BlackRock is Growing its Bitcoin Holdings Aggressively

Hello Readers,

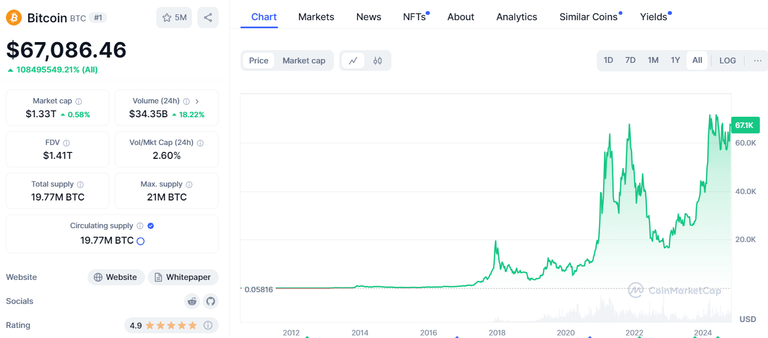

Bitcoin, the first cryptocurrency, was created back in 2009 by an unknown person or a group using the name ‘Satoshi Nakamoto’. The idea was to make a form of digital money that would not rely on centralized authorities like governments or banks. But who knew this was just the start of a financial revolution? Anyway, unlike traditional currencies, Bitcoin is decentralized and operates on a technology called blockchain. Decentralized means no centralized authority will control the print or flow of the Bitcoin currency and blockchain is a technology where each transaction that happens with Bitcoin will get stored permanently in a block and these blocks will be connected together like a chain to provide security and transparency. Now talking about Bitcoin, it has a limited supply by design, and only 21 million coins will ever exist, making it a highly scarce and valuable asset over time. While Bitcoin was initially considered a niche idea, over the years, it has grown to become one of the most popular forms of investment.

Who is BlackRock?

BlackRock is a USA-based multinational investment company and the largest asset manager in the world. It is currently handling trillions of dollars in investments across various sectors. Founded back in 1988, they are well known for their expertise in exchange-traded funds (ETFs), which are investment funds traded on stock exchanges. ETFs make it easier for regular people to invest in various assets including Bitcoin, without actually owning the cryptocurrency directly. BlackRock has become a significant player in the world of finance, and its influence extends to almost every market.

BlackRock’s Bitcoin Move

Right now, BlackRock holds over 391,000 Bitcoins, which is worth more than 26.5 billion USD. To give you a sense of how much that is, it is nearly 2% of all the Bitcoin that will ever exist! And no, they are not at all stopping there. Finance experts believe that by the end of 2024, they could be increasing their holding by as much as 500,000 Bitcoin. But why is BlackRock so focused on buying so many Bitcoins? Well, the answer is simple, they know its true value and its potential for growth in the future. With only a limited amount of Bitcoin available, many investors believe the price will only continue to rise from here, especially as more people and companies start to realize its importance. BlackRock, as the king of ETFs, is making sure they secure as much of this valuable asset as possible before BTC actually goes to the moon.

Why We Should Pay Attention

If BlackRock, one of the most powerful financial companies in the world, is buying up so many Bitcoins and holding them, it clearly tells us the importance of Bitcoin and crypto, as they are already seeing it as a valuable investment for the future. As one of the biggest financial institutes trusts in the future potential of Bitcoin and cryptocurrency, this fact alone should make anyone more interested in their financial future take notice. BlackRock is not just investing in Bitcoin for themselves, they are doing it on behalf of their customers. But remember, BlackRock controls those Bitcoins they own. With such large amounts of Bitcoin being held by major players like BlackRock, the current available supply of Bitcoin is shrinking. This could decrease the supply and thus lead to higher prices in the future. So, if you are thinking about getting into Bitcoin, now might be a smart time to act before the price skyrockets further.

Time to Act

Bitcoin is considered Digital Gold because of its finite supply and its price is influenced by supply and demand. As BlackRock and other large institutions continue to buy and hold Bitcoin, it is possible that in the near future, the cost of owning even a small fraction of a Bitcoin (what we call "Satoshi") could go up. So, if you have an interest in Crypto and ever thought about buying Bitcoin, I think now might be the right time. Do not wait until it is too expensive for most people to afford. You do not have to be a big investor like BlackRock to start. Even owning a small amount of Bitcoin or investing small amounts to buy Sats today could pay off big time in the future. BlackRock has its eyes locked on Bitcoin’s potential already, but what about you?

In spite of mixed global reactions on Cryptocurrency, Bans, or High Taxes in many countries and other problems, BlackRock’s aggressive pursuit of 500,000 Bitcoins shows how seriously big institutions are taking cryptocurrency. Bitcoin is no longer just for tech enthusiasts or niche investors, it has become a Valuable Asset of the Digital era and obviously a growing part of the global financial landscape. While BlackRock continues to increase its holdings, everyday investors should consider how Bitcoin could fit into their own financial plans. However, this is not Financial Advice and please DYOR before investing your money anywhere.

I hope you liked reading my post about Bitcoin and BlackRock and now tell me, are you ready to secure your piece of Bitcoin before it's out of reach? Let me know in the comment section below and I will be seeing you all in my next post.

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 10.00% vote for delegating HP / holding IUC tokens.