UPI Payment System and Linking to Credit Card - Effects on Industry

Hello all friends and $LEO lovers.

The Unified Payments Interface (UPI) has gained significant popularity in recent times within India. Its prominence has grown alongside the Digital India campaign, an initiative launched by the Indian Government aimed at providing citizens with electronic access to government services. This campaign involves an effort to enhance online infrastructure and expand Internet connectivity. It's worth noting that India is known for having some of the most affordable Internet rates globally. Virtually every smartphone in the country is equipped with Internet connectivity, and basic Internet packages are often included in mobile phone plans.

Turning our attention back to the Digital India initiative, which was inaugurated on July 1, 2015, it stands as the government's flagship program with the overarching goal of fostering a society empowered by digital advancements.

Unified Payments Interface (UPI)

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that make its exchange possible.

Unified Payments Interface aka UPI is an instant payment system developed by National Payments Corporation of India (NPCI). The interface enable users to inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) tractions. The mode is one of the fastest way to do financial transections between two bank accounts . The user has to registered his / her mobile number with the bank and need to create the UPI ID and the UPI ID may be used for the bank transection. The UPI payment system is one of the most successful payment system in the world because of the number of users, the volume of the transection and the number of transection.

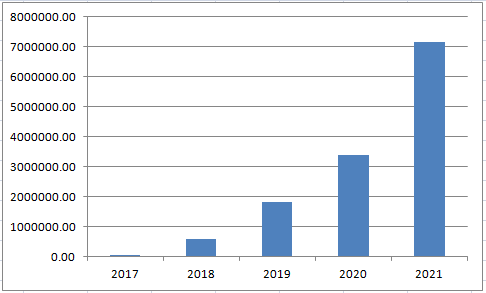

Source

The above chart sows the value of transections in Crores over a period of last five years.

UPI For Credit Cards

The UPI facility was available for the users using a bank account and has linked their bank account and mobile link. But their is big change happening in credit/debit cards and banking system in India. Indian Credit card ecosystem may missive changes are happening after an announcement by RBI (Reserve Bank of India). As per the RBI's latest announcement, credit card users will now be given the flexibility

to choose their credit card network i.e. user may has option to choose credit card network between Visa, Mastercard and Rupay. Up to this it doesn't looks any special or make change in the industry. After the above announcement their was another change that RBI has asked and that is going to be a game changes in the industry. RBI asked why not the UPI on Credit Cards. Till now the UPI was available for financial transection form one bank to other bank but now it is opening the way for credit cards also. Credit card on UPI, which will be a revolutionary for all the credit card users.

Lets understand what effect it will create in market -

For normal UPI payments when a user make the transaction the amount is deducted immediately form the payee bank account. I am also using the UPI and to be honest it always make my bank statement messy. .A small amount of even les then $1 get reflected in my bank statement and in this way the statement become more and more lengthy.

Making UPI transection does not reward users but on other side the credit cards has the reward system. The reward points with every transection always good and they provide the ,40 Days of interest free period also. But always keep in mind failing to pay back the credit cards on time results in bad CIBIL Score.

First mover always get benefits, in this case also not all the bank has this facility only some banks and some app gives the facility to link the credit card and UPI. The Creed app is one which has the facility and the facility is available for the RuPay credit cards only. The option for Visa and Mastercard is not available, because of this reason the Visa and Mastercard customers are already getting dissatisfied.

Visa and Mastercard's setup was very expensive, which involves the initial setup, POS machine and after that, 3% transaction charges. But with Rupi credit card, both costs will be significantly less and the initial cost of the setup is almost 0 because QR codes can be scanned, that is the reason I think in the next 5 years, Rupay credit cards will be in a very dominant position. At present Rupay credit cards have 20% market share in the Indian credit cards But in the coming years the scenario will be changing and expecting it will go easily to 35% in next five years. And Visa and Mastercard will be less in India

Final Words

The integration of RuPay credit cards with UPI is poised to bring about a substantial transformation within the credit card sector. Building upon the government's vigorous promotion of RuPay's debit cards, which propelled them to a dominant market position, they subsequently ventured into the credit card arena. Through assertive marketing efforts, RuPay credit cards captured a notable 20% market share. The government's aspiration is to establish RuPay as a frontrunner in the credit card market. This strategic approach holds the potential to reshape the industry landscape, offering considerable advantages to merchants and engendering greater spending flexibility.

Nevertheless, this move could herald the decline of conventional swipe cards and corresponding machines, as the popularity of UPI payments continues to surge. In parallel, UPI-enabled transactions offer not only ease and convenience but also the possibility of enhanced rewards and streamlined expense management when using platforms like CRED. Collectively, this decision reverberates across the credit card industry, ushering in implications that stand to benefit businesses and consumers alike.

Posted Using LeoFinance Alpha

Congratulations @guurry123! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Thanks for update

You are welcome @guurry123, that's with pleasure! We wish you a happy buzzy week 😊👍🐝

https://leofinance.io/threads/guurry123/re-guurry123-dcxq3sya

The rewards earned on this comment will go directly to the people ( guurry123 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Yay! 🤗

Your content has been boosted with Ecency Points, by @guurry123.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Thanks

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks