Forget UST - The Spotlight Should Be on Basis Cash (BAC)

UST's founder Do Kwon already has 1 dead stable coin...

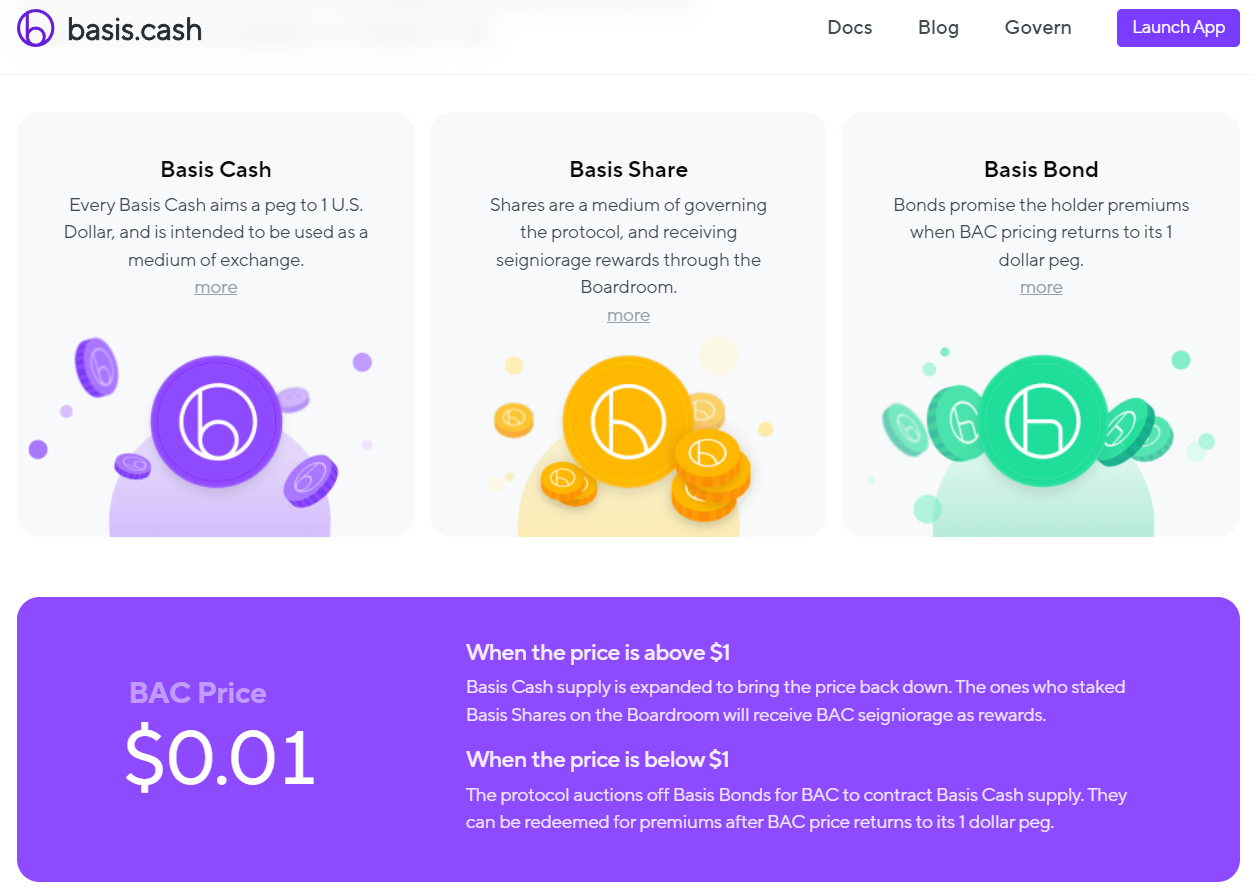

Basis Cash (Basecoin)

Before Terra LUNA and UST even existed back in 2020, Basis Cash was born as one of the first iterations of this type of stable coin. It was based on an even earlier version called Basecoin that was almost launched in 2018. Regulators nipped Basecoin in the bud and the creators ended up returning investors' money. CoinDesk revealed that one of the anonymous founders of Basis Cash is none other than Do Know. Our friend that is really trying to save UST and LUNA during this crash.

I mean, the man literally liquidated 42,000 BTC and injected those funds into UST to try and prop up the peg... Anyway - his failed project Basis Cash tried to maintain its peg to $1 algorithmically through a system of bonds. Basically, the protocol would read the price from BAC-DAI on UniSwap every 24 hours as a basis for its peg. Based on this, BAC would either be minted or sold. Bonds could be bought and would guarantee holders a premium when redeemed based on price. Sound familiar?

The fact that the website is still live is hilarious. Clearly the plan worked, and the peg is maintained at $1 LOL. It says $0.01 right next to the explainers about how it is supposedly pegged. That's just comedy gold right there. Kudos to them for keeping the website active. It's not even accurate though. This thing went below a penny. BAC is currently trading at $0.006 and has a $350,000 market cap still (somehow).

Despite raising $133 million, this thing died pretty fast. Basis Cash was backed by nothing but an algorithm. Literally the system was betting on people willing to buy it. While this works in theory, clearly it doesn't work in reality as we can see from what's happening to UST. Someone or a group of people with enough money can literally destroy the value of the asset. Forcing it to lose its peg therefore causing people to panic, and sell.

The same thing is happening right now with LUNA and UST. Do Kwon can pump all the money he wants into it. The problem is that LUNA literally can't repay the debt it's in to itself. The debt ratio on UST is at 700%. UST may get back to its peg eventually or at least close to it... But the damage to the name of the project is done. People are never going to have the confidence they once had in the protocol. LUNA is completely decimated.

From around $90 only 7 days ago to 32 cents... Sheesh! Talk about an absolute beat down. Let's talk about some ways this could have been mitigated. Some of HBD's mechanics are good examples. One is the haircut. HBD stops printing at a certain percentage off peg based on a 3.5 day average. That percentage is 10%. This makes HBD a lot harder to attack in a similar fashion.

I'm not going to sit here and compare the 2, because I already did that in a previous post titled HBD > UST. It was not much of a comparison though, because you know, I'm no expert and it's kinda apples to oranges. The fact that LUNA and UST are able to be converted back and forth instantly... It's just bad design. It's just a few lines of code.

If you want to discourage attacks like these (I personally feel like this is a coordinated attack), add some kind of limit and wait period. This makes it a lot more annoying to try and coordinate. It's not rocket science. Or maybe it is. I dunno. What I do know is that UST is almost exactly the same as Basis Cash, and you see where it went. I sincerely hope UST recovers its peg and people recover some of the money they've lost. But damn, it should have been obvious that this could happen.

What do you think about the situation?

Thanks for reading! Much love.

Links 'n Shit

| Play to Earn | Read emails, Earn Crypto | Get free crypto every day | Get a WAX wallet |

|---|---|---|---|

| Gods Unchained | ListNerds | PipeFlare | WAX.io |

| Splinterlands | GoodDollar | ||

| Rising Star | FoldApp |

Posted Using LeoFinance Beta

Congratulations @l337m45732! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 4500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPGeorge Soros made his billions by organizing a group that broke the Bank of England. The Bank of England was trying to maintain a peg between the Deutschmark and the Pound.

Efforts to maintain currency pegs put the system maintaining the peg in jeopardy.

HIVE has a low market value. It would probably be easy for dedicated currency manipulators to completely tear our little blockchain apart by manipulating the HBD peg and its vaunted 20% interest rate. Our witnesses are good, but the cartels that manipulate currency are better.

Posted Using LeoFinance Beta

I hope that will never happen… some people have just to much power.

Posted Using LeoFinance Beta

Wow - I had no idea about the Bank of England thing. HIVE is too low profile for an attack like that anyway . I hope lol

Posted Using LeoFinance Beta

Interesting read, it is crazy to see what happened in such a short time. For me too it sounds like an coordinated attack.

Posted Using LeoFinance Beta

Yeah, I can't say for sure but I feel like it was.

Posted Using LeoFinance Beta

Exactly… maybe we will find out one day.

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @l337m45732.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more