Demystifying - How Collateral works in Crypto? With Real Example $ATOM Collateralized to Mint $USK on $KUJI...

Hey All,

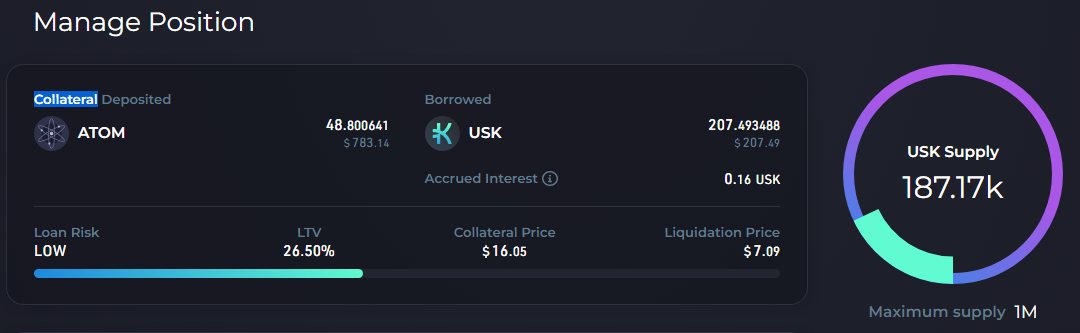

In this post, I am going to make an attempt to Demystify - How Collateral works in Crypto? With a real example, where I have collateralized 48+ $ATOM tokens to mint the stable coin $USK on KUJIRA APP BLUE

In simple terms collateral helps you to take Loan for your assets. And in crypto world these collateral assets are locked into a smart contract until you pay back your loan. In my case, I had locked 48+ $ATOM to mint $USK; which is the stable coin on KUJIRA blockchain to borrow $207 and the same can be seen on the above image.

- Collateral Value = $778+ USD

- USK Borrowed = $207+

- New LTV = 26+%

- Liquidation Price - $7+

Loan to value (LTV) determines the amount of crypto one would need as collateral before one could get a loan. Precisely LTV in crypto lending basically helps minimize the risk on the lender's part. Higher the LTV higher is the risk of collateralized assets being liquidated to pay off the loan. Lower is the LTV, lower is the risk of collateralized asset being liquidated.

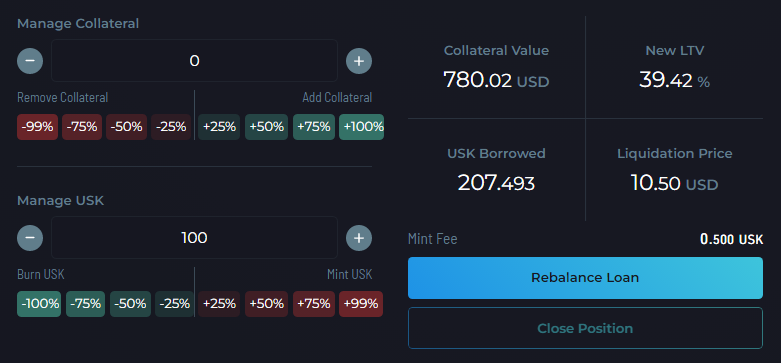

In my case, you can see that my LTV is lower and for collateral to be liquidated the $ATOM price should come down to $7.9 from its current price which is close to $16+. LTV keeps getting adjusted based on the collateral assets value and the amount of loan you take against you collateral assets. Lets take an example here, assume I need another $100 to buy some $CUB. Lets see what would be the change in my LTV, while I mint another $100 $USK to buy $CUB..

There is an increase in LTV and Liquidation price of the collateral assets i.e.

- LTV increases from 26% to 39%

- Liquidation Price increases from $7+ to $10+

This means that now if the $ATOM price come between $10 then my collateral would be sold to pay of the debt and the reaming money in the form of the stable coin i.e. $USK would be paid back to me. Incase the liquidation price does not come to that level, then I need to pay of my total debt which is $207+ to get my 48+ $ATOM back that is locked in smart contract.

Why take Loan - Collateralizing crypto Assets?

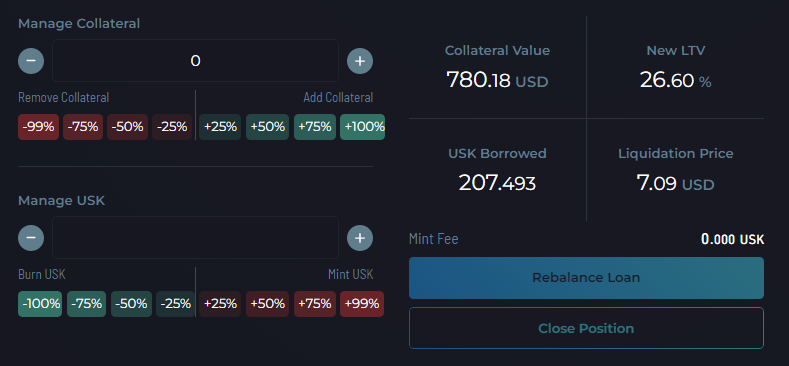

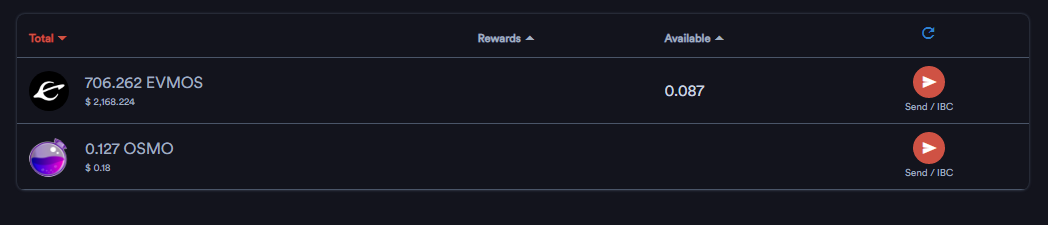

Following is my current position of my collateral. I am in a debt of $207, with 48+ $ATOM locked. So why did I take loan comes the real question? It would depend people to people and their needs. In my case, I was looking to buy $EVMOS and $ATOM tokens. I didn't have cash in hand and hence collateralized my $ATOM to take loan and buy the above mentioned crypto assets - $EVMOS And $ATOM.

And to be honest, I staked $EVMOS to further increase my $EVMOS staking rewards and the $ATOM that I bought I added it into my collateral position to further reduce my LTV and liquidation price. This way, I took advantage of a crypto crash where buying in cheap the assets that I was looking for even without having cash in hand

& taking the advantage of collateralizing your assets to take a loan.

My plan is to take my daily $EVMOS rewards and convert them to $USK and pay of my debt of $207+ dollars. My loan still stand at a low LTV so I need not fear of my collateral being liquidated and if further market crashed, I could take advantage of collateral to borrow some more money and buy in cheap $ATOM or maybe even $CUB or $SPS.. who knows what would be the exact move... I hope, I was able to explain this big term of collateral in crypto world; how it works with a clear example of my collateral assets on KUJIRA APP BLUE

#collateral #loan #ltv #cryptoloan #Collateralized #howtotakecryptoloan

Demystify - How Collateral works in Crypto?

Image Credits:: kujira.app, evmos.disperze

Best Regards

Posted Using LeoFinance Beta

https://twitter.com/Arc7icWolf/status/1571408052779192320

https://twitter.com/LeofinanceAlpha/status/1571677629643890688

The rewards earned on this comment will go directly to the people( @arc7icwolf, @leoalpha ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I got it but what is the interest rate in this case?

You take loan of $207 then what will be time period to pay back and interest rate?

!CTP

Posted Using LeoFinance Beta

There is no time period as far I know. It depends upon you and the liquidation price.. As far as the liquidation price does not hit you are safe and regarding the interest it accrues and is nominal. Which is shown on the dashboard..

so far its $0.19.

Cheers

Posted Using LeoFinance Beta

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Congratulations @gungunkrishu! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Interesting. Remembers me on Anchor protocol ;-)

I will look into it.

Rehived.