Bitcoin's Recovery and Market Dynamics. ( A Path to New Highs)

If we take a closer look at the current market conditions, it becomes evident that the market is in its recovery phase. Yesterday, the market experienced a slight crash, primarily due to being overbought, leading to a natural pause and correction. However, this correction is a healthy and necessary part of the market cycle, providing an opportunity for stabilization after significant upward movements.

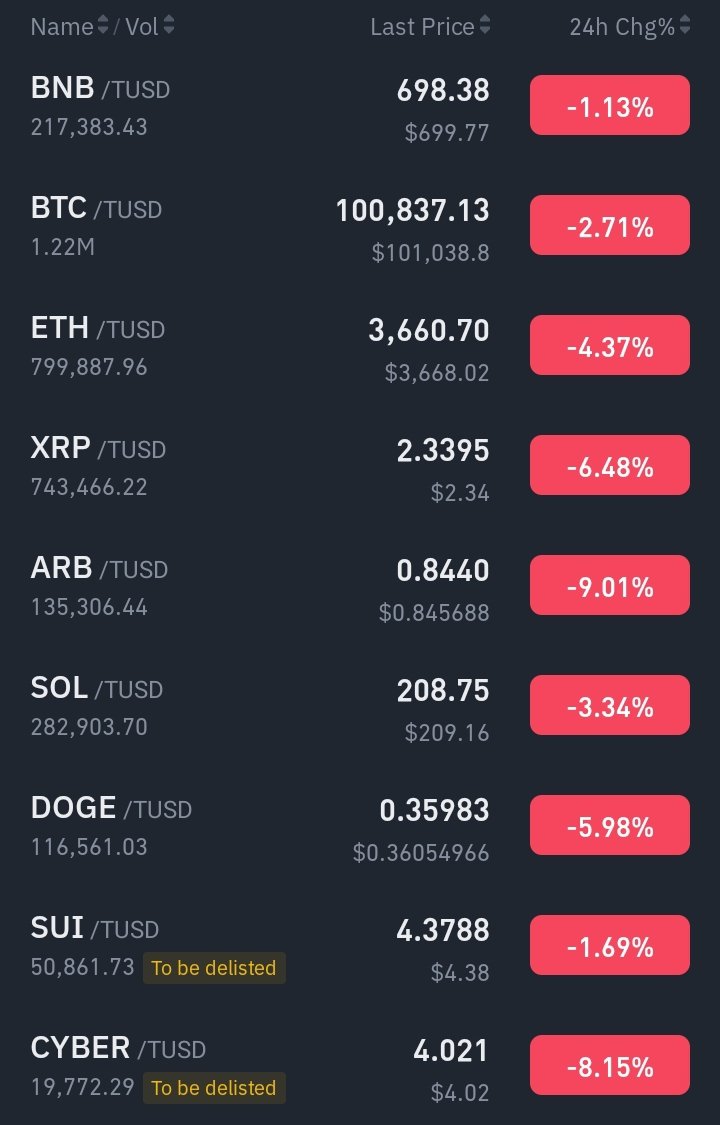

Currently, Bitcoin (BTC) is undergoing a healthy correction, which is crucial for building a stronger foundation for future growth. Alongside this, BTC dominance , the key market direction indicator, is gradually increasing, reflecting a shift in market focus. This incremental rise in BTC DOM often signals upcoming shifts in momentum, influencing the broader cryptocurrency market. As a result, other alt coins are also undergoing their own corrections, which are vital for consolidating gains and preparing for the next upward It’s important to note that these corrections do not signify a full-fledged market crash. Instead, they represent a temporary adjustment that allows the market to regain strength, recover, and set the stage for future growth. With BTC stabilizing, the market as a whole is positioned for a more sustainable environment, benefiting both Bitcoin and alt coins in the long term.

Looking ahead, Bitcoin's price trajectory remains promising. After an extraordinary surge of nearly 150% throughout 2024, Bitcoin is currently trading around $104,000 and is on track to reach new all-time highs in 2025. Over the past six months, Bitcoin has not only maintained its upward momentum but has also outperformed prominent tech stocks, such as Nvidia. While Nvidia's stock has seen minimal movement, Bitcoin has delivered over 55% returns, showcasing its strength as a leading asset in the market.

This exceptional performance has sparked discussions among investors about reallocating their portfolios. Some are considering selling Nvidia stock, which appears to be slowing in growth, in favor of undervalued opportunities like Intel stock, which could capitalize on future technological advancements. Meanwhile, Bitcoin continues to attract both institutional and retail investors, solidifying its position as a dominant player in the global financial landscape.

With these developments, Bitcoin’s unparalleled growth trajectory reaffirms its potential to achieve even greater heights in the coming years. As the market recovers and consolidates, all signs point to a promising future for Bitcoin and the broader cryptocurrency market.

The content I shared with you guys is based on my education and knowledge. I wish you people will appreciate this post and reblog if you like it. Thanks for sticking till the end.