Calculating Net Gains of PolyCUB Investment - Week 8 💰

PolyCUB platform on Polygon Network is a Yield Optimizer that helps you maximize your De-Fi earnings with higher APY rates for your staked Liquidity Shares on the platform.

This experiment tracks the return of investment on the PolyCUB platform from the first day of the launch. As the experimenter, I believe the return on my investment will be quite worthy before the end of this year. However, there will be up-n-down times in crypto as expected.

The long-term re-investment strategy is updated as a result of the first xPolyCUB Governance Voting. As the window time is reduced to 30 days, paying %50 penalties may not yield the best results. Thus, the claims will be kept as the liquid for 30 days before they are staked on xPolyCUB.

The Results of Investment Week 7

The 7th Week of Investment was not different from the previous 2-3 weeks in terms of the net gains/losses as the price of PolyCUB token was between 25-30 cents (W7 -> pCUB= $0.27).

In total:

+$231 from xPolyCUB

-$276 from Farms

We got -$45 in sum. However, getting 52 more PolyCUB tokens in xPolyCUB staking is the best part of this week's results. WHY?

We clearly see the down-trend for the token as it is nearly the same for many altcoins. As the global risks and inflation rates increase, people sell their tokens. In the end, many coins share the same view as it is on the chart above.

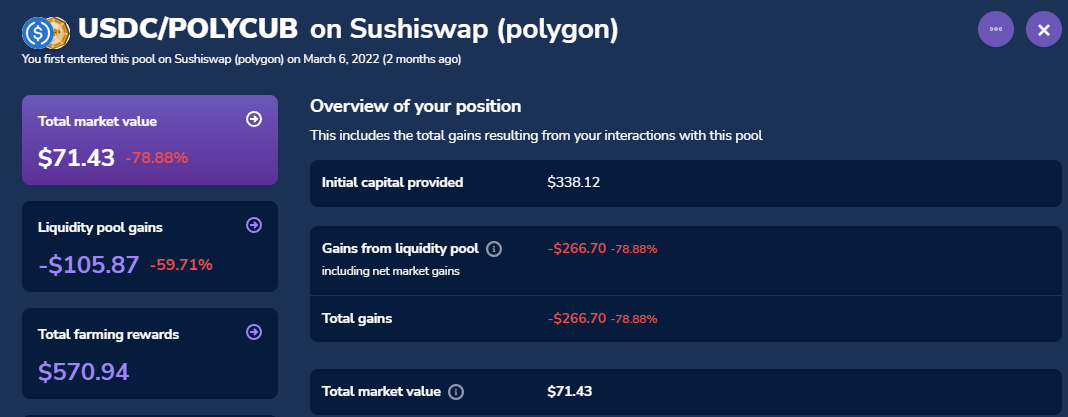

The Performance of PolyCUB Farms - Week 8

The price of PolyCUB token dropped by around %50 in a week. Thus, the return of the pools decreased accordingly. Briefly, we have - %70-80 net gains from our investment for both USDC and ETH farms.

The same case applies for ETH farm. Meanwhile, both Ethereum and PolyCUB token lost their value gradually.

Basically, we can see that we receive -$305 from our net gains from liquidity farms with %70+ negative return.

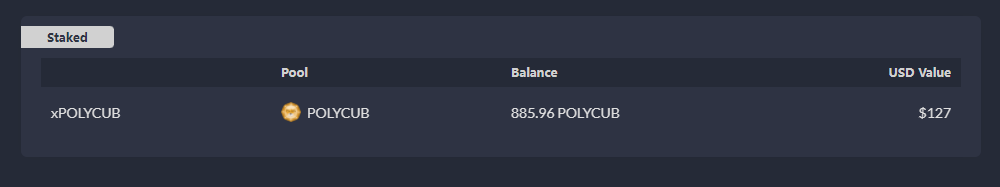

xPolyCUB - The Superman

Okay.. Superman looks tired these days 😅

Last Week the value of xPolyCUB was $231 (pCUB = $0.27)

However, this week it is worth $127 with 885 PolyCUB being staked.

Additonally, it is the first time that we harvested token but we did not claim them by paying penalty. This week we received 32 PolyCUB ($4.5) besides the compounding xPolyCUB staking.

In total:

-$305 from Farms

+$127 from xPolyCUb

+$4.5 from Liquid pCUB

=-$203,5 in sum.

Experiment Part 2 - pHBD / USDC (Wallet 2)

Last week we initiated the first comparison of HBD staking (%22 APY) on Hive Savings and pHBD farm on PolyCUB.

Our $137 worth of stablecoin investment brings us 6.47 PolyCUB.

These tokens are harvested but not claimed because it will reduce the amount in half. After 30 days, these tokens will be staked on xPolyCUb to compare Hive Savings returns periodically.

TL;DR

The drop in the price of PolyCUB affected the returns of farms and xPolyCUB directly. Even though the previous weeks were below -$50 in net gains/losses, this week we saw three digits in red.

In total, -$200 net loss is calculated taking the returns of farms, liquid PolyCUB tokens and xPolyCUB into consideration. However, we should never forget the fact that the price and the return can dynamically change according to the market sentiment. Even when the price drops %50, It's fine to me.

The second experiment showed that $137 worth of stable farm on PolyCUB platform brings 6.47 PolyCUB token. As of writing, the APY is %33. We will see and compare the returns of Hive Savings and stablecoin farm when we get to 30th day of investment.

%50 penalty to be paid or not... You tell us 🦁

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1520890865765474306

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Congratulations @idiosyncratic1! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

I was kind of expecting the price to drop because they haven't really show how they are different from other platforms just yet. The bonding and loans have been delayed and I think the hope for those was what was keeping up prices. However, the market crashing is obviously going to take everything along with it.

Posted Using LeoFinance Beta

Yeah both not showing up the new features and the bear market affected the price negatively. Yet, I'm still hopeful for the Q3 & Q4 :)

Posted Using LeoFinance Beta