypto markets continue to fall the same institutions may be unable to supply enough dollars to avoid margin calls. Yet what if this does not happen and institutions have to sell in order to obtain enough dollars? Some pension funds have monthly withdraws. They need to hold enough dollars for the process to operate smoothly but if there is not enough dollars assets such as crypto and stocks will continue to be sold.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Thanks for the write up.

It seems crypto keeps falling into the 2008 trap of its biggest pillars also being the biggest speculators. We need to start demanding that these companies don't take on market risk in the same way Dodd-Frank prohibited banks from doing it. Otherwise, the only thing that's going to stabilize this is regulation.

Financial institutions are in a constant battle with each other and these small crypto firms are no match for them. As more wall street institutions decide they want in, they are going to target these smaller crypto companies pain points. If that means knocking ethereum down by half just to watch Celsius implode so they get a better price on eth while bringing more customers under their trusted umbrella, they will do it.

No idea if that's what's happening here but these exchanges are putting themselves in very vulnerable positions that are now hurting the whole space.

I don’t know if I want that kind of regulation in crypto as in stocks. I do feel something is needed but crypto is meant to be leverage from the get go. It just want too far and to fast. Now as the tides are receding we see who are swimming naked.

What makes you say crypto was meant to be leveraged?

The fiat and financial system that currently stands does not rise as fast as real inflation so the wealth of the younger generation lagging. With crypto put into defi the growth accelerated to out pace real inflation. The risk is of course it can all crumble down. Fast rise can also come with fast falls.

I think that this is the exact example why you should not leave your funds with centralized exchanges! Not your keys, not your crypto.

Thank you for the summary of what is happening right now! :)

True that don’t store crypto in central exchange as they own it.

This is a somewhat catastrophic time for crypto and stocks. Better days ahead

Posted using LeoFinance Mobile

Yes that’s the spirit. Bulls rule! Let’s go.

Well I just hope we get better someday Because the look of things now, is getting unbearable again

Posted Using LeoFinance Beta

👍💪🇦🇷

It's bad news for the crypto market and it's going to put a larger view on the APR provided by crypto. I guess that itself might be a good thing as there are a lot of unstainable projects out there.

Posted Using LeoFinance Beta

It is going to be a rough ride down by but hold long term and invest in what we have convection in such as Hive. In this together ;)

This is a good analysis. There are many factors affecting the markets right now. But the one that worries me the most is fud spreading across social media. People are spreading false information about certain coins and companies. If people believe something is going to fail, then it's likely they will sell off those assets before it happens. This could cause the collapse of many different projects, including ones that might actually succeed.

I hope we can get through this together.

Well said. Weather the storm no matter how long we may one day see the fruits of our labor. Another bull run in crypto will come. That is my belief.

It's interesting to see how lots of stablecoins are losing their pegs, melting down the whole crypto market.

!1UP

which is making Hive and HBD look the better!

You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @bee-curator, @neoxag-curator, @pal-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

Not your keys, not your crypto! It's amazing how centralized entities can withhold funds, when the whole point of crypto was to get away from the banks that withhold our funds!

We noticed you are a Defi enthusiast, so we want to invite you to check out our Yield tracking app at defireturn.app, perhaps you like how much details we provide for each pool!

Posted Using LeoFinance Beta