Are Stablecoins Still Under Attack?

The stablecoins are one of the most hotly discussed digital assets in crypto. For some people, they are used to hedge the intolerable risks in crypto while others see them as the black swans in an infant ecosystem.

Putting the exact opposite points of view aside, these coins have an important place in the crypto ecosystem. From institutional investors to retail investors, we feel the need for a nearly stable asset that will always have a position in our portfolio.

At that point, the Hive blockchain has HBD which is a Hive-backed stablecoin (we use to get 20% APR in Hive Savings or use it cross-chain via PolyCUB for decent stablecoin return) and there are 4 different types of stablecoins as of 2022.

With the collapse of UST, the. stablecoins started experiencing depeg situations more frequently than before. Are we done with this devastating FUD wave?

UST is Left Behind (I mean... USTC)

TerraClassic team realized the risks that they could not deal with in the Luna case and they did not choose to have a stablecoin in their LUNA 2.0 project.

Due to this move, they have a little hope that nay help Terra 2.0 projects recover and start operating as before. However, the scope of the FUD was devastating. Thousands of people still suffer from this catastrophic case.

At least, we are done with it ✅

USDT is Experienced

Tether & Ripple are the black swans of crypto for me. However, any speculation on Tether may bring terrible problems to the crypto ecosystem even worse than the UST occasion.

Tether "lost" its peg for just a $0.05 drop in the recent case. I believe it may also stem from market manipulation by centralized exchanges to push customers to adopt their own stablecoins like (GUSD, BUSD, etc.) but in the end, the drop in value would not be as serious as an earlier drop that we tested $0.70 for a stablecoin 😅

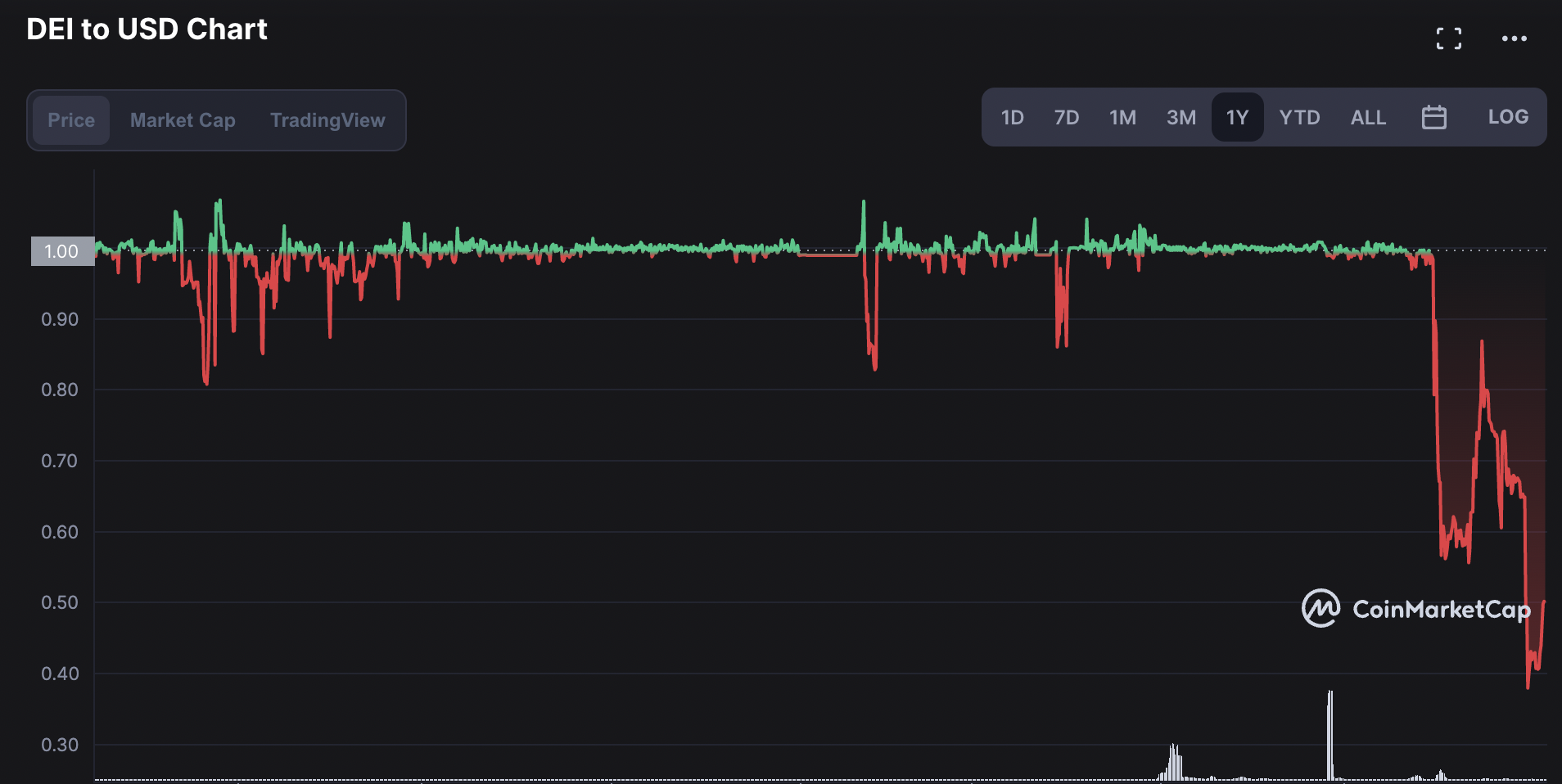

DEI is Still Suffering

DEI, not DAI!, could not recover in the stable FUD. However, it is not a factor that effects crypto investors' financial decisions. It looks like the narrative Depegged Stablecoins is over.

Will DEI recover? I do not know. Actually, as long as I do not need to use it, it does not matter because the other stablecoins took their lessons and, at least for now, they are well-prepared for a depeg fight.

TL;DR - Depeg is No Longer a Valid Narrative

Everything is super-fast and extreme in crypto ecosystem. Even though the depegged stablecoins are putting the whole ecosystem under the threat of huge damage, we all have taken good lessons from our past experience.

The depegged stablecoins are not likely to have massive impact on crypto ecosystem if the FUD takes place once again. From the last battle, we lost USTC (Terra) and DEI as stablecoins. However, the rest of the stablecoins adopted the motto that "what does not kill me makes me stronger" by preparing themselves to similar conditions.

For the next couple of months, stablecoins are not likely to be a reason for FUD and FOMO in crypto.

Their watch has ended 🏁

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1532443297557495826

The rewards earned on this comment will go directly to the people(@idiosyncratic1) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

DEI? I could say I’ve never heard about it before. If not for the censorship that is capable of coming up with centralized stable coins, centralized stable coins aren’t so bad.

But you see these algo stables, most are a time bomb

Posted Using LeoFinance Beta

Unfortunately, the algo stablecoins are open to attack. Many people see them quite risky and tiny FUD may become avalanche if it is spread over algo stables.

BUSD is fully backed by USD in bank account. Interestingly, the CEX stables are favored in this period ^^

Posted Using LeoFinance Beta

Super correct. Decentralized algo stables will have their day in the sun once again in due time.

The term 'under attack' still makes me laugh.

It's just the market doing its natural thing.

Exploiting weakness and transferring money from the weak to the strong.

Jungle Rules 🦁

Actually, I also think the "attack" sounds like a planned action but, in reality, it is the fear that made it happen. Sell pressure on stablecoins due to FUD may express the situation better but this is how the media handles the case so far 🤣

Posted Using LeoFinance Beta

I guess the game is over for algorithmic stablecoins after UST crash.

Posted using LeoFinance Mobile

It seems like they are going to be the last option in the eyes of people :)

UST definitely left the cryptospace with a bad taste in their mouth, and it left the outside potential users with a bad impression of algorithmic stable coins, seems like HBD is built differently, but we are definitely in for a stable coin ride in the next few months, where the stables with no fundamentals or shaky tokenomics will suffer (or will they?).

You mentioned Polycub in your post, which caught our attention because we've been very involved with the Polycub ecosystem by adding all the farms and the xPolycub vault to our DeFi tracker, which allows users to track their positions with a lot of details regarding cost, value and profits earned. If you have any DeFi investments, we would appreciate if you check out our recently launched website app at https://defireturn.app

Posted Using LeoFinance Beta

I frequently visit defireturn and suggest the platform to my fellows. I hope we can grow together when LeoFinance and Defireturn are hand in hand ✋🏼

Definitely! The more synergy, the better :D