Papa John's Valuation Using the Discounted Cash Flow Model

Hi there Pizza lovers and fellow Hivians!

This is my 4th blog post in a series where I am valuing 2 publicly traded pizza companies!

Here are the prior posts for reference:

Calculating the Cost of Equity is covered in the 1st post here: https://peakd.com/hive-185582/@hurtlocker/calculating-the-cost-of-equity-for-dominos-and-papa-johns.

Calculating the Cost of Debt is covered in this 2nd post: https://peakd.com/hive-185582/@hurtlocker/calculating-the-cost-of-debt-for-dominos-and-papa-johns.

Using the Cost of Equity and Cost of Debt to calculate the Weighted Average Cost of Capital (WACC) is covered in the 3rd post: https://peakd.com/hive-185582/@hurtlocker/dominos-and-papa-johns-cost-of-capital-weighted-average-cost-of-capital

Forecasting the Firm's Financial Statements

To value Papa John's we first need to forecast the financial statements into the future and then calculate a terminal value. Forecasting financial statements can be complex and tedious. For simplicity, I am going to give 3 high level tips on how to forecast financial statements. If you would like to forecast financial statements on your own and need help, you can ask me questions in the comments below or you can go to the Hive Pizza discord https://discord.com/invite/hivepizza and ask for me there.

High Level Tips:

• Forecast 3-5 years into the future

• Do the annual sales growth forecast based on historical % sales growth. Typically use the average % sales growth over the prior 3-5 years.

• Forecast expenses, assets, and liabilities as a % of sales based on the most recent year.

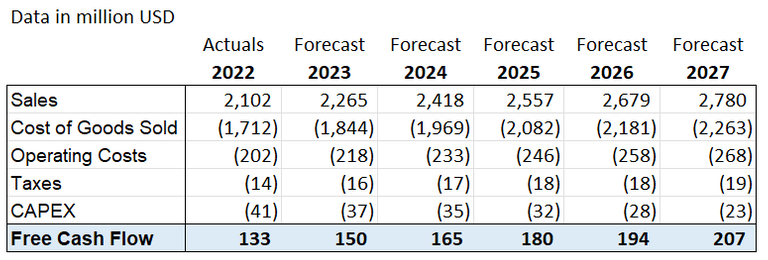

Calculating the Free Cash Flow

We need to calculate the Free Cash Flow of the firm to use in the DCF model.

Free Cash Flow = Sales - Cost of Goods Sold - Operating Expenses (Excludes Depreciation) - Taxes -Capital Expenditures

The best way to understand Free Cash Flow is this is the cash flow that is actually coming into the business through its operations and is the cash "available" to stock holders and debt holders.

I put "available" in quotes because typically firms will reinvest a large % of the Free Cash Flow back into the business versus paying out to investors.

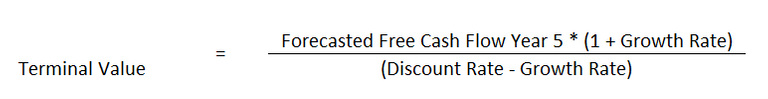

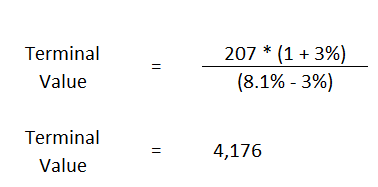

Calculating the "Terminal Value"

The current forecast only accounts for the value of Free Cash Flow through year 2027. There is value to the Free Cash Flow past this point as well; however, instead of doing math until infinity, we can use the below formula that captures the perpetual value of the firm's Free Cash Flow.

For the Discount Rate we use the WACC we calculated in the previous post.

For the growth rate I typically will use 3%. This is a theoretical value that should represent the growth rate expected into infinity. A good proxy for this is the long term inflation rate of a developed country. The long term inflation for a developed nation typically runs at around 3%.

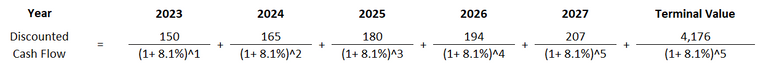

Putting the Future Cash Flows into Present Day Value

When looking at any value into the future, this caries risk. When valuing future cash flows we can take this into account by discounting the firm's future Free Cash Flow by its WACC.

Here is the math by year:

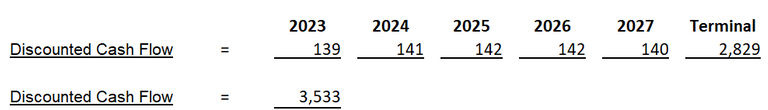

In total:

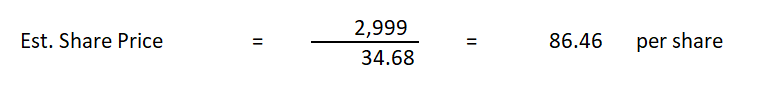

Using the DCF Value to Derive Papa John's Stock Value

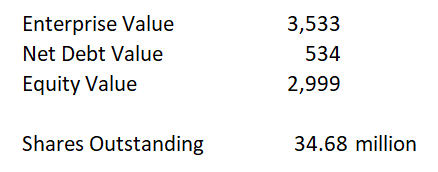

The value of $3.533 Billion is the model's estimation for Papa John's Enterprise value.

The Enterprise value of the firm is the firm's total value of Equity plus its Net Debt.

The Equity value of a firm is equivalent to its Market Cap. If you divide a firm's Market Cap by its Total Shares Outstanding, this will give you the price per share as calculated below.

NOTE: This is not financial advice. This post is just showing how to value a company based on its Free Cash Flow. You should not use this post as a basis for any investment decisions.

Hive PIZZA is a great gaming guild that really LOVES Pizza.

Stop by the discord channel for events or to share your tasty pizza pictures in the #pizza-pics channel.

Join the Hive PIZZA Guild Discord - https://discord.com/invite/hivepizza

Visit Hive Pizza Website - https://hive.pizza/

Follow PIZZA on Twitter - https://twitter.com/PizzaOnHive

Follow me (@hurtlocker) on Twitter - https://twitter.com/Hurtlocker360

https://twitter.com/1491474826158129155/status/1635703730396884992

The rewards earned on this comment will go directly to the people( @hurtlocker ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

@hurtlocker! The Hive.Pizza team manually curated this post.

PIZZA Holders sent $PIZZA tips in this post's comments:

@hurtlocker(1/20) tipped @relf87 (x1)

relf87 tipped hurtlocker (x1)

Join us in Discord!

Serving some !PIZZA for your analysis!

TY! I hope you enjoyed the read!

!PIZZA

Congratulations @hurtlocker! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 400 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!