SEC Files Charges Against Binance and Coinbase | Time to Freak Out?

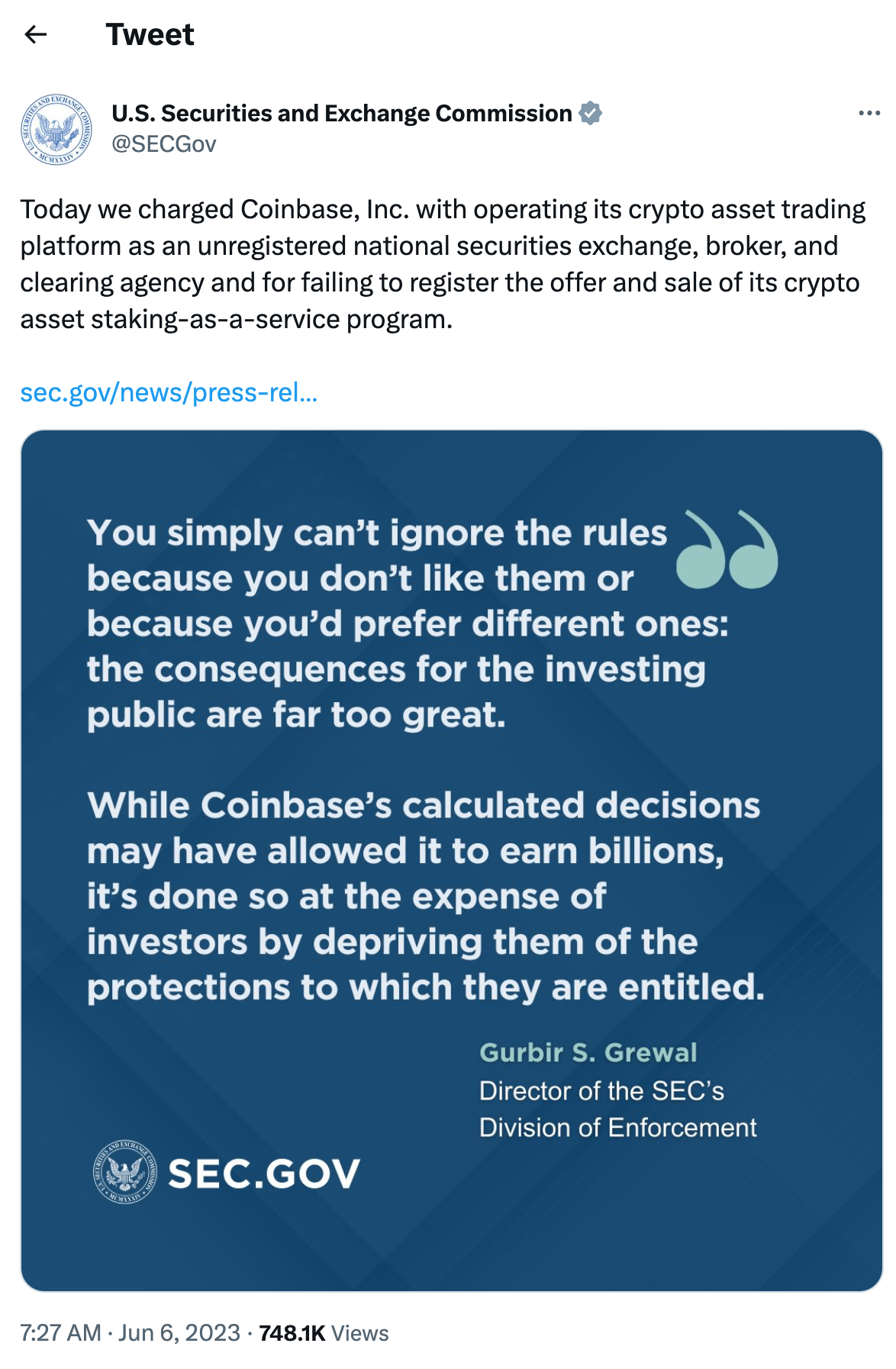

The big news of the day is that the SEC is officially filing charges against Binance (yesterday) and Coinbase (today).

Many people are saying this is the final shoe to drop for the crypto industry. A lot of naysayers are now calling for the end of crypto. Others are saying that this is a key indicator for the end of the bear market and beginning of the bull market.

Who's right? Nobody knows. But surely, we'll find out soon ™️.

SEC Files Charges Against Binance and Coinbase | Time to Freak Out?

An SEC Press Release shows the official chargest against Binance. They're saying that Binance was/is:

"operating unregistered exchanges, broker-dealers, and clearing agencies; misrepresenting trading controls and oversight on the Binance.US platform; and the unregistered offer and sale of securities."

After years of Binance essentially doing whatever they want and then eventually leaving the US over the past 2 years, this is really unsurprising news.

The one that's shocking everyone is Coinbase.

Coinbase

Coinbase is all over the news now and this caused a panic sell event in the crypto space. Nothing like Terra LUNA or FTX crashing but this is still not a good look for the overall industry.

The SEC's actions lately have been super erratic. At one moment, it seems they're meeting with people in the crypto space and looking to act in a collaborative manner. The next moment, they're backstabbing them and filing charges.

Erratic behavior is for the companies. The government is supposed to lead the conversations. They are supposed to both foster innovation while simultaneously protecting individual investors.

The problem I - and many others - have is that there needs to be regulatory clarity. Whether you're a user of crypto like me or a big company like Coinbase, you need to be able to understand what is and isn't allowed in the regulatory framework.

There is a lot of certainty for public stock market investing but very little for the crypto industry.

The ironic thing is that Coinbase filed for their IPO. They got approved by the SEC just 2-3 years ago to become a publicly traded entity.

That process is super hard. It requires countless months of paperwork and filings and transparency with the SEC.

Coinbase went through all of that and the SEC cleared them to go public... what has changed from then to now?

Well, leadership at the SEC has changed. The view of crypto has changed.

This all being said, I think it's an incredibly important moment for the U.S. We're on the verge of the printers being turned back on.

We're seeing a lot of recession fears. We're seeing people scared. We're seeing people unemployed. Record inflation. Low trust in the government and the dollar.

This is a time to foster innovation and PROFIT from it. The government has a huge opportunity to swoop into crypto and take the industry to all new heights be enacting proper rule sets and profiting off tax dollars.

It seems they are playing a losing game right now but I hold out hope that a better administration is out there and may succeed where this one is failing.

As for crypto, it will win either way. The question is: does innovation flee overseas and leave the U.S. or does the U.S. do what it used to be good at and keep it here and thriving?

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha

I think the web3 communities need to set their own rules. Forget government oversight. They can't even do the job the were elected to. 🤔🤔🤔

We need to become our own nation.

You mean something like Nation3

https://www.nation3.org/

Am I REALLY seeing this? It does not appear to be backed by a corporation or other legal entity. 😱😁😁😁

And yes, like this. 😁😁👍 Is this the only one or are there others?

This one seems to be more mature one, although it is still experimental and in early phase.

I make a post on this soon

LIVING ON THE INTERNET INFRASTRUCTURE OWNED AND OPERATED BY CORPORATIONS ? ?

YEAH THAT'S GOT A FUTURE...

NOT VULNERABLE AT ALL.

please do freak out, I'm always on the look out for some super cheap Hive :P

Time to leave the US.

Plenty of crypto friendly countries out there.

We have seen that there is a willingness to scapegoat crypto in the US. Now 10 different states are suing Coinbase and the states are not the ones that fit the stereotype of coming after crypto firms. Anti-crypto sentiment is strong especially with older U.S. citizens. A small minority of U.S. citizens are engaged with crypto in the first place and most are young. Young people don't vote, old people do. The state and federal government are giving the voters what they want.

https://www.benzinga.com/markets/cryptocurrency/23/06/32742440/coinbase-faces-regulatory-storm-as-10-us-states-take-legal-action-against-the-crypto-excha

My point don't fret, this is already too big an industry. They need to keep their nerves and be talking sense...

Seriously this is confusing , well, thanks for sharing

The SEC is just bringing more drama, trying to put pressure on crypto companies. I don't think much has changed since Coinbase went public a few years ago. Crypto will indeed survive and thrive amidst the crackdowns.

Thanks for the insightful article. The SEC is causing a lot of uncertainty in the market. I'm unsure if it's intentional or if they are using these cases to shape regulations. I believe many cryptocurrencies will be classified as securities, which will greatly affect their value. On the other hand, non-security cryptos may see an increase in value as people shift their funds to them.

The SEC will soon goof hard. It’s perhaps what will form the new narrative that will pump BTC, people are saying no new money is coming in, I say nobody will tell new money to buy BTC when fiat world crumbles on its knees.

The US want to stifle crypto because they dont have control over it, its a valid counter-option for their precious dollar. The best thing that could and is happening is the world de-dollaring, the US have far too much global power as things stand and as such are using trade as a weapon and attempting to crush anything that threatens their dominance. Empires fall, the pound was the gold standard for a long time and only really stopped being so in the 80s/90s. Now it seems the US and its aggressive policies are gonna spell the end of their time at the top.

Utterly agree.

The dollaring time is starting to fall, and they react like a wounded wild beast.

I could see major crypto players leaving US few years ago, given their strategy in the past 3-4 years. It will happen, and others will profit and make money from crypto as governments. We will see it. US may be bankrupt in next 5-10 years, if they persist to oppose innovation.