Can the crypto world do without Centralized Exchanges?

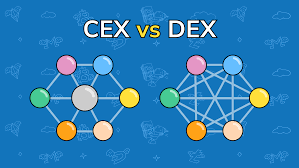

The world of cryptocurrency has seen an explosion of growth in recent years, with many investors and traders turning to decentralized platforms for trading. Decentralized exchanges (DEXs) are increasingly seen as a viable alternative to centralized exchanges, which have long been the dominant players in the crypto space. In this blog post, we will explore the pros and cons of both centralized and decentralized exchanges and consider whether the crypto world can do without centralized exchanges.

Advantages of Centralized Exchanges

Centralized exchanges, such as Binance and Coinbase, are run by a single entity that controls the exchange's infrastructure and user data. These exchanges have several advantages over DEXs. For one, they tend to have larger trading volumes and deeper liquidity, which can result in tighter bid-ask spreads and faster execution times. Additionally, centralized exchanges usually offer a wider range of trading pairs and have more advanced trading features such as margin trading, stop-loss orders, and futures contracts.

Furthermore, centralized exchanges often have more robust security measures and can offer insurance against hacks and thefts. They also tend to have better customer support and more user-friendly interfaces, making them more accessible to beginners.

Disadvantages of Centralized Exchanges

Despite their advantages, centralized exchanges also have significant drawbacks. One of the biggest concerns is the centralization of power, where a single entity controls the exchange's infrastructure and user data. This creates a single point of failure, which can be exploited by hackers or governments seeking to censor or control the exchange.

Centralized exchanges are also subject to regulatory scrutiny, which can result in the imposition of strict Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements and potential government intervention. Moreover, centralized exchanges often charge high fees, both for trading and withdrawals, which can eat into traders' profits.

Advantages of Decentralized Exchanges

Decentralized exchanges offer several advantages over centralized exchanges. For one, they are much more resistant to censorship and control, as they operate on decentralized networks that are not controlled by a single entity. This makes them much more difficult to hack or shut down, and it allows for greater privacy and anonymity.

Moreover, decentralized exchanges often charge lower fees than centralized exchanges, as there are no intermediaries to take a cut. This can result in significant cost savings for traders, particularly those who trade frequently or in large volumes.

Disadvantages of Decentralized Exchanges

However, decentralized exchanges also have significant drawbacks. For one, they tend to have lower trading volumes and less liquidity than centralized exchanges, which can result in wider bid-ask spreads and slower execution times. Additionally, decentralized exchanges often have less advanced trading features and fewer trading pairs than centralized exchanges.

Furthermore, decentralized exchanges can be more difficult to use, particularly for beginners who are not familiar with the underlying blockchain technology. They also tend to have weaker security measures than centralized exchanges, as they rely on smart contracts and decentralized protocols that are not yet fully tested.

Conclusion

In conclusion, while decentralized exchanges offer several advantages over centralized exchanges, they are not yet a complete replacement. Centralized exchanges still have several advantages, such as higher liquidity and more advanced trading features, which make them a more attractive option for many traders.

That said, the crypto world is rapidly evolving, and decentralized exchanges are likely to become more user-friendly, more secure, and more widely adopted in the coming years. As such, it is important for traders and investors to remain aware of the strengths and weaknesses of both centralized and decentralized exchanges, and to choose the exchange that best suits their needs and preferences.