Bitcoin Dips Below $100,00 Price Mark | Bear Season begins?

Hello Readers,

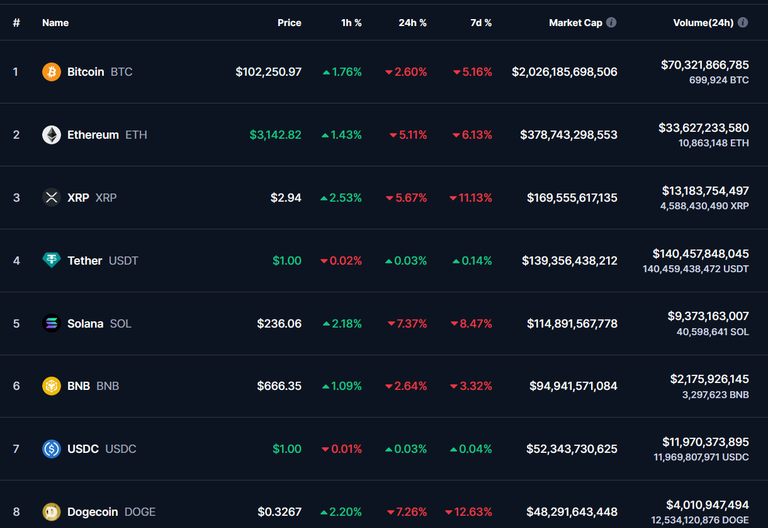

I hope all of you are doing well in life and having an awesome Monday with your family and friends. The crypto world is wild indeed, sometimes it flies like a rocket and sometimes it dips like a fallen knife. As we talk, Bitcoin, the biggest OG and also the most globally famous cryptocurrency, has taken a hit after a good uptrend season. It is dropping below the $100,000 mark as of today January 27. The dip in its price came as shared in news is stating that Bitcoin traders have decided to book profits after a strong rally in $BTC in recent weeks. In the last 24 hours, Bitcoin’s value had dropped by a whopping 4.32% and it is currently sitting at $100,321 after doing a bounce back from the recent fall. This decline also impacted other crypto tokens like Solana, Dogecoin, Sui and Cardano, all of which saw sharper losses today like Bitcoin, and of course, our Hive is on the list as well. But what is behind this sudden almost 5% drop? Let us try to break it down in simple terms.

Traders dipped Bitcoin?

As we all know Bitcoin’s price movements are a tug-of-war between buyers, what we call bulls and the sellers aka bears. While some miners and big traders are cautious with the continuous rally and selling off their $BTC holdings due to recent market fluctuations, I believe the long-term Bitcoin enthusiasts remain hopeful. Even crypto experts like Avinash Shekhar, who is the present CEO of Pi42 have pointed out that most short-term investors are currently being cautious because of these big liquidations and unstable trading volumes. Does it mean the price correction will proceed further?

Another factor behind this play is the broader economy scaling the global present condition. Ryan Lee, the Chief Analyst at Bitget Research has explained that technical indicators are currently showing some uncertainty in the crypto market. Upcoming big decisions like U.S. interest rates and meetings by the Federal Open Market Committee (FOMC) are about to dictate the near future for crypto.

Bitcoin | The Role of Trump

Bitcoin had previously surged to around $109,000 some weeks ago, the sentiment went positive during the time of Donald Trump’s inauguration. Many believed that President Trump’s policies would encourage growth in the crypto market on a global scale. Anyway, just recently, Mr. Trump has doubled down on his support for crypto by ordering a dedicated task force to create new regulations and even explore the idea and possibility of a national cryptocurrency reserve.

But this optimism has been taken strongly overall and added to the mix of other global financial issues. For example, BlackRock’s CEO, Larry Fink has recently hinted at ongoing discussions with the sovereign wealth funds about buying Bitcoin. Meanwhile, Arthur Hayes, a well-known crypto trader has recently warned about a potential "mini financial crisis" that may push Bitcoin prices down to around $70,000 to $75,000.

Effect on Other Cryptos

Bitcoin is well known for its largest market cap holder and the first mover advantage in the crypto market. So of course, it was not the only crypto token to take a hit. As I checked, Ethereum has dropped by 6% and is now valued at $3,144. Other crypto coins like Solana, Dogecoin and Sui also experienced even bigger losses, with Sui falling down by a whopping 11.6%. This is the lost of some major cryptos performed on Monday -> Solana - Down 9.9%, Dogecoin - Down 9.3%, Cardano - Down 8.2%, Sui - Down 11.6%, Shiba Inu - Down 9% and Chainlink - Down by 8.3%. Anyway, at Overall, the global crypto market has no doubt shrank a bit and by a margin of a sharp 5.4% dip, it is now dropping to a total value of $3.42 trillion.

Bitcoin’s Dominance

Despite the market downturn, Bitcoin still dominates the whole crypto market and right now holds 58.12% of the total crypto market share. Its 24-hour trading volume surged by a whopping 88.2%, reaching a total of $40.88 billion. Stablecoins also played a major role and accounted for 89.57% of the total trading volume. This latest dip in Bitcoin is just another reminder of how volatile the crypto market can be. Factors like the US, China and other global financial decisions, technical trends and investor sentiments in all these different sectors play a pivotal role in reshaping Bitcoin’s price.

https://x.com/CryptoHayes/status/1883682137897099624

What’s Next for $BTC

As I stated above, while Bitcoin’s recent dip may feel like a setback to new or short-time traders, many long-term investors will only remain confident in this situation. As the world continues to explore the role of crypto, Bitcoin is now even being accepted by the global financial systems one after another. So, though in the long term everything looks super cool, Bitcoin’s journey will likely be filled with ups and downs for a short-term span. Last but not least, this is not financial advice and please do your own research before investing in crypto. The crypto market is risky so if you are a trader or invest in new projects, please be cautious, especially during these high times. Whether you are a seasoned investor or just a new soul exploring the crypto world, just always remember that in this volatile space, patience and staying informed are the main 2 keys. The market is brutal and unpredictable, but for us Bitcoin believers, the future will always hold a golden vibe.

Information Source:

I hope you liked reading my blog about the Bitcoin's recent Dip and hope you find reading this post informative and helpful. Let me know your thoughts regarding this topic in the comment section below and I will be seeing you all in my next post.

Posted Using INLEO

Wow..this is quite a good observation. I'm glad you had to put this together in such a beautiful way.