Research diaries #18: About inflation returning to normal levels

In the last year we have experienced extreme rates of inflation as we have an upward pressure on energy and food and a decline in export as a result of Covid and the war in Ukraine. As this normalizes how will this effect your savings if you are in the EU?

It sure is shocking when you hear a monthly annoucement of inflation rates of over 10%. These are yearly rates so on a monthly scale dividing them by 12 is more representative and it is not going to do that much damage if it normalizes by the end of the year. So let's do a quick computation.

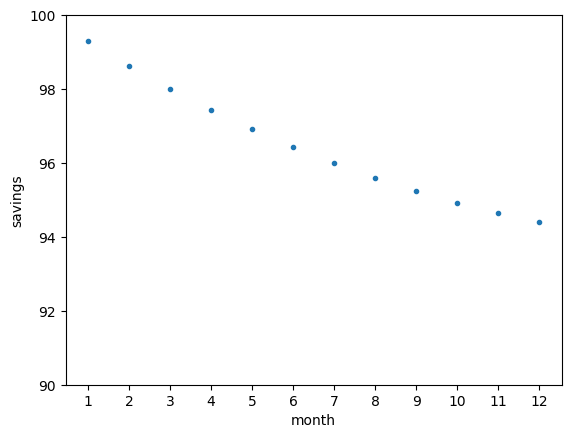

Let's assume that the inflation in January is 8.5%, EU rate, and then linearly goes to 3% by the end of the year. The 3% is just a rough esitmate based ECB historical data in Germany and the linearity is also based on some historical data, have a look over here is some nice evidence why we assume it is linear). Let's get back to the calculation. You then can just take the product of all the rates to determine the yearly inflation rate. Assuming you have a 100 euro sitting in the bank your money will inflate like this:

The data points correspond to the inflated value at the end of the month. The yearly rate is 5.6% which is fairly close to what you would get if you just do the whole computation with average rates. Also note that the reverse process will affect your savings in the same way because products commute, or in formulas a x b = b x a, so if we change the order of the rates we end up with the same number.

The dollar is sitting at about 6% inflation US rates. So it would be more optimal to convert your euros to dollars atm. I have no idea where the dollar is going to be by the end of the year but it is seems likely to be in a better shape. Seems like a better deal to get dollars. Of course putting your dollar in a HBD savings account might even get you further ahead in the game :D

I suspect this is a somewhat simplistic view on inflation but I would be happy to hear from any experts about how to create more accurate models and what the optimal ways are to dealing with inflation while minimizing risk ^^

Many thanks to mobbs for giving me a topic to write about ;)

Cat tax

Hey @mathowl!

Actifit (@actifit) is Hive's flagship Move2Earn Project. We've been building on hive for almost 5 years now and have an active community of 7,000+ subscribers & 600+ active users.

We provide many services on top of hive, supportive to both hive and actifit vision. We've also partnered with many great projects and communities on hive.

We're looking for your vote to support actifit's growth and services on hive blockchain.

Click one of below links to view/vote on the proposal:

Have you ever checked out Truflation as an alternative look to inflation?

I just checked their website. I cannot really find how they compute their inflation index https://truflation.com/methodology/ is it like a weighted average over those 12 components?

No idea. Figured that’s more of your expertise.

Thanks for your contribution to the STEMsocial community. Feel free to join us on discord to get to know the rest of us!

Please consider delegating to the @stemsocial account (85% of the curation rewards are returned).

You may also include @stemsocial as a beneficiary of the rewards of this post to get a stronger support.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Haha and thanks for expanding on my question with this post!

I've thrown my money into savings now with a surprisingly decent 3.2% AER, combined with very, very slowly adding into my HBD savings. Unfortunately dollars aren't an option buttttt this linear rate, combined with actions taken, feels a lot less painful now.

Plus I heard the GBP is the strongest currency in the G10 right now somehow (mostly because its coming up from such a ridiculous low, it can only go up at this point)

Do you think that the cause of the periodicity of this phenomenon in the United States is perhaps related to the US government's ability to fund, promote and place on so many fronts at the same time? That is, foreign policy tensions with China, high tariffs, the support of war conflicts and the speculative housing market, among many other causes?

To make rigorous that A -> B is quite hard. For these type of problems you would have to define a directed acyclic graph (DAG) for how different components are related and then hope that the given data is sufficient to ensure that there are no confounds that spoil your hypothesis test.

I recommend this lecture series on the topic:

Thanks @mathowl!!