137,000 BTC From Mt Gox to Crypto Market (?)

CryptoTwitter talks about the ancient Mt Gox exchange crisis and the result of the lawsuit. As a consequence of a long time of patience, the victims of Mt. Gox Hack will receive their Bitcoin that the crypto exchange did not repay for years!

When the Mt. Gox hack happened, the price of Bitcoin was just $500. Even in the deep bear market conditions, the crypto bag of Mt Gox users increased 40x while they were waiting for the case result. The good thing is that everyone is happy to see that people could save their money. The bad side is that these people may dump 137K Bitcoin on us 😅

Let's talk about the details.

Paid in Once or by Instalments

Actually, it is not certain yet. Of course, there are some well-known crypto influencers claiming that they will be fully paid at once, but this option does not sound reasonable to me.

Claims varied widely at the time of writing, with some believing that a tranche of 137,000 BTC was set for release in one go. Others said that funds would be sent piecemeal, but that payouts would nonetheless begin this weekend. -Cointelegraph

Think about the Mt Gox's owner. When he lost the funds, they were 40x less valuable. Meantime, the assets being hacked are absurdly more valuable than in old times. It is not easy for anyone to pay 137k BTC without installments. Nearly impossible.

Does it Affect Bitcoin & Crypto?

Yes, it does. However, not too much if the market is not shallow.

There is a nice example by Twitter user Rager

Around 10% of total daily trade does not kill the coin but, absolutely, the long red candles will bring panic sell-off with itself.

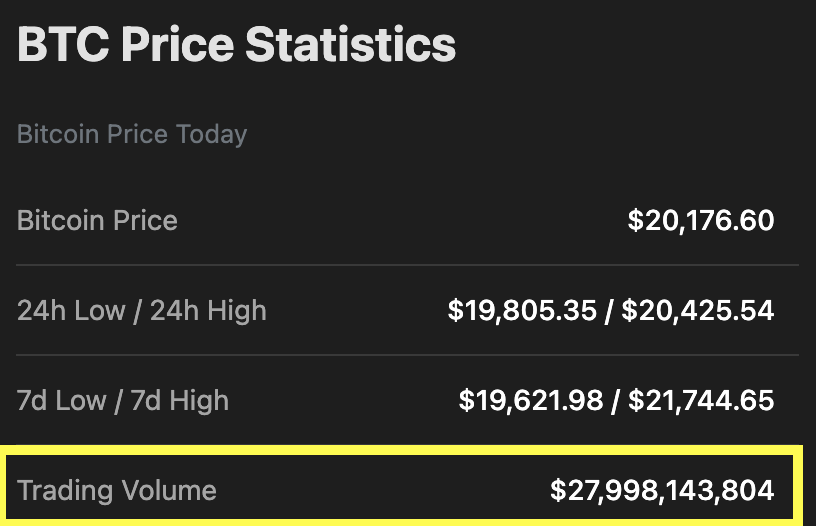

Today's trading volume shows that $28B for Bitcoin. In the case when the Mt Gox users decide to take profit on Coinbase, Binance, FTX majorly, they will have more impact on the order books as there is already low volume and fewer buyer.

My personal assumption for the worst case scenario is that dump of Mt Gox from $20K would not lower the price more than 25% of Bitcoin. Moreover, why would these people go greedy in the bear season while they can keep multiplying in the bull-run?

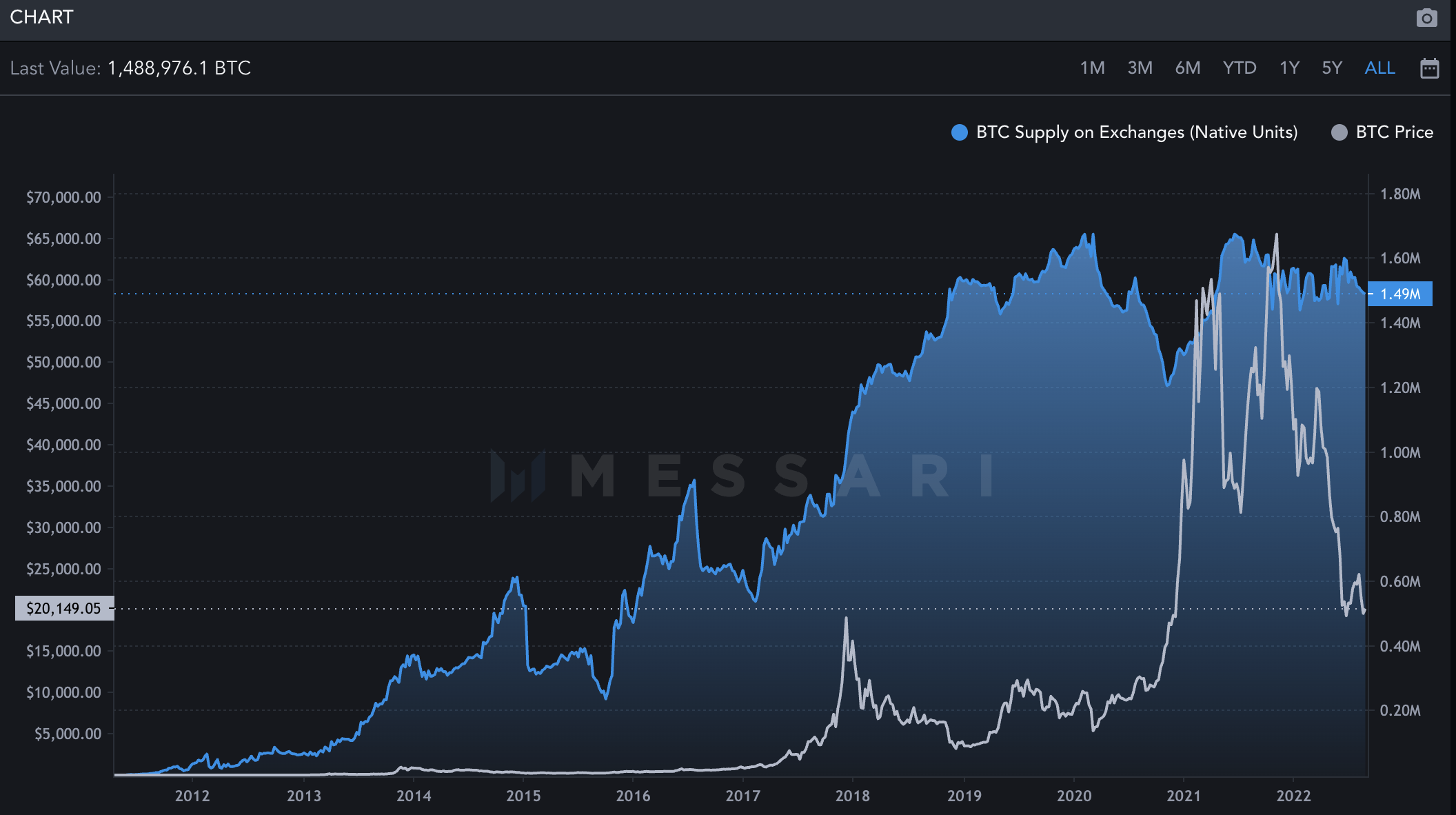

When you check Messari to see the total number of BTC on exchanges, you will be surprised as it is as low as the level in 2018.

In the bearish scenario, the dumping of 137K directly to crypto market will be as huge as extra 10% of the total circulating BTC in exchanges. When we look thing from this perspective, the worst case scenario may become more scary.

Credittors denied the possibility of BTC dump at once. However, it's not the final decision.

I would not dump Bitcoin to the crypto market at these levels.

Would you take profit after 40x when the price is $20k?

Hard to decide but share your ideas with us 😉

Posted Using LeoFinance Beta

https://twitter.com/idiosyncratic1_/status/1565114563665829888

The rewards earned on this comment will go directly to the people( @idiosyncratic1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

We also have to take into consideration the fact that people holding the MT. Gox claims have been in crypto for a LONG time and most of them currently hold crypto, maybe they're even buying more.

On top of that, I've seen reports that some people sold their claims at a discount, and the companies that bought the claims will probably hold during the bear market to maximize the gains instead of just dumping them right away.

Posted Using LeoFinance Beta

It gets crazier 😅

I do not expect to see dump of more than the quarter of the sum. No need to do it when BTC is so cheap ✌🏼

Congratulations @idiosyncratic1! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out the last post from @hivebuzz: