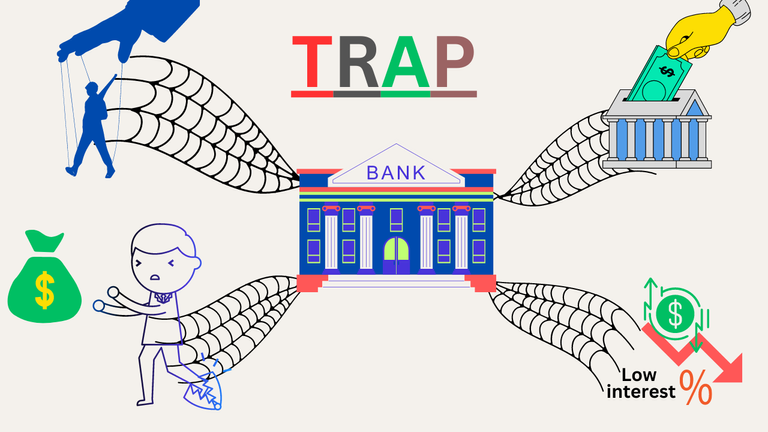

BANK is a TRAP

In this digital world, people are getting interested in cryptocurrency and trying to keep their assets in decentralized wallets. It's because a decentralized wallet gives us full freedom and access to our assets which the banking system doesn't provide us. I think that would be possible if the government wanted but that thing is not going to happen because the government always tries to control and manipulate by controlling the assets of people. In the current time, the banking system is staying against the decentralized wallet and the reason is known to everyone.

design by me using canva

It's the time of web 3.0 and decentralized wallets are taking the place of the banking system but still, many people are not aware of it. Some people think that the bank is safer than decentralized wallets. They have many pieces of logic also to defend their statement. But I think they don't understand what decentralization is or they don't have any knowledge. That is the reason people are getting afraid of it. Besides, they actually don't know how banks are playing with the money and with them.

At first, just think about the benefit of the bank providing services. Obviously, it's not providing our service without any benefits. So, what is the source of the profit, and how?

We keep our assets in the bank and banks give loans to others ( mostly businessmen). If the bank gives us interest/APY (suppose 6%) on our assets, then banks are taking more interest (suppose 12-15%) from others while giving loans. In this process, the bank generates profits. Because of it people are getting happy because they are getting interest on the stored assets and others are also happy because they are getting assets for their needs even if they need to pay a high interest. So one thing is clear how banks are generating profit from our money. In that case, I don't have any problems. But sometimes banks also suffer the loss. One best example is when one person runs away after taking a huge loan from Banks. Obviously, there exist many people but I am taking only one for explaining it.

Suppose one businessman runs away abroad after taking 1000k$ loan from a bank. Bank can't track that person also when he is abroad. So it's a loss of the bank and the bank should be responsible for the loss. And banks should balance the loss from the profit they are generating. But it's a matter of sorrow that the Bank doesn't do that. Bank simply increases the service charge. Through this process, banks are balancing the money which was lost. If you notice the service charges are increasing more than expected which is not reasonable. They take it as a service charge and general people still don't know about why the service charge is increasing too much. That means general people are paying all of the lost money for balancing. Surprisingly no one asks questions about it. Maybe they don't have any knowledge about it. From this incident, one thing is clear that if a bank is generating profit then it's the profit of the bank but when the bank faces loss then it's the loss of general people and the bank doesn't bear the responsibility of loss. Isn't it ridiculous??

Let's talk about the withdrawal system of the bank. Whenever someone tries to withdraw a huge amount of money from their account then the bank starts to ask various kinds of questions. It causes trouble sometimes and creates difficulties to withdraw money. The bank system used to say that there are asking questions because of security purposes. In my opinion, it's my money, I am here to withdraw, who the hell are you to ask me what I will do with my money? Isn't it one kind of harassment? If you want to withdraw lifetime savings from your account you will understand it very well and then intentionally delay the process of withdrawal. So it also means that even if it's our own money we are not the controller of it. It's really pathetic.

design by me using canva

Besides people are losing their money when they are holding their assets in a bank. Let me explain how. Suppose you hold 1000k$ ten years ago. Bank gives you interest and 10 years later you gained 500k$ means 50% profit on your total asset in 10 years. Indeed it's a profit but is it actually a profit?? I don't think so. The price of every necessary need increased more than 2X which also means that the value of your money has decreased even if you gained 50% profit. Besides because of inflation your money lost huge value. So in the bigger picture, you faced a loss. If you bought a land using that money you may get multiple X profit.

So tell me what is the benefit of keeping our money in the bank when we will be on the losing side at the end? It is just a trap nothing more.

If you think that I violated any rules of this platform or my word hurting you or I made any mistakes here , let me inform about it through comments or my other social network . I will try to correct it if I made any mistakes.

Find me in social media : Telegram Twitter

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha

https://leofinance.io/threads/intishar/re-intishar-9rkgs5cz

The rewards earned on this comment will go directly to the people ( intishar ) sharing the post on LeoThreads,LikeTu,dBuzz.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thank you for supporting me all the time.