Mastering forex fundamental analysis

Investments in the financial and forex industry have grown over the years. Leveraging fundamental analysis to decide on whether it is either a buy or a sell could help you come out ahead. This can be done by using some of these tips for maximizing your profits. If you want to read about what factors go into choosing between fundamental analysis and technical analysis, please stay till the end.

Fundamental analysis of Forex markets helps to predict interest rates, spending activity, and central bank policies. Before one can take part in stock market trading, one needs to prepare and understand a wide range of knowledge including the basics theory and major currency drivers.

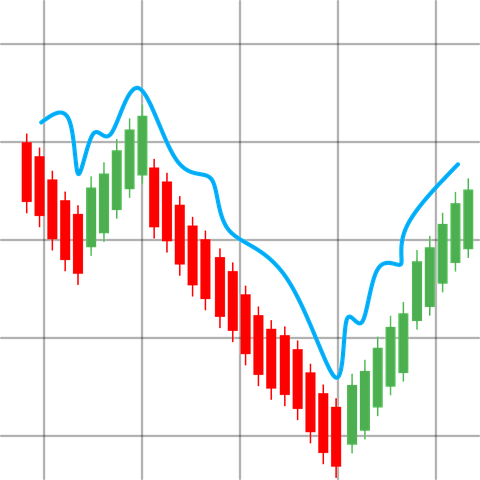

Source

This fundamental analysis is an important part of stock market trading which should never be neglected. It helps to predict the working professionals' decision-making process which will influence global markets (Forex, indices), stock prices (company's stocks), and currency values.

Follow FX news movers as well as economic calendars to anticipate trends. It is also essential to stay well-informed about financial statements such as balance sheets to make sound investment decisions.

Mastering the fundamentals is important for mastering the Forex Market. It will show what the fundamentals are, how to make a report, what an analyst should think, and what other tools are there to do forex fundamental analysis. Reading magazine like the economist help in learning the subject matter. People need to be constantly mindful of what is happening around them in an economic sense.

Systematic follow-up on international markets will help you be aware of economic developments abroad, which speed up and amplify the change that can sweep over a market. Therefore, doing your due diligence on international markets will arm you with another angle as to how macro changes might affect any given currency.

Moreover, this information is invaluable when it comes to company inventories and production expectations as well as inflation and interest rates were seen around the world.

Without sounding overly simplistic, this knowledge will provide a truism for deciding when some currencies are likely to rise and those that might be pegged or considered unattractive or cannot rise at the same pace because of their internal policies or external forces.

##Study how markets react to those economic releases (backtest)

Forex fundamental analysis uses macroeconomic release data to predict future market pathways. For example, on a given day, when the national employment report or unemployment data is released, traders hold out hope that they can identify correlations between this latest release and any corresponding movements in the markets to strengthen their indicators and forecasts.

There are two factors that traders will make use of in their forex fundamental analysis:

• Economic forecasting for the release of macroeconomic data like GDP, ISM Manufacturing Index

• Trading history for individual countries, regions, or economic releases

Forex fundamental analysis often takes a quantitative form, as a result, market prices arising from economic reports are more tightly connected. Investors need to analyze and model the reaction that many influential economic indicators have on the foreign exchange markets.

In newly rising trading markets, the predictability of these economic releases might be weak resulting in moveable technical signals overpowering their sequential elegance in the short time frame

Conclusively, forex trading is all about market sensing and interpretation. Choosing how to carry out your forex fundamental analysis depends on related investing knowledge, a perspective of each situation, investment goals, and the trader's risk and capital management skills.

Posted Using LeoFinance Beta

Congratulations @iskafan! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 8750 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks hivebuzz

You're welcome @iskafan! Have a nice day 😊👍🌹