Predictive Analysis With Binance Coin And Leofinance Token: A Questionable model

Predictive analysis in crypto currency is a branch of econometrics that tends determine the value of a variable with the use of another variable.

In this case Binance coin (bnb) and Leofinance Token (Leo). This analysis proves there is no model that supports predicting the price of leo when the price of bnb is known.

In this guide, I will present the following subsection;

A brief about BNB and Leo

Requirement for predictive analysis

Analysis of prediction between bnb and leo.

Conclusion

Other images

A brief about BNB and Leo

BNB

BNB is a native coin of the binance smart chain network. It was formerly a native token of ethereum network but now on its own blockchain. To know more about bnb visit https://www.binance.com

Leo

Leo is a token for leofinance platform. Leofinance token is built on the hive blockchain. To learn more about leofinance, visit the link https://leofinance.io

Requirement for predictive analysis

To satisfy the condition of prediction, the following must be considered

The basics

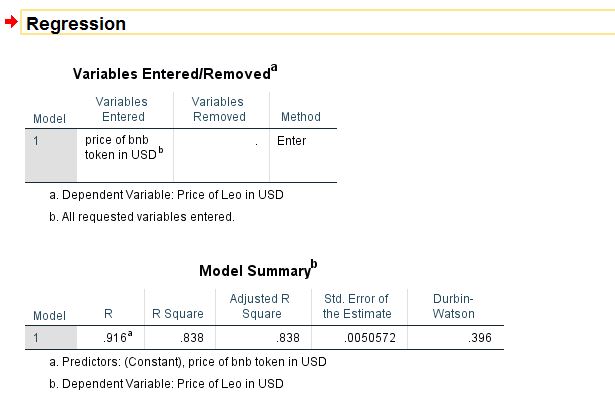

The basics are ideas as generalized the model. It can be seen that the price of binance coin (bnb) needs to be entered to determine the price of leo and also this analysis is 83% correct of the data provided from the crypto market.

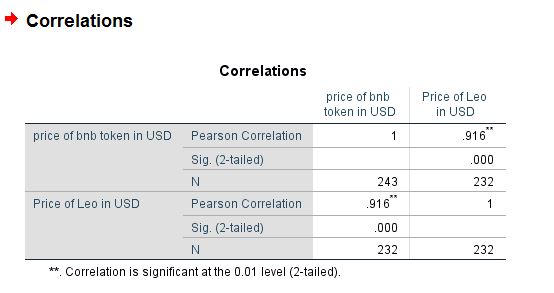

Correlation

Analysis of correlation shows that there is a very strong positive relationship between the price of bnb and that of leo in the crypto market with coefficient of ( r = 0.916). meaning as the price of bnb climbs, that of leo climbs at same rate relative to price and vice versa.

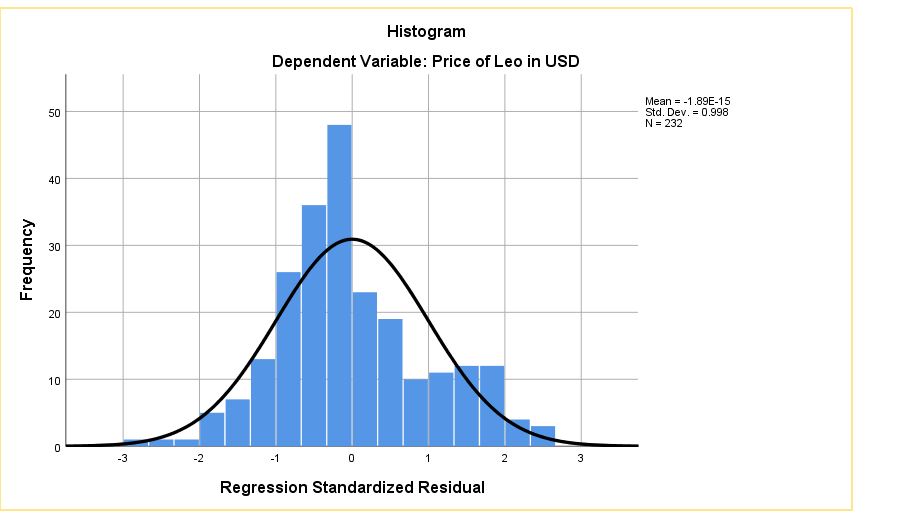

Normality test

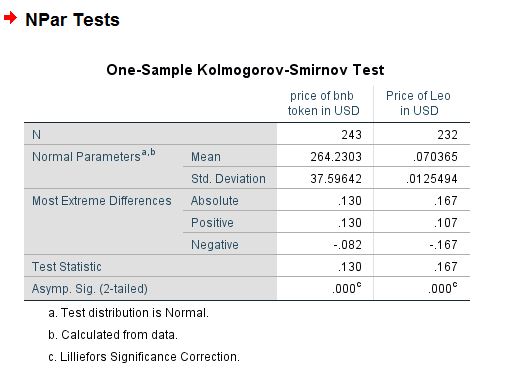

When data samples estimates much data point your variables are generalized from the population which in this case is the crypto market.

It can be seen below that the condition of normality is satisfied.

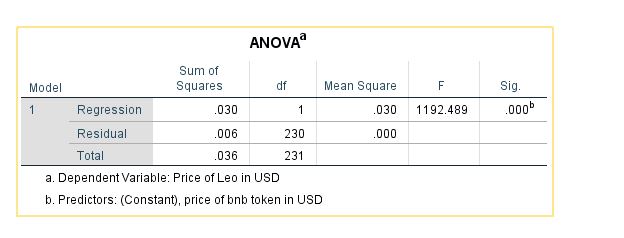

Anova

Anova test proves that there is a relationship between both crypto asset.

Analysis of prediction between bnb and leo

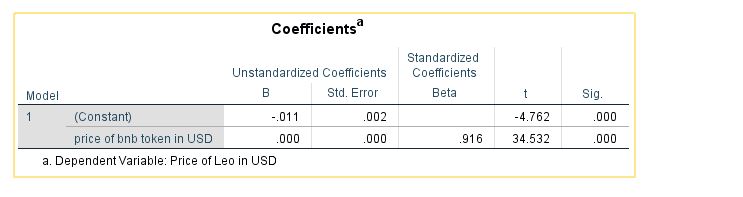

The model for estimating the price of leo is as seen below.

Price of leo = -0.011 + 0.000 * price of bnb

The first question this model carries is that the coefficient of binance price cannot be zero this shows the model is non linear.

The second question is that applying this model when the price of bnb is $320.58

Price of leo = -0.011+ 0.000 * 320.58

Price of leo = -0.011 +0

Price of leo = -0.011

The price of a crypto asset cannot be negative.

The price collection of leofinance doesn’t show any entry when the price of leo is 0.011.

Conclusion

This article has been able to prove that there is a questionable model for predicting leo price when the price of bnb is known,

Other images includes

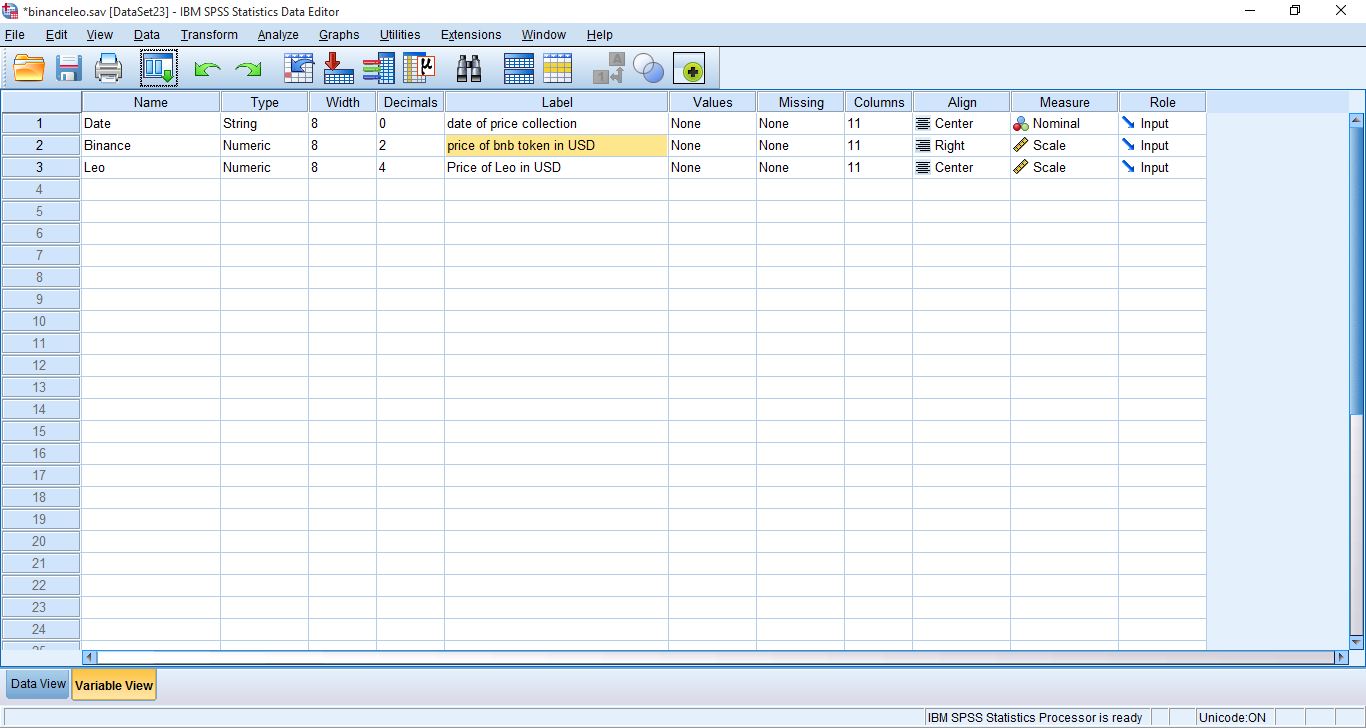

Variable view

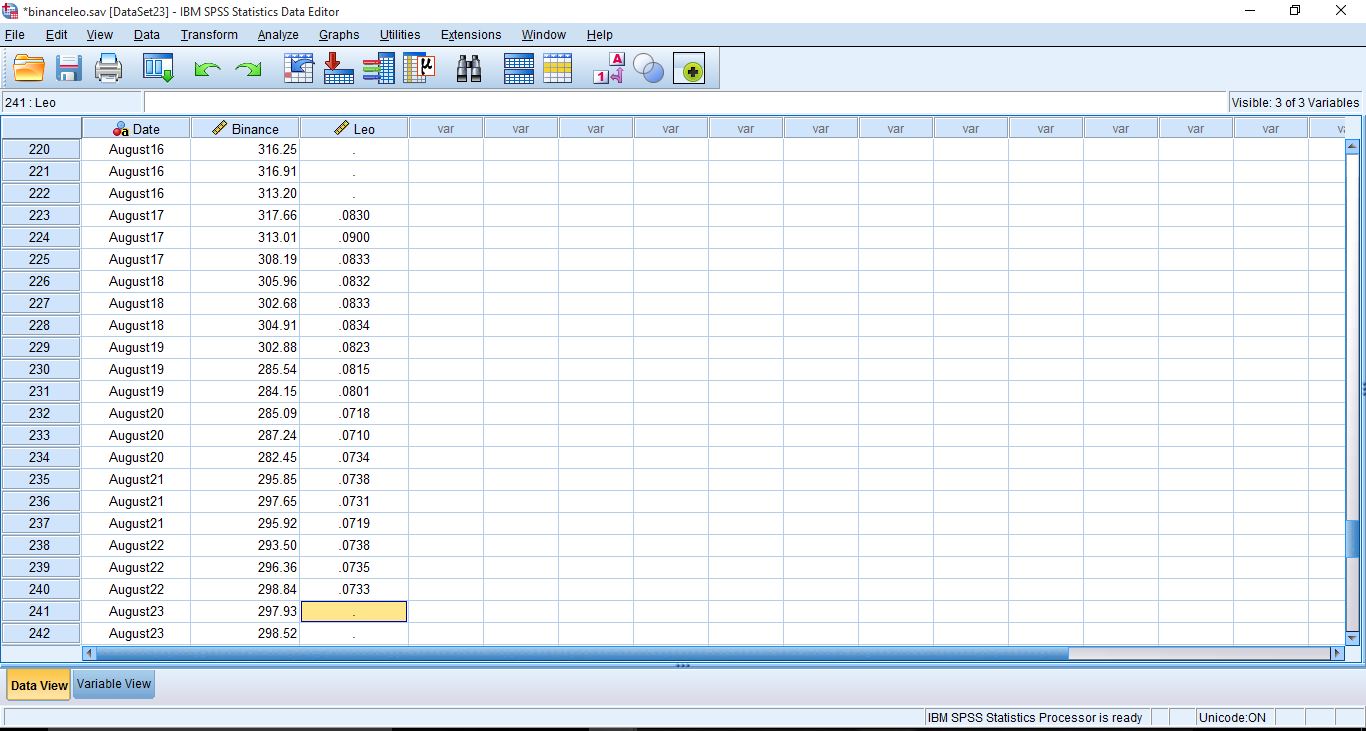

Data view

Histogram

https://twitter.com/Iniobon81962037/status/1562392374378119168

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.