LeoFinance Weekly Stats 03/06/2023 to 03/12/2023

Welcome to the weekly edition of the LeoFinance stats report.

This is a weekly report covering March 6 through 12, 2023.

If you want to learn a bit more about the LeoFinance ecosystem and dig into the numbers, this is the place to be.

The following topics will be covered:

- Issued LEO Tokens

- Top LEO Earners

- Rewards to HP delegators trough the leo.bounties program

- Daily stats on tokens staking

- Share of tokens staked

- Top Users that staked

- Unique number of LeoFInance users

- Posts/comments activities on the platform

- Posting from LeoFinance.io interface

- Price Chart

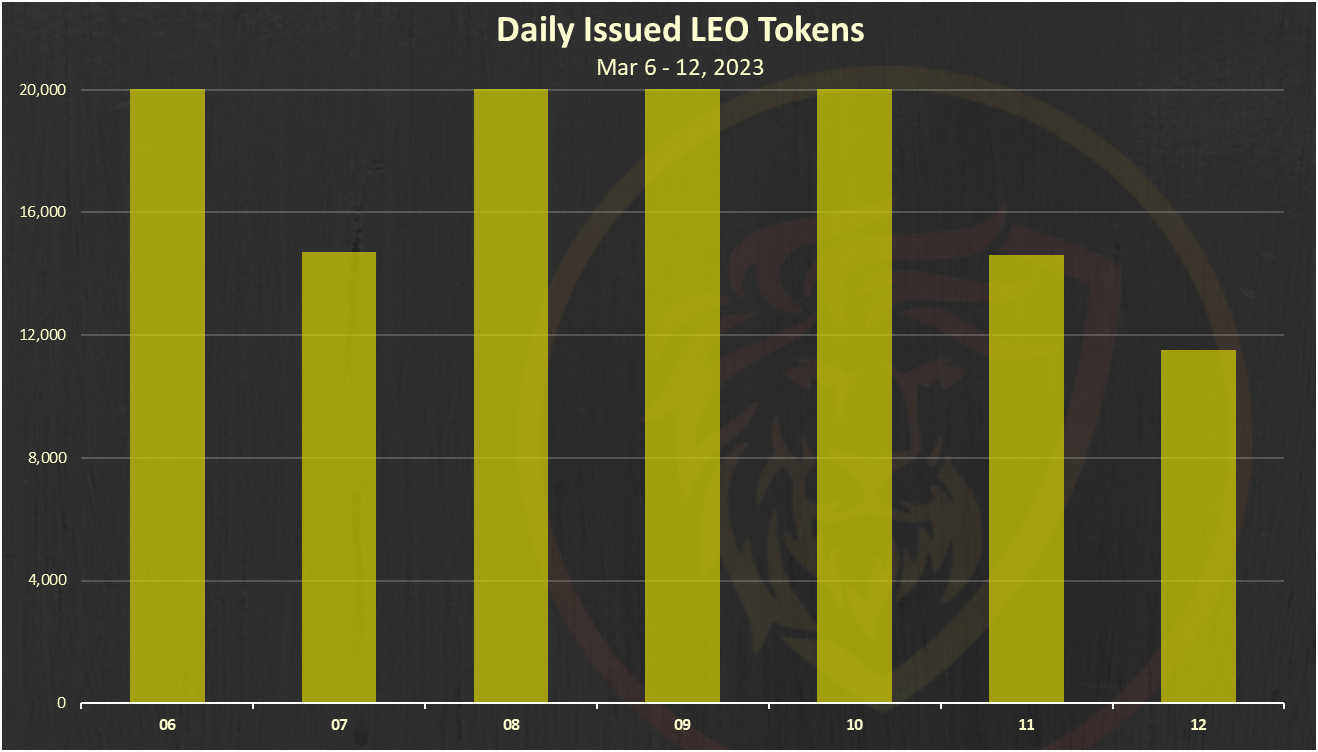

Issued LEO Tokens

Let’s take a look into token issuance and how it is distributed over time.

Below is a chart that represents the cumulative issued LEO tokens.

This chart is representing the total LEO supply, circulating supply and burned tokens.

A total of 14.49M circulating supply.

Next is the issued LEO tokens from last week. Here is the chart:

A total of 140k LEO were issued in the last week.

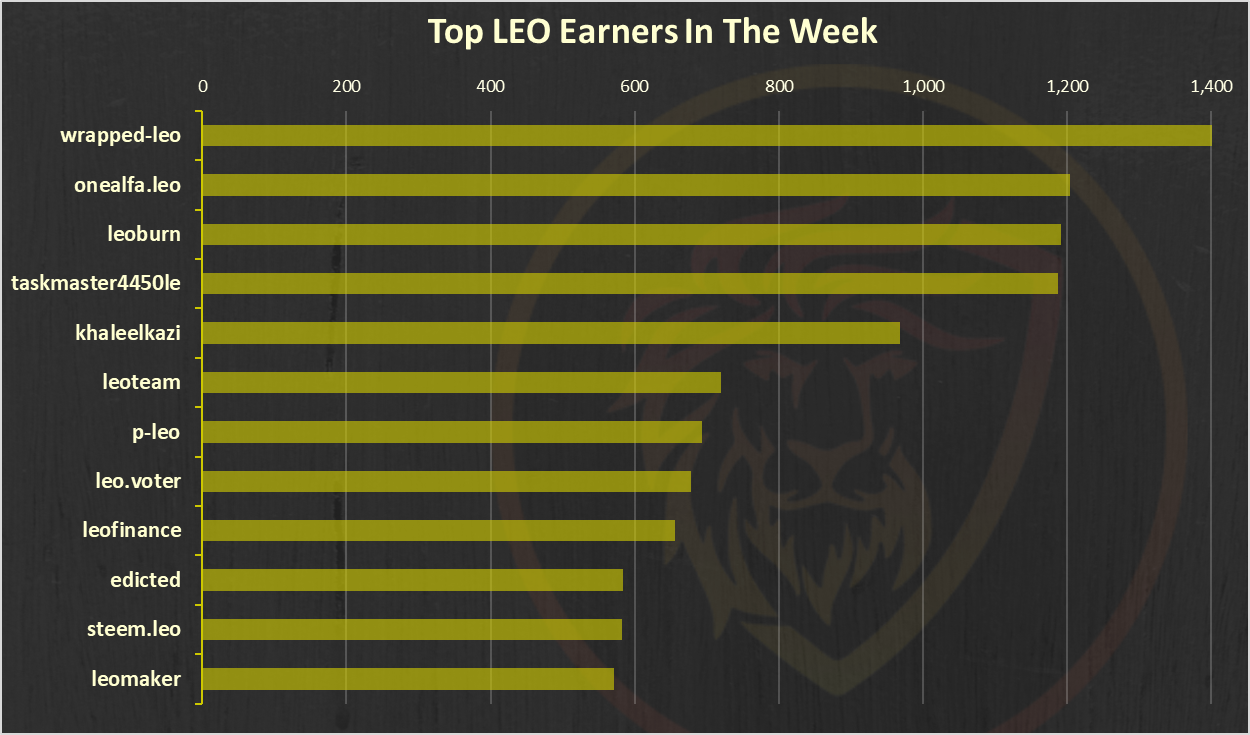

Let’s see how these tokens were distributed.

Below is the chart of the top 10 LEO earners this week.

The @wrapped-leo account is on the top here.

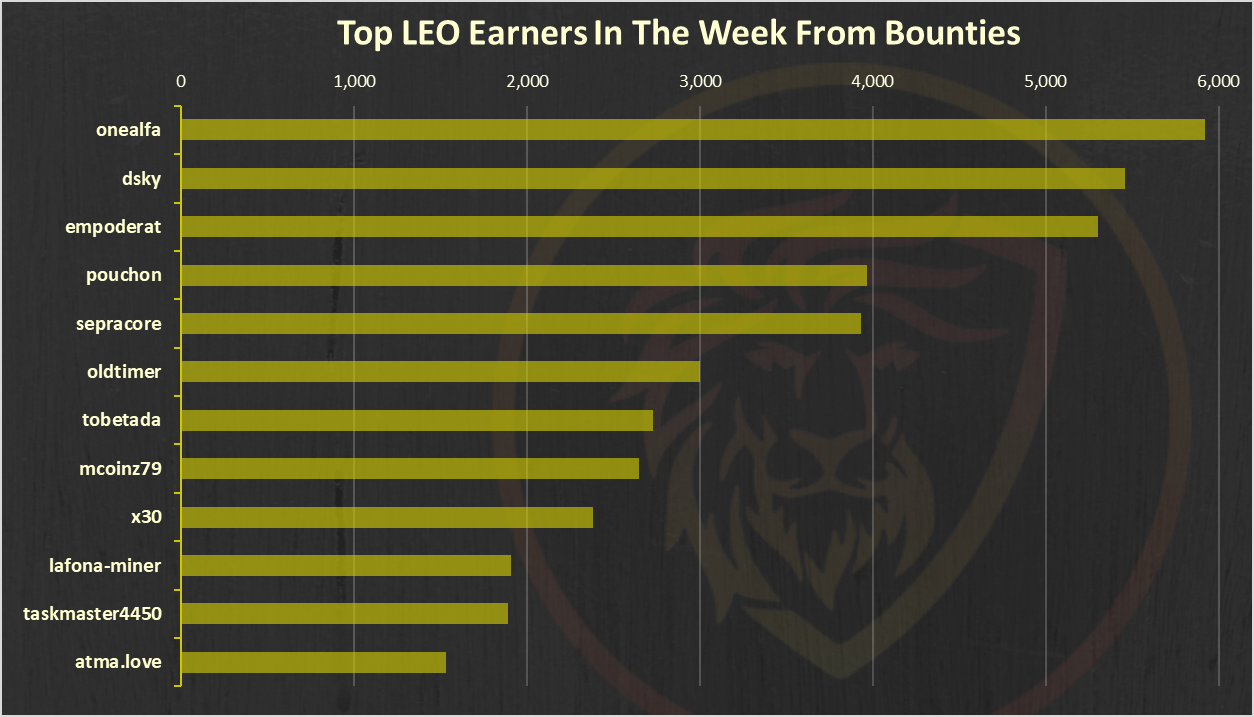

Rewards from Bounties

Users who delegate their HP to the @leo.voter receive daily payouts in the form of LEO tokens at a rate of 16% APR. Also, at time some other bounties are in place.

@onealfa is on the top here.

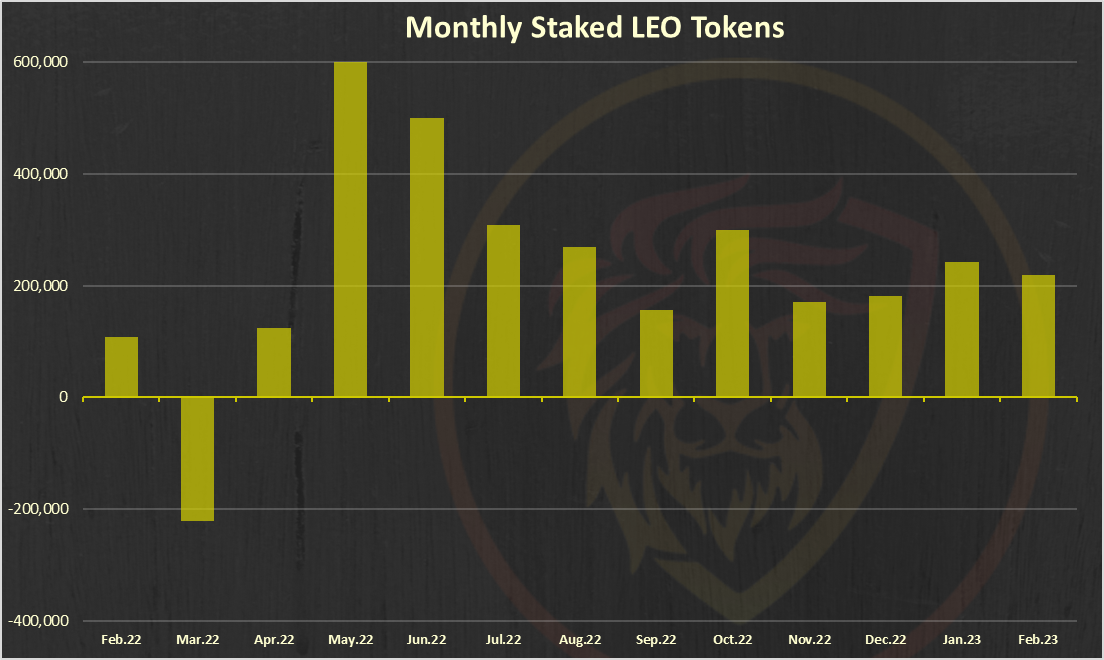

Staking LEO

Below is a chart that represents the monthly flow of staked and unstaked LEO tokens. A positive bar going up shows a day where more LEO was staked than unstaked.

More than 220k LEO tokens staked in February 2023.

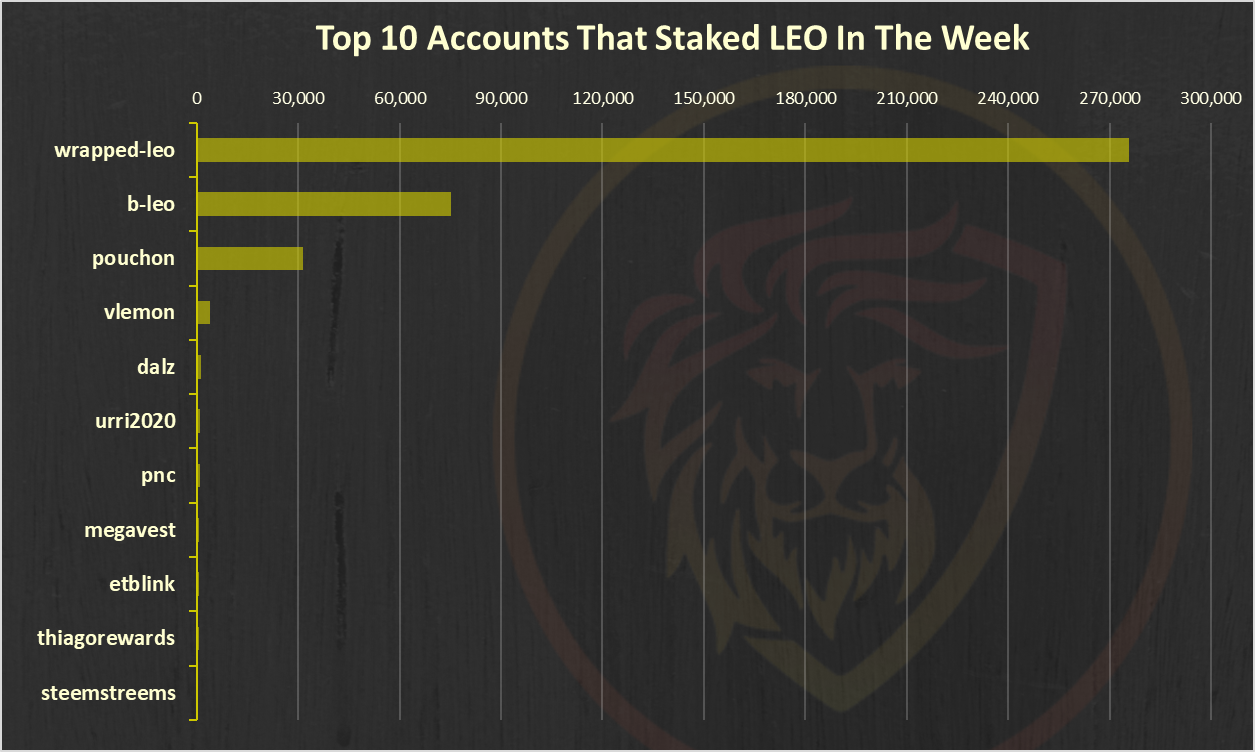

Below is the chart of the top 10 users that staked LEO last week:

The @wrapped-leo account has made some moves in the last week.

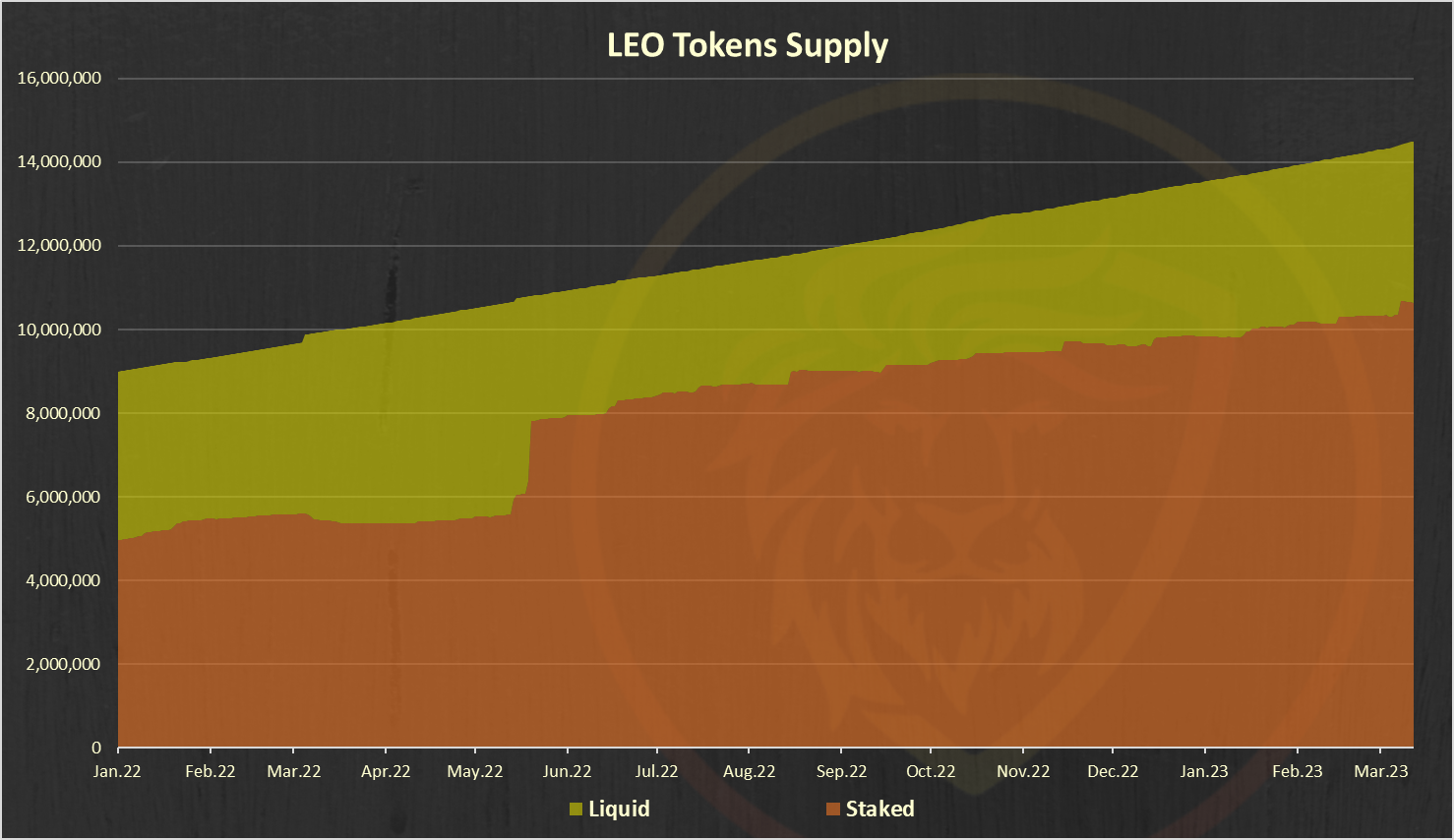

Liquid VS Staked:

Note on the yellow, liquid category above. It includes the LEO in the liquidity pools on ETH and BSC as well. If we remove that, the liquidity will be much lower.

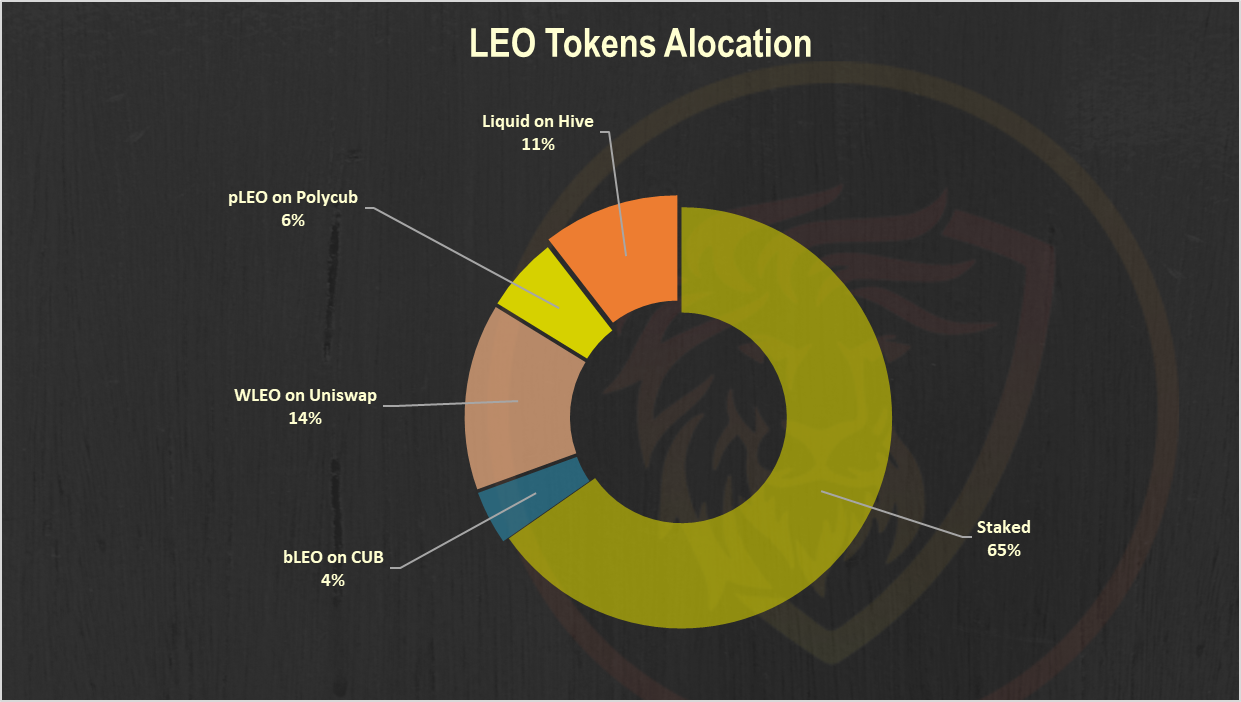

Below is a chart of the LEO tokens allocation.

A 65% share staked.

LeoFinance Users

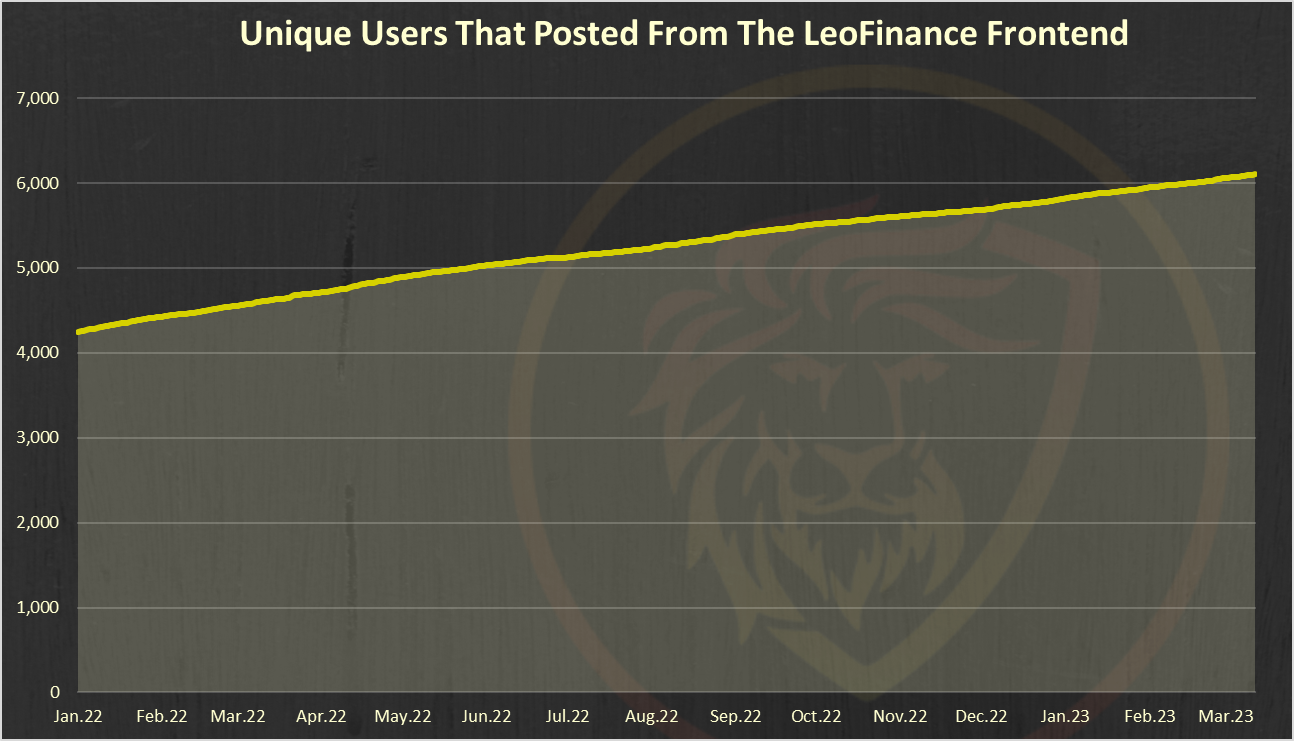

Below is a chart with the number of unique users that posted from the LeoFinance frontend.

A 6.1k unique accounts have posted from the LeoFinance interface. This is the legacy UI, the new UI is still not included.

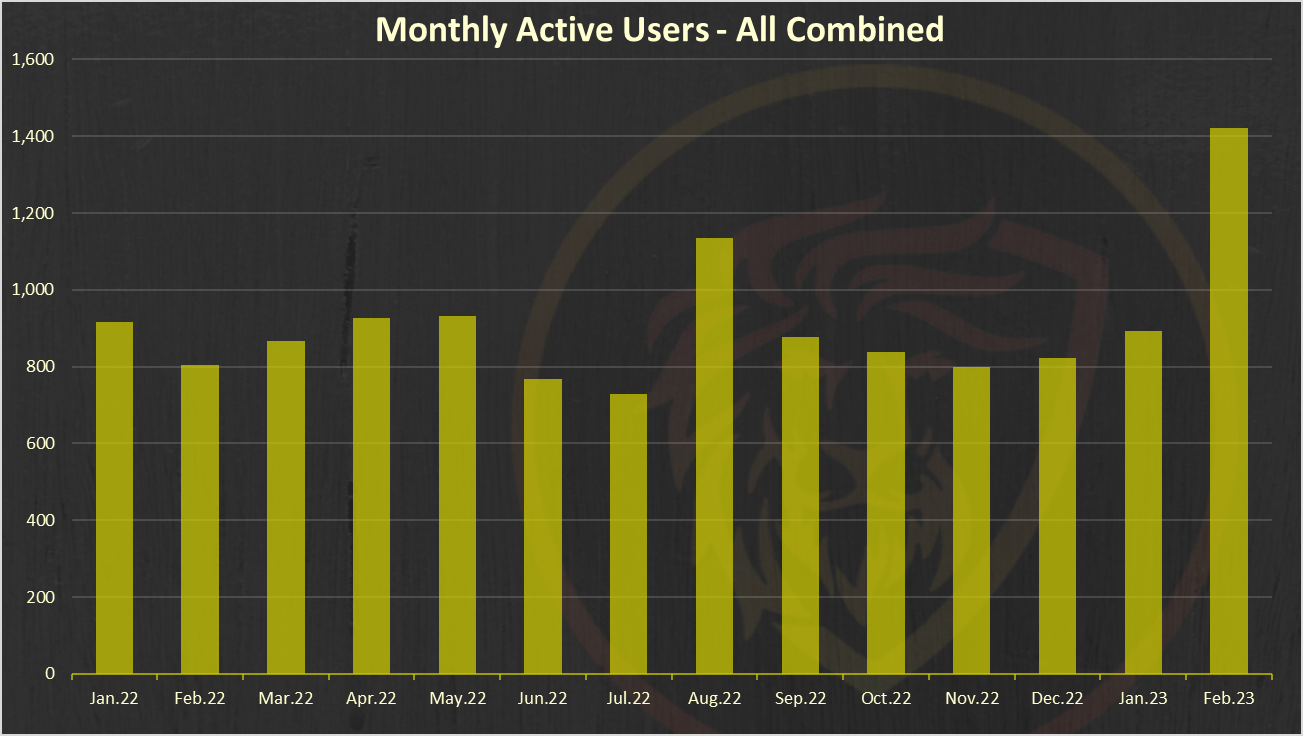

Monthly Active Users Posting and Commenting from LeoFInance [MAU]

Here is the chart for the monthly active users combined from the legacy UI leofinance.io and the new threads UI.

We can see the sharp increase in February up to 1400 MAUs. This is because of the introduction of the threads. The numbers have went from 800 to 1400 MAUs.

As mentioned this number combines all active accounts from leofinance.io and the threads UI.

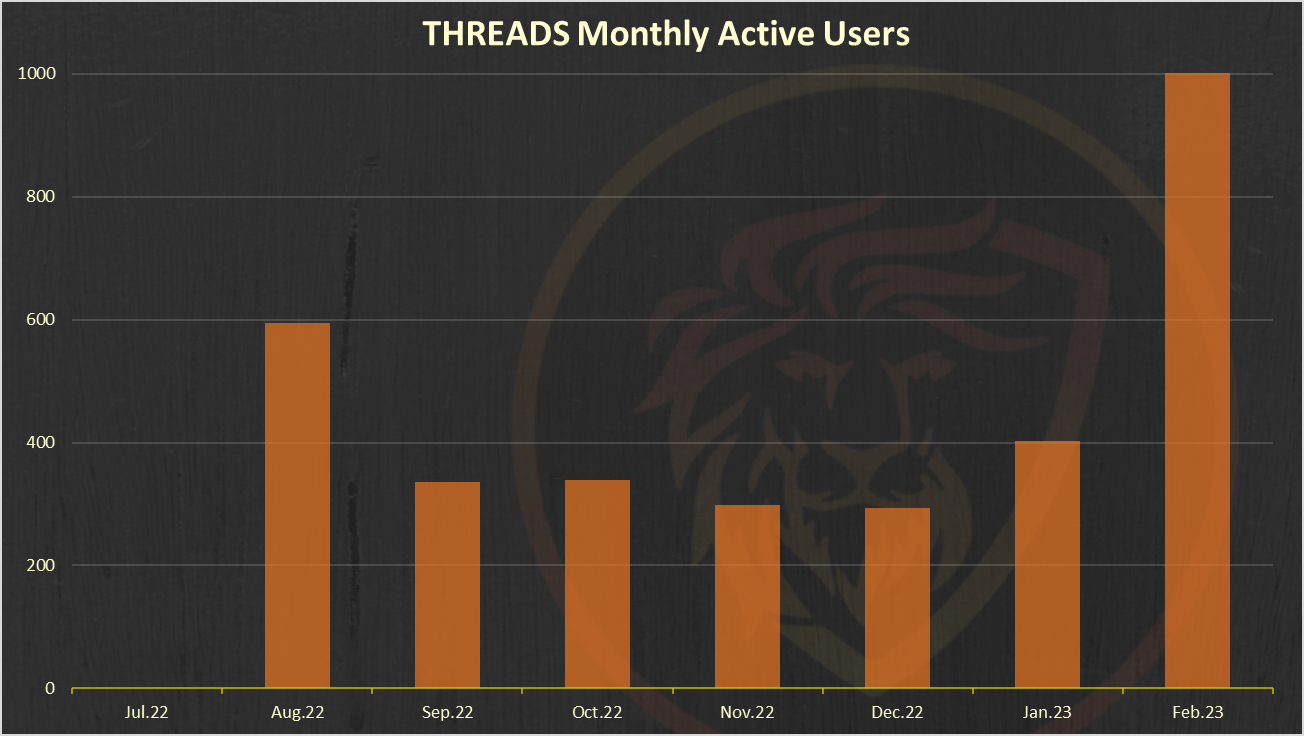

Threads MAUs

What about threads only? How are the numbers doing here? Here is the chart.

The first version of threads was launched back in August 2022, and there was around 600 MAUs. This number dropped in the months that followed, but now we are at new ATH at 1026 MAUs.

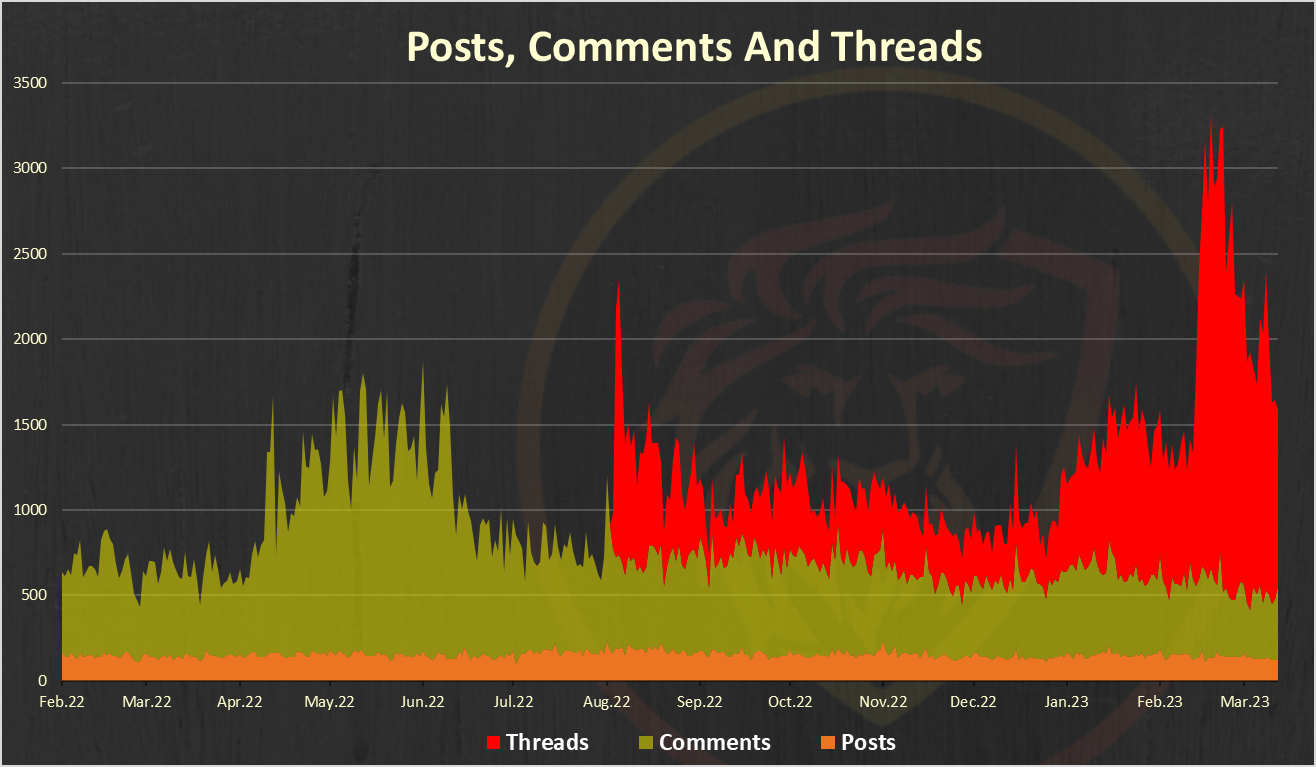

Posts, Comments and Threads

Here is the chart.

In summary last week’s looks like this:

- 900 posts

- 2.6k comments

- 10k threads

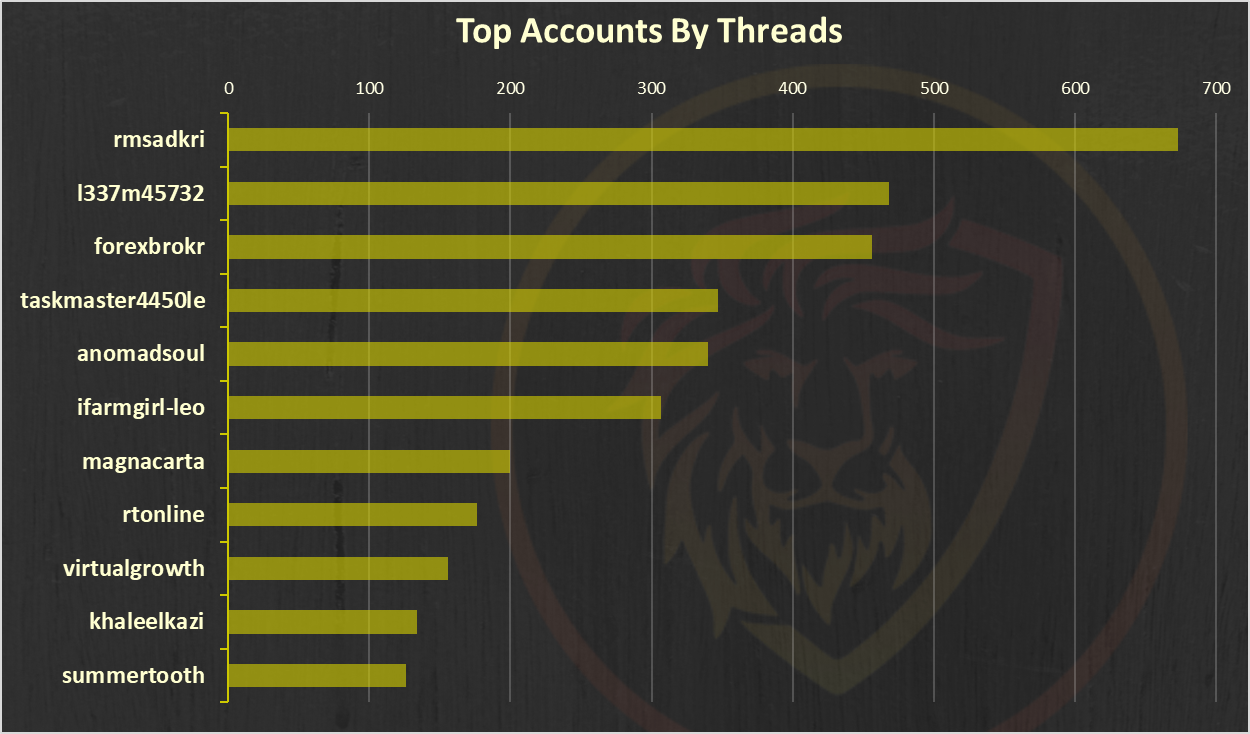

The number of threads has been on average around 1400 per day.Top Threads Creators

Here is the chart.

@rmsadkri is on the top with 670 threads. @l337m45732 is on the second spot followed by @forexbrokr.

Price

Here is the price chart in dollar value with average price.

LEO is hovering in the range between 5 and 6 cents now.

Track Hive Data New Interface! About Us Hivestats LeoFinance Beta Learn More

Trade Hive Tokens Wrapped LEO Hive Witness LeoDex Trade on Uniswap Vote

Report by @dalz

Posted Using LeoFinance Beta

https://leofinance.io/threads/@rmsadkri/re-leothreads-lng2gnk6

The rewards earned on this comment will go directly to the people ( rmsadkri ) sharing the post on LeoThreads,LikeTu,dBuzz.

That is an amazing stats

Threads is sadly losing momentum because of slow time on releases lately and giving people what they want. Hopefully that starts being turned around here very soon.

Yea this usually happens with new things ... there is a boom at first, and a slow down after. The important thing is to keep the lows higher :)

I really hope we see a pick up again once we roll out of Alpha which I hope is sooner than later. That plus the ad buy back would be a welcomed change here soon. Price action is going to have a huge affect on engagement as well. 🤞soon

And that is happening already. By next week, we anticipate another release coupled with the fact that new communities are joining.

Posted Using LeoFinance Beta

The hype curve always happens to every innovation. I see threads growth becoming more sustainable in the future.

Posted Using LeoFinance Beta

Slow time of releases?

We just released an entire new product with decentralized polling using custom JSONs on Hive and a massive LeoInfra scaling update inside of 2 weeks 😂

Idk if I agree with both that momentum is slowing or that releases are slow. @leogrowth @anomadsoul has been posting stats that Threads MAUs continue to grow but if you have conflicting data, I'd like to see it so we can work on it

Posted Using LeoFinance Beta

Yeah man, we have 800+ MAUs and it's not even the 15th, last month we closed threads a bit above 1k users. This is bullish in terms of users @bitcoinflood

pic is joke lol

Great community.

Although I am yet to grasp the full concept of the community I still enjoy the great and educative posts coming from this community

I hope you join us soon. http://alpha.leofonance.io is where to start. Talk about everything.

Posted Using LeoFinance Beta

Sure... Thanks a lot

I am a member of the community actually

Amazing stars out there. 10k threads in a week is massive. That means Leofinance interface alone contributed 12.6 comments/engagements on hive blockchain in 7 days. I see the numbers double by next month.

Threads is really killing it with the numbers. Great to see the top guys with at least 100 threads weekly. I need to train my fingers for it.

Thank you @Dalz for this.

Posted Using LeoFinance Beta

I can see the growth happening, it's apparent within LeoThreads, by itself!

Posted Using LeoFinance Beta

Hashtag consistency.

Posted Using LeoFinance Beta