What Happens When $27 Trillion in Assets Flood Bitcoin?

I keep a close eye on TradFi just as I do with DeFi. TradFi has been getting their feet very wet in crypto lately. We've seen multiple announcements that seemed to be held back until the right moment.

That moment became right when the SEC went after Coinbase, Binance and some of the established players in this space.

For one, they left out any real regulatory pressures surrounding BTC itself. By doing that, they affirmed what many of these big players were waiting for - that Bitcoin was not deemed a security and would not be a target of mounting crypto regulatory pressure.

What Happens When $27 Trillion in Assets Flood Bitcoin?

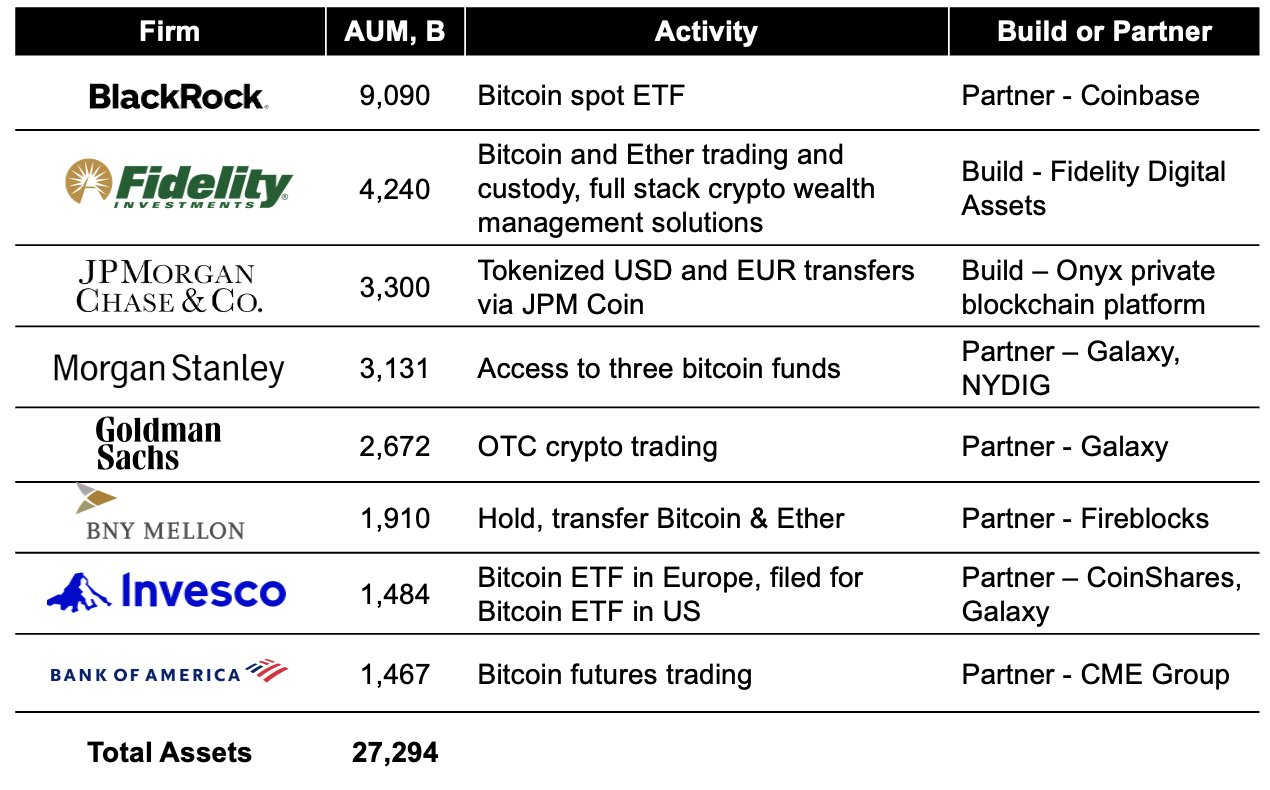

Take a look at the chart at the top of this post. These are the top players in TradFi. They've got a collective $27 Trillion (yes, with a T) in assets under management.

They're all announcing various degrees of crypto adoption. Namely surrounding Bitcoin adoption.

Blackrock being the shining example of launching their ETF proposal. Their last 525 ETFs got approved and only 1 was rejected. The odds are evidently in their favor for a BTC spot ETF to get approved.

Fidelity has long been bullish on adopting crypto. They've had various degrees of integration.

I remember the first integration a few years back where they simply allowed you to track BTC and a handful of other cryptos.

Then the integrations got deeper and it looks like they're on the hunt for more ways to adopt BTC and crypto into their business.

With $27T on the horizon and a current $600B marketcap for crypto, we're looking at a massive opening of the floodgates.

Best Practices and Building

Many of us have been building in this space. Even if you weren't building a startup or a project in this space, you've been building a crypto portfolio or even a personal content brand in this industry.

By doing these things, you've positioned yourself to be a beneficiary of this $27T floodgate getting opened.

We all dreamed of a future where it was possible. Where it would happen. That future seems to be closer than ever.

As retail, we've had a unique opportunity - unique in the sense that it doesn't happy very often in history - to frontrun the behemoths of the world.

The corporations. The governments. The super powers.

We have had this opportunity to get to the ball before they did. If you stuck with it and made it this far, congratulations. We are on the verge of mass adoption.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha

I hope more bigwigs on the wall streets invest...

Scary and exciting numbers and mass adoption has to be triggered by this sort of volume. We have all been accumulating for this type of news as this is much bigger than a bull market.

yeah but not all 27 trillion is just going to flow into bitcoin lol

Take 5% max so you're looking at max of about 1.35 trillion into bitcoin most likely. Which would still bring us up to near all time highs of the last bull run (minus a bit as there are now more coins in circulation) but that will then trigger others to fomo in so you're looking at that $130,000 max range I still feel unless the bull run holds and continues.

I love this point. That if we are building a portfolio. We have positioned ourselves to be beneficiary if the $27m. Though is not a happy thing always. What mat6 is that one has taking position in cryptocurrency space