MANTRA Finance: Trusted, Secure & Regulatory-Compliant DeFi Platform

Yesterday, I did a brief introduction to Omniverse or the Mantra ecosystem where we learned a bit more about the project and its token, OM. Today, we're going to take a look at one of the products that comprises the so-called OMniverse.

MANTRA Finance

Mantra Finance (MF) is a "fully compliant and regulatory-friendly multi-asset platform that seeks to serve as a bridge between Traditional Finance and DeFi to facilitate decentralized finance participation by both institutional and individual retail investors."¹

It is a decentralized finance application that aims to become the world's preeminent and most-trusted DeFi platform by offering institutional-grade security, compliance and democratized access.²

It allows users to trade, issue and earn from both crypto and tokenized assets. It is built upon the Cosmos SDK in order to provide scalable, interoperable decentralized applications.³ It is a globally-regulated DeFi platform that brings the speed and transparency of DeFi to the world of traditional finance.⁴

It is one of the four applications in the Mantra ecosystem (OMniverse) along with MantraChain, MantraDAO and MantraNodes.

What's on MANTRA Finance

Mantra Vault

This is a suite of DeFi products that allow users to earn yield on their crypto assets by staking them on the platform. The vault offers both single-asset and multi-asset staking. Supports Ethereum and Polygon.

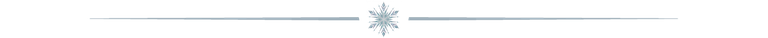

Single Asset

The vault enables users to earn yields by locking a single Proof-of-Stake (PoS) crypto in a staking contract. Yields or earnings are in the form of the asset deposited and can only be withdrawn at the end of the staking period. These are the current ERC-20 assets on the vault and their corresponding APYs:

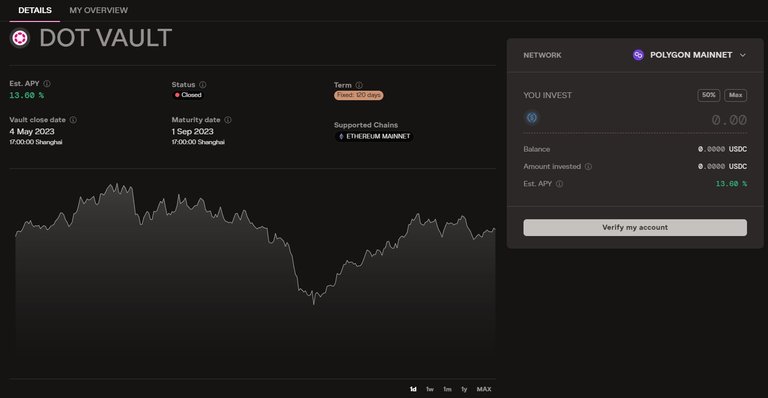

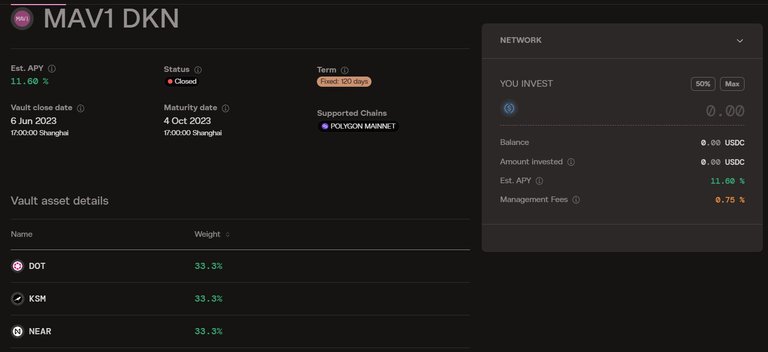

Each vault has its own detailed information, including the vesting period (term), the estimated APY, the token's info and price chart, maturity date, the vault's closing date and time, among other things.

The DOT vault for instance, allows users to stake (deposit) USDC and get exposure to DOT. Deposits to this particular vault ended on the 4th of May 2023, hence the vault is currently closed.

(src)How it works:

Taking the DOT vault as an example, there's a 7-day deposit period and after it ends, the USDC deposited by the user is converted to DOT and then staked on the Polkadot blockchain. Four weeks (28 days) prior to the vault maturity, the DOT tokens (principal and rewards earned) will be withdrawn from the Polkadot network and converted back to USDC which are then made available for the user to claim and withdraw on the Mantra app (10% from the rewards are deducted for validator commission fees).

The vault is eligible for the Early Bird Bonus, which includes 88 $OM and exclusive NFTs. This is only for the first 1000 users who successfully sign up to the platform and participate in the first staking.

Multi-Asset

This vault allows users to generate yield by staking a single asset (i.e. USDC) and getting exposure to multiple assets without the need to manage multiple wallets and going through the process of manually staking on various networks.When the staking term is over, users can withdraw their USDC (principal value of their deposit plus rewards earned, minus the validator commission fees of 10% calculated from the earned rewards). This vault is also eligible for the Early Bird Bonus.

Based on their Twitter teaser a few days ago, the second multi-asset vault is coming out soon. It will be interesting to see what other cryptocurrency assets will be included on the said vault.

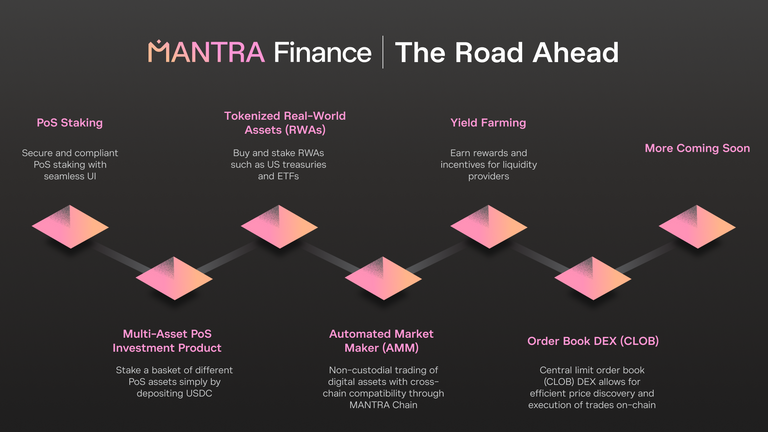

What's Coming (Project Roadmap)

Mantra DEX

There will be a Central Limit Order Book (CLOB) DEX that will offer swap functionalities and tokenized trading of traditional financial products such as debt, equities and other real world assets (RWAs).

After these products are successfully launched, MF intends to augment its decentralized exchange (DEX) offerings by providing derivative products. Throughout this process, the MF team will maintain its unwavering commitment to developing and enhancing its products within a trusted, compliant and self-custodial environment, in line with our overarching ethos.⁵

MANTRA Finance intends to provide a comprehensive DeFi platform that addresses the diverse requirements of investors, encompassing both active trading and passive investing in selected asset categories, as well as providing users with the ability to generate favorable returns on investments. To protect our users and counterparties, and help minimize the risk to all or our ecosystem participants, our products and services will be limited to users that can successfully complete their KYC onboarding process, and who reside in jurisdictions where using our platform does not expose them, or us, to any regulatory risks.⁶

Incoming (services / products) according to their FAQ page:

- Open-Ended Vaults (Q3 2023)

- FIAT Integration (Q3 2023)

- MANTRA Chain Integration (Q4 2023)

- Order Book DEX (CLOB) (Q4 2023)

- Yield Farming for Liquidity Providers

It will be exciting to see how all these will roll out. Looks like the project will keep on building and improving not only its user interface but also its products and/or offerings.

How to Get Started

Since MANTRA Finance is regulatory-compliant, it requires account creation/registration and completing of KYC before one can invest in it.

First, register or sign up to the platform through this link using your email address or via Google. Verify your email and do KYC (needs Proof of Residence and Government-issued ID card). Apparently, the verification process takes 1-2 days to complete and users will be notified when the KYC has been approved or rejected.

Do note that only the registered wallet address during the KYC process can access the services of the platform.

Also, users from the following countries cannot be onboarded to Mantra Finance, re: Cuba, Iran, North Korea, Syria, Afghanistan, Belarus, Burma, Central African Republic, Yemen, Russia, Ukraine and US.⁷

Explore and choose your preferred vault and make a deposit in either crypto or stablecoins.

Claim rewards on the vault's maturity date.

Personal Conclusion

MANTRA Finance seems to be building carefully. The number of available vaults are very limited though but they mentioned in their documentation that they are going to expand the supported tokens as they move to the full product offering."⁸

All of their vaults are closed though and there is no opening so anyone wants to invest or stake now won't be able to. That is probably because MF are pooling the assets to another blockchain so the availability will depend on such. The 10% validator commission which is taken out from the total yield is quite high in my opinion.

The CLOB DEX is quite exciting though as they say it will involve financial products and real world assets (debts, equities etc). This could be a welcoming opportunity for TradFi and institutional investors.

MANTRA Finance requiring KYC is quite a turn off for me personally but it sure is making true to its commitment as a regulatory-compliant platform. Overall, the project is pretty interesting and it will be interesting to see how it continues to build and develop into a full DeFi platform.

For more information, check the official sites:

Disclaimer: For infortainment only. None of these are to be construed as financial or investment advice.

Lead image created on Canva. Logo/s and other images were obtained from MantraFinance. No copyright infringement intended. 10072023/09:30ph

Posted Using LeoFinance Alpha

Gonna save this for now. May community na din pla

Meron sis :) You can check them out and you can also write about them :)

!LUV

@jane1289, @ifarmgirl(1/5) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoCongratulations @ifarmgirl! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 26000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

https://twitter.com/LovingGirlHive/status/1678301489960460289

The project seem to be a good one but why don't you like the KYC verification?

Yes, they seem to be focused on providing a safe and secure platform for people which is good.

I don't like giving my private information. I did that in the past without knowing any better. Guess I'm paranoid, lol! Scary to think that the information we give away through the KYC can be leaked and used for something else.😂

!LADY

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @rafzat and you earned 0.1000 LOH as tips. (1/18 calls)

Use !LADY command to share LOH! More details available in this post.

!LOLZ

lolztoken.com

Remains to be seen.

Credit: reddit

@ifarmgirl, I sent you an $LOLZ on behalf of @myintmo.shweyi

(1/2)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!

https://twitter.com/lee19389/status/1678323711341137921

#hive #posh

Ito ba yung sa Mantra Network?

I think I have heard the name before but can't able to remember where I have heard about it.

Although I am not interested in that kind of platform but there is nothing wrong with gaining knowledge about it. Who knows when and how the knowledge will be useful?

So thank you for sharing the knowledge.

!PIZZA

$PIZZA slices delivered:

@intishar(2/5) tipped @ifarmgirl

Will have to reblog this for now, will definitely love to check out on this projects here too to know more about them ,thanks for the post too

The way we're seeing it now is that they've come into the cell market, and if there's verification, it's a lot better, people's things are saved.