Oxford Physicist Argues the Quantum Computing Industry is a Bubble Waiting to Burst

Gourianov

"Oxford quantum physicist Nikita Gourianov tore into the quantum computing industry this week, comparing the 'fanfare' around the tech to a financial bubble in a searing commentary piece for the Financial Times. In other words, he wrote, it's far more hype than substance" [Tangermann, V. OXFORD PHYSICIST UNLOADS ON QUANTUM COMPUTING INDUSTRY, SAYS IT'S BASICALLY A HYPE BUBBLE. (Accessed September 5, 2022)].

He claims: "Financial bubbles occur when large groups of investors repeatedly make poor investment decisions, often due to greed, misunderstanding and easy money. A modern-day example of this is quantum computing" [Gourianov, N. The quantum computing bubble. (Accessed September 5, 2022)].

Expanding on this he explains:

Quantum computing is often portrayed as an up-and-coming technology whose eventual impact will only be rivalled by artificial intelligence. According to the quantum evangelists, it is only a matter of time before a fully-functional quantum computer will appear and do everything from revolutionising drug development to cracking internet encryption schemes. Billions of dollars have poured into the field in recent years, culminating with the public market debuts of prominent quantum computing companies like IonQ, Rigetti and D-Wave through 2021’s favourite frothy market phenomenon, special purpose acquisition vehicles (Spacs). These three jointly still have a market capitalisation of $3bn, but combined expected sales of about $32mn this year (and about $150mn of net losses), according to Refinitiv.

[Id].

From this, Gourianov concludes:

[T]he quantum computing industry has yet to demonstrate any practical utility, despite the fanfare. Why is then so much money flowing in? Well, it is mainly due to the fanfare. The views of scientists are still (mostly) respected in society, and so when physicists get excited about something, people notice. The excitement truly began in the 90s, which saw a range of pioneering breakthroughs that truly marked the birth of quantum technologies as an academic field. As more progress was made over the years, the excitement grew, eventually going well beyond the community. By the 2010s capital had become cheap, and investors started taking notice [...] With time, salesman-type figures, typically without any understanding of quantum physics, entered the field, taking senior positions in companies and focusing solely on generating fanfare. After a few years of this, a highly exaggerated perspective on the promise of quantum computing reached the mainstream, leading to a greed and misunderstanding taking hold and the formation of a classical bubble.

[Id].

"Despite the industry's less-than-stellar results, investors are still funneling untold sums into quantum computing ventures [...] In short, Gourianov believes it's only a matter of time until the "bubble will pop" and the "funding will dry up" — at which point, it's already too late" [Tangermann, supra].

Benjamin

Nonetheless, the co-founder of Quantum Motion and professor of quantum technologies at Oxford, Simon Benjamin, claims Gourianov's view on the 'quantum computing bubble' is both right and wrong. It is Benjamin's position that:

We know that many important things won’t go faster with a quantum computer. For example, the task of rendering graphics is made up of a vast number of individually easy calculations — going quantum won’t help. And not every business will benefit from quantum computers, at least at first. The earliest impact will be in areas related to materials science (including energy materials), chemistry, or optimisation (possibly stretching to logistics/transport). Even in these sectors, businesses need only get involved if they want to be part of the enabling technology rather than a user. Others can relax despite calls to become ‘quantum ready’ — they won’t miss the quantum bus, because the bus is still being built. But to suggest that there will never be high-value applications, and that quantum computers will never repay their R&D investment, is wrong. (emphasis added)

[Benjamin, S. Separating quantum hype from quantum reality. (Accessed September 5, 2022)].

Benjamin posits:

Of course, literally hundreds of research papers identify and explore prospects for quantum advantage in areas ranging from optimisation (which is key to challenges in logistics and portfolio management), through to unlocking the dynamics of complex systems in the natural and technological worlds. Are all these ideas wrong, and ultimately unable to provide value? Almost certainly not.

[Id].

Benjamin believes that for the nascent quantum computer industry there is but one 'elephant in the room' - size:

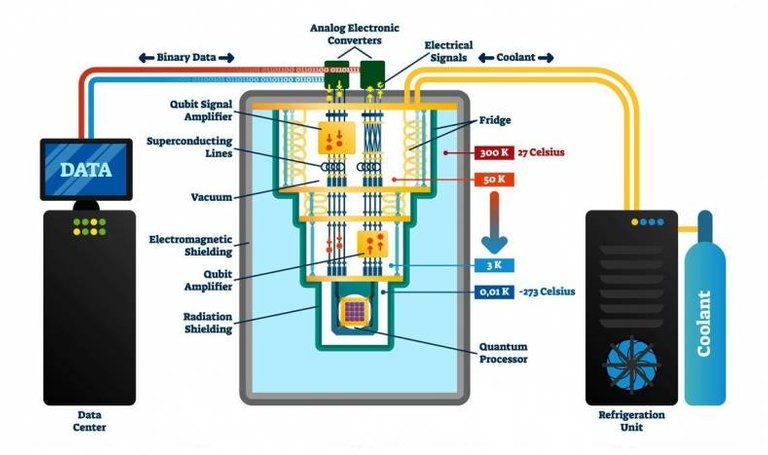

Whichever of the leading approaches you consider — superconducting qubits, or ion traps, or pure-photonic — scaling up is likely to lead to a single quantum computer occupying the floor of a large building, if not the whole building. That’s just one quantum computer with one user at a time. Building-sized quantum computers would still be impactful of course — perhaps comparable with today’s $36B HPC sector. But the sheer cost of such systems would limit their markets, and the benefits they can bring. And there aren’t many options for shrinking them. To me, the natural route is altering today’s silicon chips to host qubits instead of bits, but at the same minuscule scale. Certainly some solution to the size problem is needed if quantum computers are to reach their full revolutionary potential.

[Id].

Final Thoughts

"It’s fair to acknowledge that there are disconnects between the widely-held ideas of what quantum computers can be, and the reality of what they will be. But it is very wrong to assert that there is scarcely more to the field than hype. Progress toward quantum computers is real, and the path to commercially important machines is clear with obvious milestones. In that respect quantum computing is like any other disruptive technology" [Id].

Posted Using LeoFinance Beta