In the Midst of Stable Problems

The stablecoins market has been, interestingly, stable with no fun or FUD around. Yet, the collapse of Silicon Valley Bank (SVB) spoiled the silence in the market as USDC was exposed to the bank for $3.3 Billion as they stated.

The FUD in the stablecoin market has always been around USDT because of the previous history of crypto investors. Since 2018, the existence and domination of USDT perceived as a threat to both crypto itself and Central Bank's own stablecoins. Printing USD is a precious privilege and this power cannot be shared with any other parties by the FED that easily.

Centralization has 2 sides

If some parties take the risk of creating and sustaining stablecoin projects, then they also prepare themselves to face serious concerns that may put them into undesired conditions. USDT accepted all these risks and stepped in. The debut of USDC was welcomed by the crypto ecosystem as the alternative to USDT was a good step for crypto.

The more focus was shifted to USDC, the riskier it became for the company to sustain growth. USDC is always loved by crypto people, crypto service providers (such as Coinbase), and regulators as Goldman Sachs is among the partners of Circle. Yet, eventually, centralization kills. We experienced it thousands of times and the result has never changed.

Diversification can be Illusionary

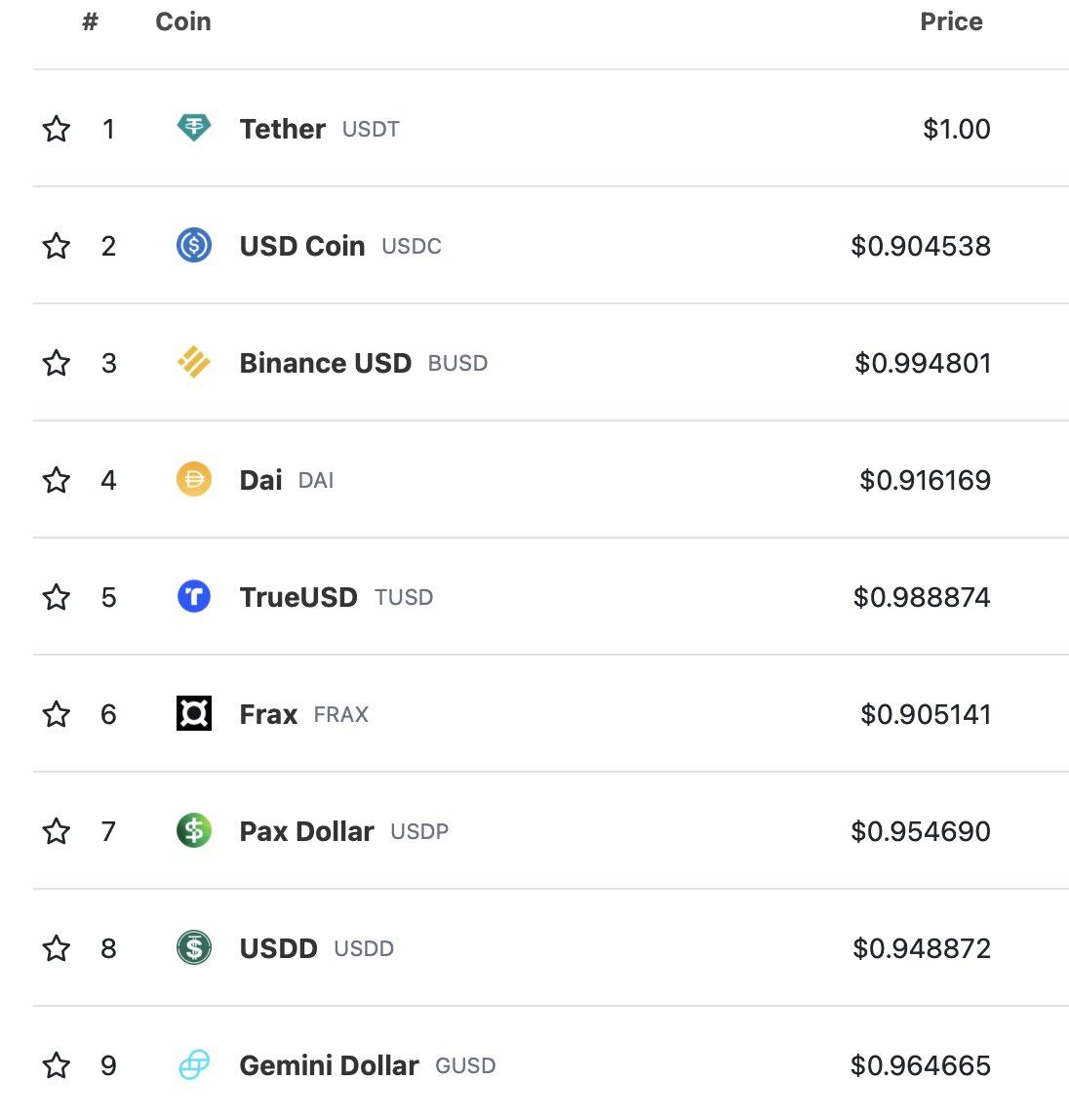

Look at the coins below. All of them are supposed to be $1 forever. Guess what, there are only 2 stables and tens of casualties with a FUD.

People may forget the fact that crypto is still seen as magic internet money or a gamble for a serious number of people. When everything looks stable, you can always expect something really great or terribly bad for the ecosystem.

Nothing is stable in crypto, including us. USDC will get back to its peg, I have no concern with that. The FED would not let such a devastating occasion to hit the banks in the US and Circle will cover its losses sooner or later. The peg may not happen in a month but it will be sustained again by Circle.

Too big to fall is not a real argument. Every single unit may rise or fall in finance. We may only think about the risks and possible event that may come after the FUD. What I see is that Banks will be protected if we do not want to experience another 2008 crisis.

Posted Using LeoFinance Beta

https://twitter.com/3305546045/status/1634622596577624064

The rewards earned on this comment will go directly to the people( @idiosyncratic1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The de-pegging of USDC (https://www.coingecko.com/en/coins/usd-coin) is a signal that even having currency as collateral is not a sure thing. I think there is still space to innovate on what a real stablecoin should look like, while I believe that HBD is one that repels many risks compared with others.

Posted Using LeoFinance Beta

Strongly agreed.

1:1 does not make any sense because it is vulnerable to sudden drops. Overcollateralization might be a possible option. HBD is a solid proof for that

The banks will most likely be protected and the average tax payer will be paying for it. I honestly think that the bank failed because it diversify enough. The tech/crypto sector has taken a large beating and it will be some time before we can see how much is lost.

Posted Using LeoFinance Beta

The FED ruined the harmony in the economy with the fear and aggression that it released. Eventually, tax payers will pay for the newly-born problems as usual.

I don't think it's the Fed. The Fed only sets expectations but it's the banks and the governments that control the policies.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks for your support dear team