DEC-SWAP.HIVE Liquidity Pool: Impermanent Loss Explanation and Calculation + Holding VS Liquidity Pool Comparison after 118 days (ENG/ITA)

La versione in italiano è subito dopo la versione in inglese - The Italian version is immediately after the English version

La versione in italiano è subito dopo la versione in inglese - The Italian version is immediately after the English version

Today I am finally able to resume my posting activity on Hive after a period full of work commitments, a period in which I had very little free time on my hands.

Publishing posts on Hive and interacting with other Hive users is something I really enjoy doing but work and family always take precedence as they should.

In today's post I want to share the financial assessment of my investment in the DEC-SWAP.HIVE liquidity pool after 118 days since I added liquidity.

DEC-SWAP.HIVE: Financial Evaluation after 118 days

Impermanent Loss Explanation and Calculation + Holding VS Liquidity Pool Comparison

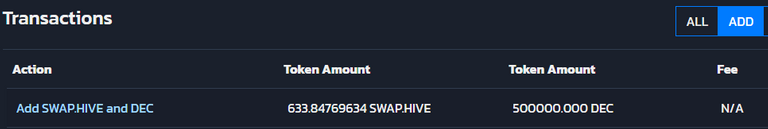

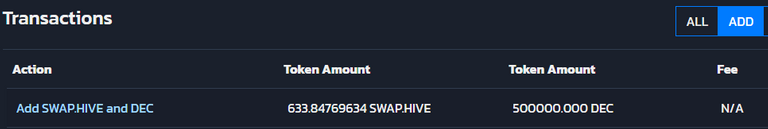

My investment in the DEC-SWAP.HIVE liquidity pool began on September 2, 2022 when I put in the following liquidity:

- 500000 token DEC

- 633.84769634 SWAP.HIVE

Investing in a liquidity pool is the alternative choice to Holding and/or staking in case a token provides for this possibility.

If you have a pair of tokens that you have no intention of selling you should always consider and evaluate as a viable and alternative option to invest in a liquidity pool.

But beware, investing in a liquidity pool has risk factors to consider and the main risk factor to evaluate is the impermanent loss.

If you are not familiar with the mechanisms governing a liquidity pool, I suggest you study them before investing.

The impermanent loss is a loss that is realized:

- only when liquidity is removed from a pool.

- only if there has been a change in the value of the tokens injected as liquidity into the pool in the time interval between the injection of liquidity and the removal of liquidity, and only if the ratio of the value of the tokens injected as liquidity has changed.

To better explain the concept of Impermanent Loss I will show you some example cases:

1st Case: The tokens put into the pool had the same change in value.

| Example 1 | Example 2 | Example 3 |

|---|---|---|

| token A = +50% | token A = +0% | token A = -50% |

| token B = +50% | token B = +0% | token B = -50% |

| Impermanet Loss = 0% | Impermanet Loss = 0% | Impermanet Loss = 0% |

2nd Case: The tokens put into the pool had a different change in value.

| Example 1 | Example 2 | Example 3 |

|---|---|---|

| token A = +20% | token A = +200% | token A = +500% |

| token B = -10% | token B = -40% | token B = -95% |

| Impermanet Loss = 1.03% | Impermanet Loss = 25.46% | Impermanet Loss = 81.89% |

From the examples I have shown you, it is easy to deduce that the first case is highly improbable and therefore investing in a liquidity pool will almost always produce an impermanent loss.

But the impermanent loss can be covered and/or exceeded by the value of incentives distributed to liquidity providers:

- fees

- rewards

Valuation of an investment in a liquidity pool must therefore be based on the evaluation and calculation of the value of three elements:

- impermanent loss

- fees

- rewards

After this parenthesis that I used to explain impermanent loss I can turn to the practical financial valuation of my investment in the SWAP.HIVE-DEC pool to date that will allow me to answer the following question:

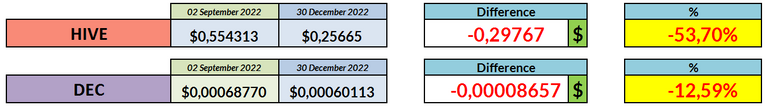

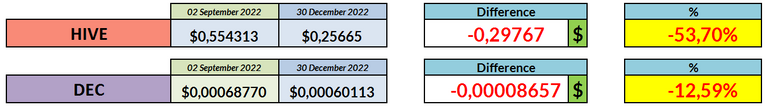

On September 2, 2022, when I added liquidity to the SWAP.HIVE-DEC pool:

- 1 token SWAP.HIVE was worth $0.554313

- 1 token DEC was worth 0.00068770$

Today December 30, 2022, after 118 days, the market value of SWAP.HIVE tokens and DEC tokens has changed from the time I added liquidity:

- the HIVE token is worth $0.256648

- the DEC token is worth 0.00060113$

In the time interval September 2, 2022 - December 30, 2022:

- the HIVE token lost 53.70% of its value

- the DEC token lost 12.59% of its value

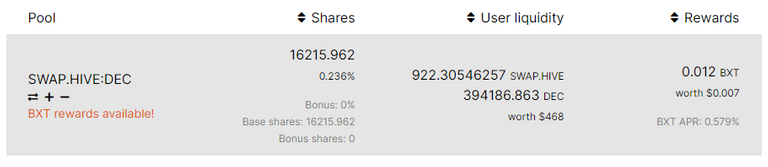

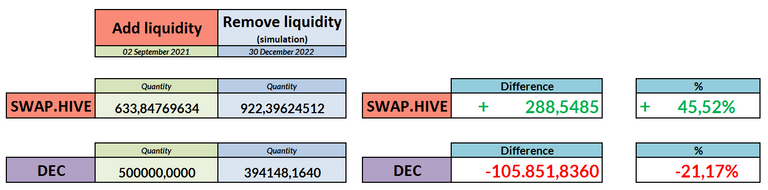

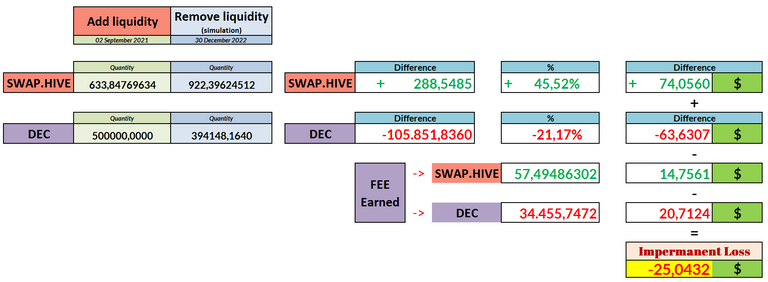

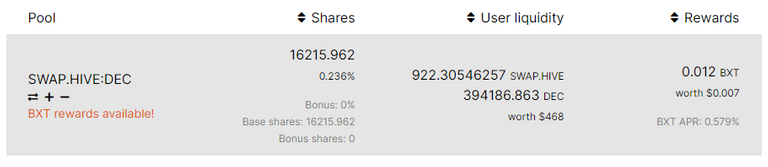

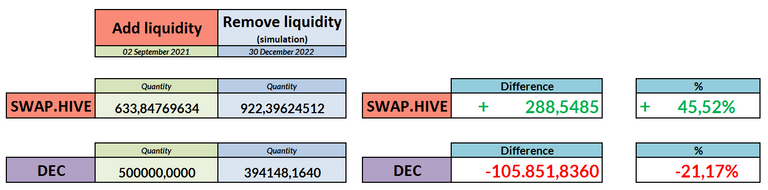

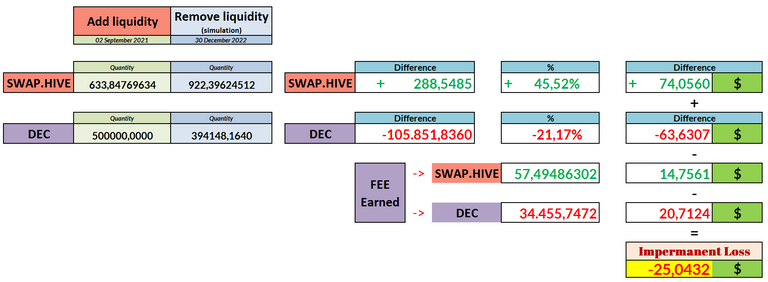

Due to the different change in the value of the tokens in the DEC-SWAP.HIVE pair, the amount of tokens I can remove from the DEC-SWAP.HIVE pool has also changed from September 2, 2022.

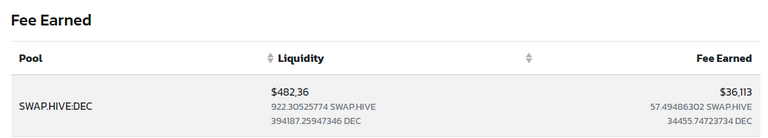

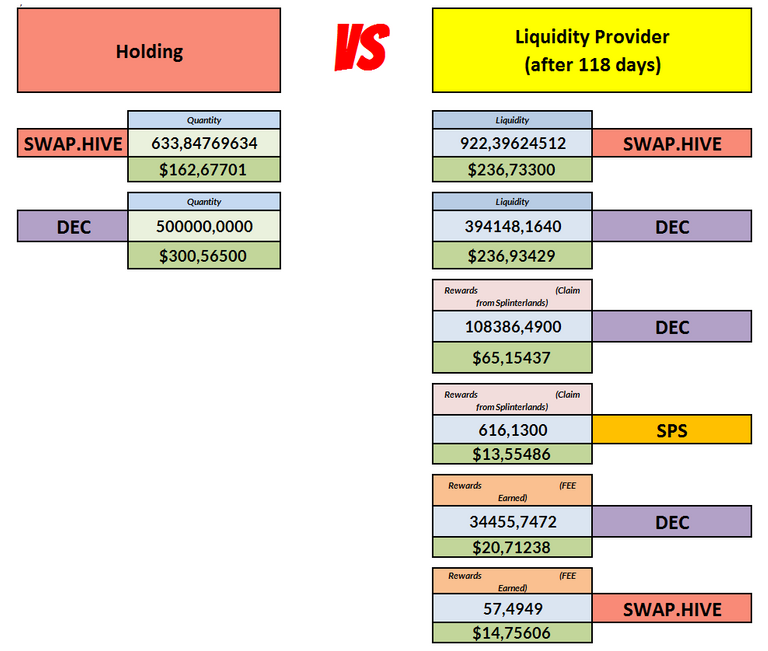

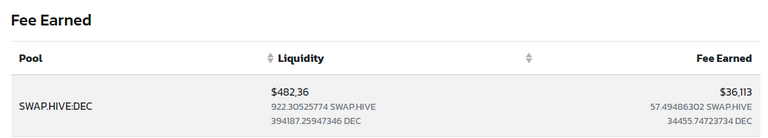

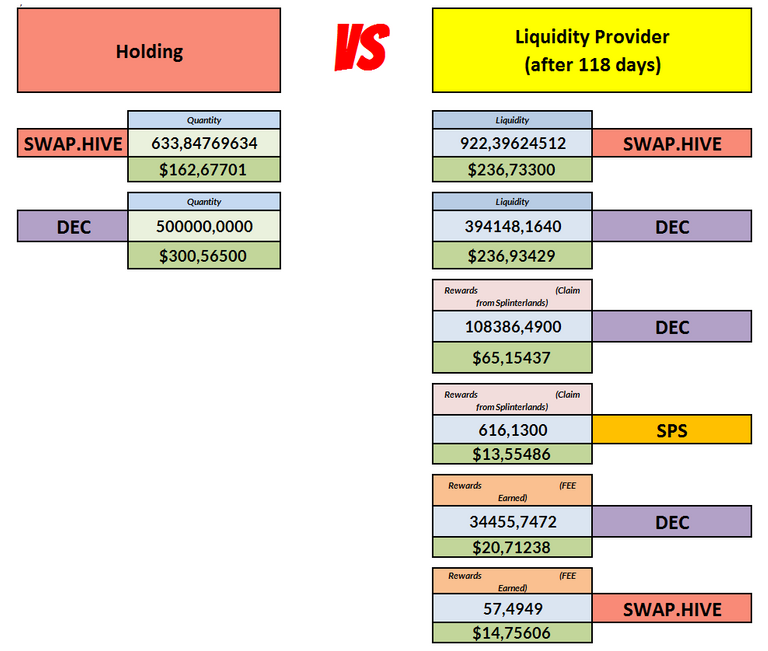

In the following image you can see the change in the amount of tokens within the DEC-SWAP.HIVE pool that I recorded today and calculated in my spreadsheet.

To calculate the impermanent loss I must first know the value of the fees I received as a reward for adding liquidity.

In 118 days from liquidity providers I got (fee earned):

- 57.49486302 SWAP.HIVE

- 34455.74723734 DEC

The fee earned are not distributed in the wallet of Hive Engine or TribalDEX of the liquidity providers but are added to the liquidity injected into the pool.

Therefore to calculate the impermanent loss I subtracted the amount of DEC tokens and SWAP.HIVE received as rewards.

As you can see from the calculations in the table below the impermant loss of my investment in the DEC-SWAP.HIVE pool today is -25.0432$ (obviously only if I decide to remove all my liquidity from the pool).

My choice to add liquidity to the SWAP.HIVE-DEC pool will have been a good choice so far only in case the total value of the rewards and fees I have obtained so far is greater than the value of the impermanent loss.

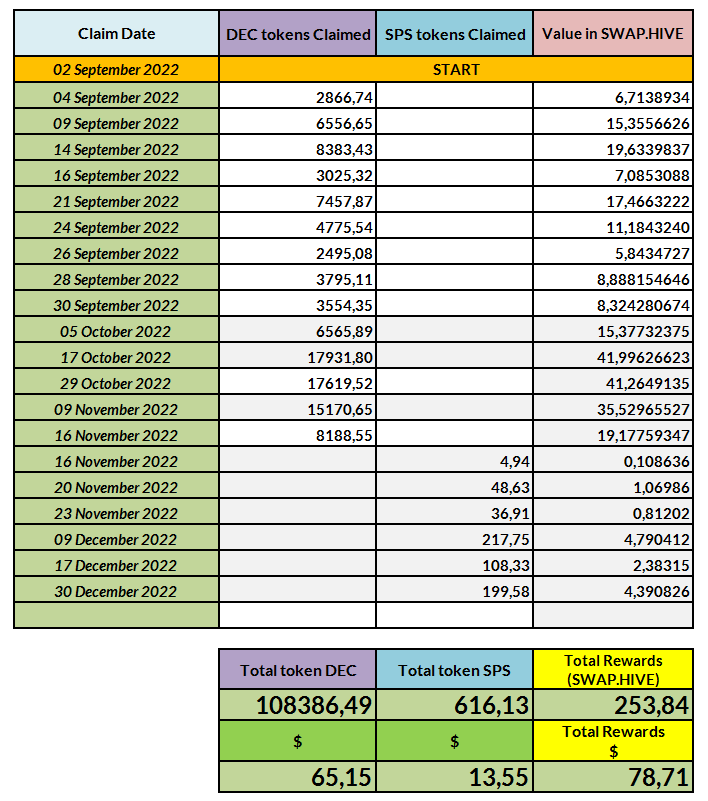

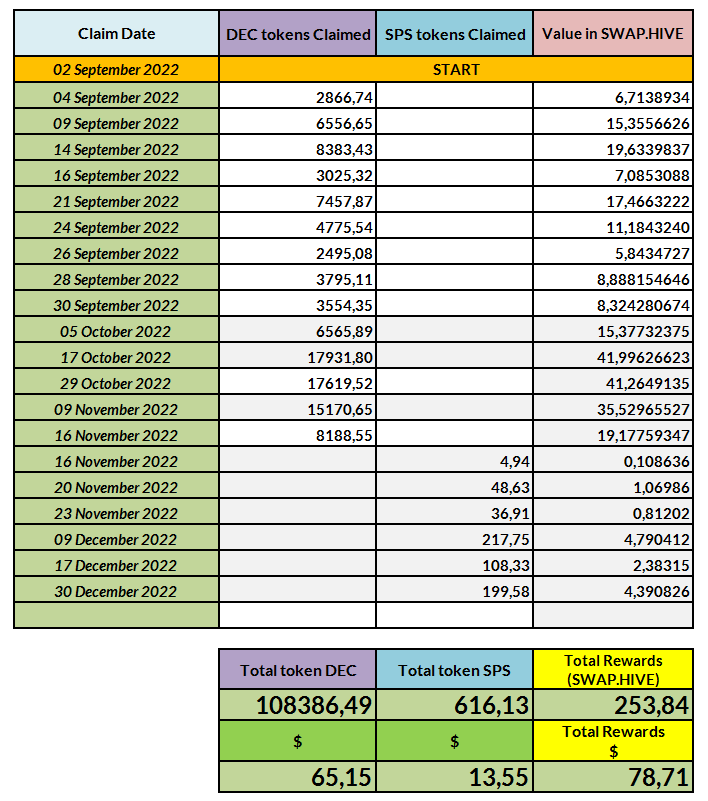

In the table below you can see the amount of DEC tokens and SPS tokens that I have obtained to date as rewards (Claim from the Splinterlands site).

Until mid-November the pool distibuted DEC tokens as claimable rewards from the Splinterlands site then distributed SPS tokens.

In 118 days I received:

- 108386.49 DEC

- 616.13 SPS

The total dollar value is $78.71.

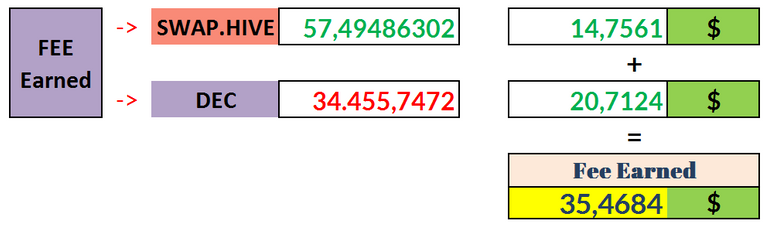

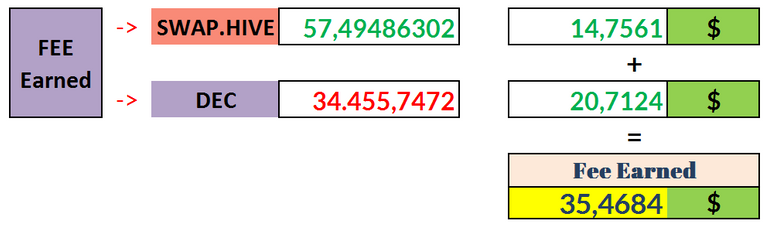

Already this value is higher than the value of the impermanent loss but I have not yet calculated the dollar value of the fees I got:

- 57.49 SWAP.HIVE

- 34455.74 DEC

The dollar value is 35.4684$

I now have all the necessary data to be able to evaluate my investment in the DEC-SWAP.HIVE pool after 118 days.

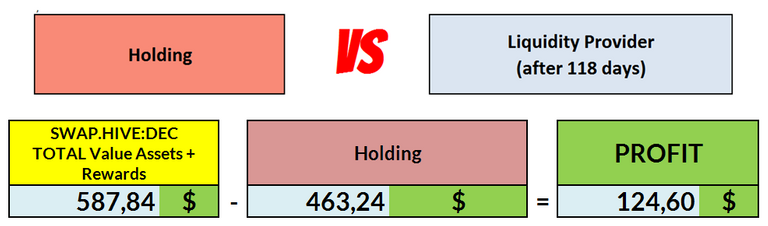

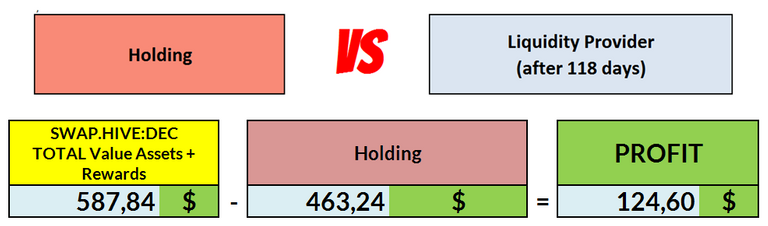

If on September 2, 2022 I had simply chosen to keep liquid (holding) DEC tokens and SWAP.HIVE tokens today I would have a value of $463.24.

Choosing to add liquidity to the DEC-SWAP.HIVE pool allowed me to have a total value (liquidity + rewards) of 587.84$.

Choosing to become a liquidity provider was a better choice than choosing to hold and allowed me to get a profit versus holding of +$124.60.

Final Considerations

Investing in a liquidity pool should always be a subjective and personal decision that each investor must make based on his or her personal forecast and after doing his or her own research and evaluation.

I am not a financial advisor and the information in this post is not financial advice.

The purpose of this post of mine is to share my personal investment in the DEC-SWAP.HIVE liquidity pool and more importantly to show my readers what elements to evaluate and the calculations that need to be done to evaluate an investment in a liquidity pool.

Often those who have created a Defi platform use the APR value of a liquidity pool to incentivize investment.

My advice is to not only consider the value of the APR as an element for investing.

An APR of 1000% or 4000% is just an estimated percentage value that could be worth much less and even in the short term if it is linked to a token that:

- has no use cases other than buying and selling

- will have no future use cases.

The decision to invest in a liquidity pool should primarily be based on the prediction of the future value

- of the tokens placed as liquidity

- of the tokens distributed as rewards (fees + rewards)

I decided to invest in the DEC-SWAP.HIVE liquidity pool because:

- the DEC tokens have many use cases.

- the HIVE tokens have many use cases.

If on September 2 I had chosen to sell the DEC tokens and the SWAP.HIVE tokens today I would have made a bigger profit ($695) but selling the DEC tokens and the SWAP.HIVE tokens was not my option that day and it is still not my option today.

I need the DEC tokens to buy Splinterlands cards.

The SWAP.HIVE tokens I need to power up and increase my weight on the Hive blockchain, which is my favorite blockchain project.

I am satisfied with the financial results I have achieved by adding liquidity in the DEC-SWAP.HIVE pool in 118 days especially considering the current Bear Market situation.

Although I am satisfied with adding liquidity to the DEC-SWAP.HIVE pool today I have decided to remove the liquidity.

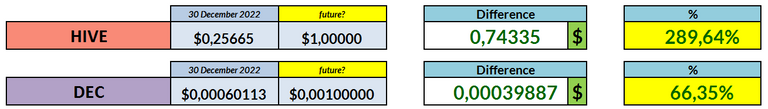

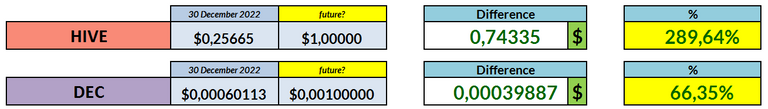

The main reason for my decision is in the current value of HIVE tokens: $0.25.

I consider this value really too low when compared to the usefulness and the many use cases the HIVE token has and if and when the Bear Market ends HIVE could easily exceed the value of $1 (this is my personal opinion and not financial advice).

If in the future the value of 1 token DEC reaches its peg: $0.001 the increase in value would be + 66.35%

If in the future the value of 1 token HIVE reaches a value of $1 the increase in value would be +289.64%.

With 1 HIVE token at $0.25 I would rather take an amount of +288.54 HIVE today than the amount of HIVE I had on Sept. 2 and initially put into the pool.

I will use the DEC tokens removed from the pool to continue buying cards from the market to increase the battle strength of my card collection.

Although by removing the liquidity from the pool I will lose a reward in SPS tokens with the cards I will purchase with the DEC tokens I could increase the in-game rewards which are just the SPS tokens.

I hope I have given you useful information and thank you for taking the time to read this post :)

#Splinterlands = #Hive based #Play2Earn!

Are you not a Splinterlands player?

Any game that allows the purchase of NFTs and tokens is never just a game but is also an investment and should always be considered as such.

I am not a financial advisor and if you decide to invest in the Splinterlands game you do so by your own choice, after making your personal evaluations and after considering all possible risk factors.

A selection of my previous Splinterlands posts

HIVE ON and Splinterlands ON!

DEC:SWAP.HIVE liquidity pool: Spiegazione e Calcolo dell'Impermanent Loss + Confronto Holding VS Liquidity Pool dopo 118 giorni come liquidity provider

Oggi finalmente riesco a riprendere la mia attività di pubblicazione su Hive dopo un periodo pieno di impegni lavorativi, periodo in cui ho avuto davvero poco tempo libero a disposizione.

Pubblicare post su Hive e interagire con gli altri utenti di Hive è un'attività che mi piace molto fare ma gli impegni lavorativi e gli impegni familiari hanno sempre la precedenza come è giusto che sia.

Nel post di oggi voglio condividere la valutazione finanziaria del mio investimento nella liquidity pool DEC-SWAP.HIVE dopo 119 giorni dal momento in cui ho aggiunto liquidità.

Il mio investimento nella liquidity pool DEC-SWAP.HIVE è iniziato il 2 settembre 2022 quando ho immesso la seguente liquidità:

- 500000 token DEC

- 633.84769634 SWAP.HIVE

Investire in una liquidity pool è la scelta alternativa all'Holding e/o allo staking nel caso un token prevede questa possibilità.

Se hai una coppia di tokens che non hai intenzione di vendere dovresti sempre considerare e valutare come opzione possibile e alternativa di investire in una liquidity pool.

Ma attenzione, investire in una liquidity pool ha dei fattori di rischio da considerare e il principale fattore di rischio da valutare è l'impermanente loss.

Se non conosci i meccanismi che governano una liquidity pool ti consiglio di studiarli prima di investire.

L'impermanent loss è una perdita che si realizza:

- solo nel momento in cui si rimuove liquidità da una pool

- solo se c'è stata una variazione del valore dei tokens immessi come liquidità nella pool nell'inervallo di tempo tra l'immissione di liquidità e la rimozione di liquidità e solo se il rapporto di valore dei quantitativi di tokens immessi come liquidità è variato.

Per spiegare meglio il concetto di Impermanent Loss ti mostro alcuni casi di esempio:

1° Caso: I token immessi nella pool hanno avuto la stessa variazione di valore.

| Esempio 1 | Esempio 2 | Esempio 3 |

|---|---|---|

| token A = +50% | token A = +0% | token A = -50% |

| token B = +50% | token B = +0% | token B = -50% |

| Impermanet Loss = 0% | Impermanet Loss = 0% | Impermanet Loss = 0% |

2° Caso: I token immessi nella pool hanno avuto una diversa variazione di valore.

| Esempio 1 | Esempio 2 | Esempio 3 |

|---|---|---|

| token A = +20% | token A = +200% | token A = +500% |

| token B = -10% | token B = -40% | token B = -95% |

| Impermanet Loss = 1.03% | Impermanet Loss = 25.46% | Impermanet Loss = 81.89% |

Dagli esempi che ti ho mostrato è facile dedurre che il primo caso è altamente improbabile e quindi investire in una liquidity pool produrrà quasi sempre un impermanent loss.

Ma l'impermanent loss può essere coperto e/o superato dal valore degli incentivi distribuiti ai liquidity providers:

- fees

- rewards

La valutazione di un investimento in una liquidity pool deve quindi basarsi sulla valutazione e sul calcolo del valore di tre elementi:

- impermanent loss

- fees

- rewards

Dopo questa parentesi che ho utilizzato per spiegare l'impermanent loss posso passare alla valutazione finanziaria pratica del mio investimento nella pool SWAP.HIVE-DEC fino ad oggi che mi permetterà di rispondere alla seguente domanda:

Il 2 settembre 2022, quando ho aggiunto liquidità alla pool SWAP.HIVE-DEC:

- 1 token SWAP.HIVE valeva 0.554313$

- 1 token DEC valeva 0.00068770$

Oggi 30 dicembre 2022, dopo 118 giorni, il valore di mercato dei token SWAP.HIVE e dei token DEC è cambiato rispetto al momento in cui ho aggiunto liquidità:

- il token HIVE vale 0.256648$

- il token DEC vale 0.00060113$

Nell'intervallo di tempo 2 settembre 2022 - 30 dicembre 2022:

- il token HIVE ha perso il 53.70%

- il token DEC ha perso il 12.59%

A causa della diversa variazione di valore dei token della coppia DEC-SWAP.HIVE è cambiata anche la quantità di token che posso rimuovere dalla pool DEC-SWAP.HIVE rispetto al 2 settembre 2022.

Nell'immagine seguente puoi vedere la variazione della quantità dei token all'interno della pool DEC-SWAP.HIVE che ho registrato oggi e che ho calcolato nel mio foglio di calcolo.

Per calcolare l'impermanent loss devo prima conoscere il valore delle fees che ho ricevuto come ricompensa per aver aggiunto liquidità.

In 118 giorni da liquidity providers ho ottenuto (fee earned):

- 57.49486302 SWAP.HIVE

- 34455.74723734 DEC

Le fee earned non vengono distribuite nel wallet di Hive Engine o TribalDEX dei liquidity providers ma vengono aggiunte alla liquidità immessa nella pool.

Per questo motivo per calcolare l'impermanent loss ho sottratto il quantitativo di token DEC e SWAP.HIVE ricevuto come ricompensa.

Come puoi vedere dai calcoli presenti nel prospetto seguente l'impermant loss del mio investimento nella pool DEC-SWAP.HIVE è oggi di -25.0432$ (ovviamente solo se decido di rimuovere tutta la mia liquidità dalla pool).

La mia scelta di aggiungere liquidità alla pool SWAP.HIVE-DEC sarà stata una buona scelta fino ad ora solo nel caso in cui il valore totale delle rewards e delle fee che ho ottenuto fino ad oggi è superiore al valore dell'impermanent loss.

Nella tabella seguente puoi vedere il quantitativo di token DEC e di token SPS che ho ottenuto fino ad oggi come ricompensa (Claim dal sito di Splinterlands).

Fino a metà novembre la pool ha distibuito i token DEC come ricompense claimabili dal sito di Splinterlands poi ha distribuito token SPS.

In 118 giorni ho ricevuto:

- 108386.49 DEC

- 616.13 SPS

Il valore totale in dollari è di 78.71$

Già questo valore è superiore al valore dell'impermanent loss ma non ho ancora calcolato il valore in dollari delle fee che ho ottenuto:

- 57.49 SWAP.HIVE

- 34455.74 DEC

Il valore in dollari è di 35.4684$

Ho adesso tutti i dati necessari per poter valutare il mio investimento nella pool DEC-SWAP.HIVE dopo 118 giorni.

Se il 2 settembre 2022 avessi scelto semplicemente di mantenere liquidi (holding) i token DEC e i token SWAP.HIVE oggi avrei un valore di 463.24$.

La scelta di aggiungere liquidità alla pool DEC-SWAP.HIVE mi ha permesso di avere un valore totale (liquidity + rewards) di 587.84$.

La scelta di diventare liquidity provider è stata una scelta migliore rispetto alla scelta di holdare e mi ha permesso di ottenere un profitto rispetto all'holding di +124.60$.

Considerazioni Finali

Investire in una liquidity pool deve essere sempre una decisione soggettiva e personale che ogni investitore deve prendere in base alle proprie previsioni personali e dopo aver fatto le proprie ricerche e valutazioni.

Io non sono un consulente finanziario e le informazioni contenute in questo post non sono consigli finanziari.

Lo scopo di questo mio post è di condividere il mio personale investimento nella liquidity pool DEC-SWAP.HIVE e soprattutto di mostrare ai miei lettori quali sono gli elementi da valutare e i calcoli che è necessario fare per valutare un investimento in una liquidity pool.

Spesso chi ha una piattaforma Defi utilizza il valore dell'APR di una liquidity pool per incentivare all'investimento.

Il mio consiglio è di non considerare mai solo il valore dell'APR come elemento per investire.

Un APR del 1000% o del 4000% è solo un valore percentuale stimato che potrebbe valere molto meno e anche nel breve termine se è collegato ad un token che:

- non ha casi d'uso oltre all'acquisto e alla vendita

- non avrà casi d'uso futuri.

La decisione di investire in una liquidity pool dovrebbe principalmente basarsi sulla previsione del valore futuro:

- dei tokens immessi come liquidità

- dei tokens distribuiti come ricompensa (fee + rewards)

Io ho deciso di investire nella liquidity pool DEC-SWAP.HIVE perchè:

- i token DEC hanno molti casi d'uso

- i token HIVE hanno molti casi d'uso

Se il 2 settembre avessi scelto di vendere i token DEC e i token SWAP.HIVE oggi avrei fatto un profitto maggiore (695$) ma la vendita dei token DEC e dei token SWAP.HIVE non era una mia opzione quel giorno e non lo è ancora oggi.

I token DEC mi servono per acquistare le carte di Splinterlands.

I token SWAP.HIVE mi servono per fare power up ed aumentare il mio peso sulla blockchain di Hive che è il mio progetto blockchain preferito.

Sono soddisfatto dei risultati finanziari che ho ottenuto aggiungendo liquidità nella pool DEC-SWAP.HIVE in 118 giorni soprattutto considerando l'attuale situazione di Bear Market.

Anche se sono soddisfatto di aver aggiunto liquidità alla pool DEC-SWAP.HIVE oggi ho deciso di rimuovere la liquidità.

Il motivo principale di questa mia decisione è nel valore attuale dei token HIVE: 0.25$.

Considero questo valore davvero troppo basso se rapportato all'utilità e ai tanti casi d'uso che ha il token HIVE e se e quando il Bear Market terminerà HIVE potrebbe facilmente superare il valore di 1$ (è la mia opinione personale e non è un consiglio finanziario).

Se in futuro il valore di 1 token DEC raggiungerà il suo peg: 0.001$ l'incremento di valore sarebbe del + 66.35%

Se in futuro il valore di 1 token HIVE raggiungerà un valore di 1$ l'incremento di valore sarebbe del +289.64%.

Con 1 token HIVE a 0.25$ preferisco prendere oggi un quantitativo di +288.54 HIVE rispetto al quantitativo di HIVE che avevo il 2 settembre e che ho immesso inizialmente nella pool.

Userò i token DEC per continuare ad acquistare le carte dal mercato per aumentare la forza in battaglia della mia collezione di carte.

Anche se rimuovendo la liquidità dalla pool perderò una ricompensa in token SPS con le carte che acquisterò con i token DEC potrei aumentare le ricompense di gioco che sono proprio i token SPS.

Spero di averti dato informazioni utili e ti ringrazio per aver dedicato il tuo tempo alla lettura di questo post :)

#Splinterlands = #Hive Based #Play2Earn!

Non sei un giocatore di Splinterlands?

Ogni gioco che permette l'acquisto di NFT e di token non è mai un semplice gioco ma è anche un investimento e come tale deve sempre essere considerato.

Io non sono un consulente finanziario e se decidi di investire nel gioco di Splinterlands lo fai per tua scelta, dopo aver fatto le tue personali valutazioni e dopo aver considerato tutti i possibili fattori di rischio.

Una selezione dei miei post su Splinterlands

Posted Using LeoFinance Beta

Congratulations, @libertycrypto27 Your Post Got 100% Boost.

@libertycrypto27 Burnt 81.468 UPME & We Followed That Lead.

Contact Us : CORE / VAULT Token Discord Channel

Augurandoti buon anno e rinnovando la stima per l'egregio lavoro che svolgi e per il supporto alla community!

@tipu curate 2

!PGM

!LUV

!LOLZ

Upvoted 👌 (Mana: 11/51) Liquid rewards.

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

A cab.

Credit: marshmellowman

@libertycrypto27, I sent you an $LOLZ on behalf of @elikast

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(3/4)

@libertycrypto27, @elikast(1/1) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

Grazie mille cara @elikast per le tue gentili parole

Tantissimi auguri di buon anno a te e tutti i tuoi cari

Un fortissimo abbraccio

!LUV

!PGM

!LOL

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Congratulations, @libertycrypto27 Your Post Got 100% Boost.

@libertycrypto27 Burnt 68.59 HELIOS & We Followed That Lead.

Contact Us : HELIOS Token Discord Channel

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

thanks for the support

!PGM

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Complimenti per come hai gestito questo investimento: il guadagno che hai ottenuto è davvero impressionante, soprattutto considerato che nello stesso periodo i token coinvolti non hanno fatto altro che perdere valore.

Grande davvero! E buon ultimo dell'anno :)

!PGM

!LOL

lolztoken.com

You’re not alone.

Credit: reddit

@libertycrypto27, I sent you an $LOLZ on behalf of @arc7icwolf

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(1/6)

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Si e avrei continuato se la ricompensa fosse stata in token DEC e se i token HIVE non avessero perso tanto valore. Tra l'holding e le liquidity pool preferisco sempre le liquidity pool quando i token coinvolti e le ricompense hanno casi d'uso ;)

Grazie del commento e buon ultimo dell'anno anche a te :)

!PGM

!LOL

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

It was clear from the gecko.

Credit: reddit

@arc7icwolf, I sent you an $LOLZ on behalf of @libertycrypto27

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/8)

Impermanent loss isn't an issue so long as the APR offsets it and I think the pool definitely did so. The DEC pool is also a pool that gets a ton of trading. I am kind of surprised at how much I could get back to offset the loss from the fees generated.

Posted Using LeoFinance Beta

Exactly when in a pool the tokens have use cases and the Swap function is used often the impermanent loss becomes only a small loss covered and largely exceeded by fees and rewards ;)

Thank you for your comment and happy new year :)

!PGM

!LOL

!PIZZA

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

Too many cheetahs.

Credit: marshmellowman

@jfang003, I sent you an $LOLZ on behalf of @libertycrypto27

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(2/8)

Well you share really informative information. You're calculations are right. You share your massive experience. And splintersland game is easy and best way to earn. In bul market we see sps tokan on the top. In bear Market hive also performing good.

Yes I agree with you, considering the current Bear Market both Splinterlands and Hive are doing very well and when the Bear Market ends those who have continued to increase the amount of tokens could be rewarded very well ;)

!PGM

!LOL

Posted Using LeoFinance Beta

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

A horse-pital.

Credit: reddit

@lee1938, I sent you an $LOLZ on behalf of @libertycrypto27

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(6/8)

Yes it's absolutely true

I gifted $PIZZA slices here:

@libertycrypto27(2/10) tipped @djbravo (x1)

libertycrypto27 tipped elikast (x1)

libertycrypto27 tipped arc7icwolf (x1)

curation-cartel tipped libertycrypto27 (x1)

libertycrypto27 tipped underlock (x1)

libertycrypto27 tipped jfang003 (x1)

Learn more at https://hive.pizza!

I am sharing with you my personal opinion. I think staking is best to earn some reward daily and your investments also save. A disadvantage of staking is that if the prize queens keep going down, they are a loss for you. If you have the folding power, then you can keep them all until the bull market, then they will give you a good profit.

staking and liquidity pool are two good alternatives in the Bear Market but obviously only on tokens with many use cases ;)

Thanks for your comment

!PGM

!PIZZA

Posted Using LeoFinance Beta

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

!1UP Good work!

Thanks a lot for the comment and for curation

Happy New Yeak

!PGM

!LOL

!PIZZA

Posted Using LeoFinance Beta

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

It was just so lava-able.

Credit: belhaven14

@underlock, I sent you an $LOLZ on behalf of @libertycrypto27

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(5/8)

You have received a 1UP from @underlock!

@monster-curator, @oneup-curator, @leo-curator, @ctp-curator, @bee-curator, @pimp-curator, @vyb-curator, @pob-curator, @neoxag-curator, @cent-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

yes indeed the price of the hive has dropped a lot, and we'll see if it doesn't go down even more ☹️

If it goes down further it will be a good opportunity for me to buy or convert HBD. When this bear market passes the value will rise ;)

!PGM

!LOL

Posted Using LeoFinance Beta

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

I'm over you.

Credit: reddit

@speedtuning, I sent you an $LOLZ on behalf of @libertycrypto27

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(4/8)

Great article and information!

!LOLZ

!LUV

@libertycrypto27, @thebighigg(2/3) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

lolztoken.com

I told her to get out of my fort.

Credit: lofone

@libertycrypto27, I sent you an $LOLZ on behalf of @thebighigg

Thanks for supporting The LOLZ Project. We !LUV our users!

(6/6)

@thebighigg, @lolzbot(3/4) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

thanks and I'm glad you liked my article

Happy New Year

!PGM

!LOL

Posted Using LeoFinance Beta

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

You ain't seen muffin yet.

Credit: reddit

@thebighigg, I sent you an $LOLZ on behalf of @libertycrypto27

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(3/8)

Congratulations @libertycrypto27! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Congratulations @libertycrypto27! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: