If Only Robinhood Knew About Hive Dollars

Ever since Robinhood ruined its reputation during WallStreetBets fiasco, they have been trying to reinvent themselves, giving a try for innovation once more, and coming up with different ideas to attract more users to their platform. One of their latest ideas is to offer 3% APR on uninvested cash. However, to qualify for this users need to sign up for Robinhood Gold, which would cost about $5 a month. Users can early 1.5% interest even without trying Robinhood Gold.

My first reaction was - 3%? That's it? lol. Here on Hive we are spoiled with low risk 20% APR on our Hive Dollars, and 3% does not sound interesting at all. Perhaps there are investors who would be interested in earning 3% on uninvested cash. I don't know. But given the inflation rate has been 8+% as of late, not sure who would be interested in keeping cash for 3%. To be fair, their primary business is not taking/giving loans. They would much rather prefer users trading and investing on their platform. It wouldn't hurt to earn 3% bonus just in case an investors decides to stay in cash and watch the market at the sidelines and wait for the next investment opportunity.

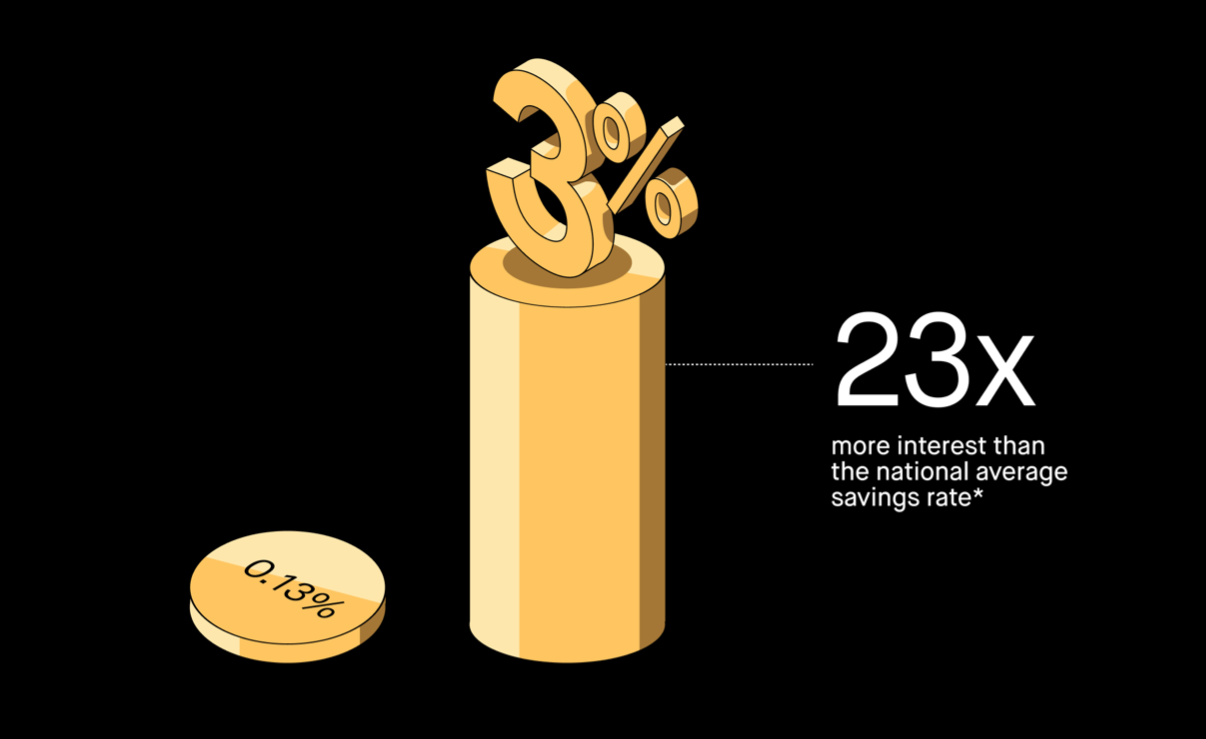

However, when I saw above image taken from their website, where they try to compare their 3% interest to national average saving rate and advertise it as something 23 times better, it got me confused. I didn't know Robinhood was in cash savings business. Even if they were, 3% is not a competitive rate to offer. Moreover, why would people want to keep their cash in Robinhood? If it was me I would only keep my stocks there. I don't see a need for them to hold my cash, especially for long period of time.

Now I have a better idea for Robinhood. A billion dollar idea. I am willing to give it to them for free. We don't charge fees for ideas on Hive. lol. One of the ways trading/investment platforms like Robinhood make money is by offering margin, like their Robinhood Gold accounts. Providing credit for margin trading/investing is a risky business. If the traders or investors start losing on their trading or investing ideas, without a collateral it can become possible that the users won't be able to return the borrowed money or stocks. For this reason they have margin calls. As soon as it becomes evident that money loaned is at risk, they activate margin calls and maybe even liquidate the stocks to return the funds. What if there was a better collateral for margin accounts? I Hive Dollars can be a solution for such model.

Robinhood is already heavily involved in crypto and crypto wallets. For them integrating Hive and/or HBD into their platform wouldn't be an issue. By offering HBD wallets or HBD representation on their platform, they can easily let users earn 20% APR on their HBD with a disclaimer that it would take 3 days to cash out HBD funds if users so choose. Let's say I buy or transfer 100k HBD to my Robinhood Account. Robinhood can keep them in the Savings on my behalf and pay me 20% APR in HBD and it wouldn't cost them anything extra, because Hive is the one who is paying the interest.

Now that Robinhood is holding my cash in HBD, they know I have collateral for a margin account. They should be able to lend me same 100k USD to trade or invest with zero risks. In the meantime, I am still earning 20% on my HBD and able to trade with the same amount of money. It is a big win for a trader or investor on Robinhood. But it is also a big win for Robinhood, because they would be earning interest on margin loan, and they would have more active users on their platform.

Are there risks for such a model? There are always risks. But these risks seem to be very low. If a user decides to invest in HBD, they are making their own trading/investment decisions just like buying anything else. Robinhood is not risking any of their money, because their is always user's HBD they can liquidate to return their margin loan if the user starts losing in their trades/investments. But since there is 100% backing of the margin loan, they don't have to activate margin call until users trade goes to zero or close to it.

The risk can be that the price of HBD would drop below $1, let's say to $0.9 or $0.8. Now the collateral is worth less than the margin loan. This may be of temporary concern for Robinhood. But this can also be mitigated by either charging higher interests or asking the user to add to their collateral, as they would do with the margin call. Since it doesn't take HBD to recover too long, I doubt this would be needed either.

Another risk is, Hive witnesses may come to consensus to decrease the APR paid on HBD or even completely stop paying interests. This shouldn't bother Robinhood, as Robinhood is not necessarily earning these interest payments but the users are. Users can reevaluate their investment and trading strategies as such changes happen.

It unlikely Robinhood will be wise enough to take this brilliant idea and create an interesting trading instrument bundle. But if they did, it would create demand for HBD. Demand for HBD would create demand for Hive. As a result Hive would appreciate in price and HBD become more stable and the HBD market would become more efficient. Win for Robinhood, win for traders, win for Hive & HBD.

Let me know your thoughts in the comments.

Posted Using LeoFinance Beta

https://twitter.com/geekjen/status/1574980955848462370

https://twitter.com/LXSXL2/status/1575012585942159360

https://twitter.com/joyundisputed/status/1575152793840664578

https://twitter.com/metodologiaecs/status/1576383822072905728

The rewards earned on this comment will go directly to the people( @geekgirl, @lxsxl, @joydukeson, @pedrobrito2004 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Let's all be honest here though HBD still comes with increased risks.

Really? What are the risks attached to HBD?

It's not stable that's for sure. And of course it has the risks of just about any other cryptocurrency. Just because it's called a stable coin does not mean it's 100% guaranteed to hold that $1 peg.

that is true, but the peg is not even so important as we can always do the HBD>Hive conversion guaranteeing the conversation being at $1

This is simply false. Market forces can drag this lower. There is no such thing as a low risk 20% yield. There is indeed risk. What do u think happens to Hive price if there is a massive move lower in HBD and this is the way it’s artificially kept close to a dollar.

but is it? I think you are not appreciating the algorithmic part of HBD. We are always guaranteed to get $1 worth of HBD as long as the hair cut rule doesn't come into play. And that would only really be happening in the opposite case: when Hive crashes and there is too much HBD (in HF26 30% of Hive supply). If HBD crashes then we won't have the hair cut rule and you will always be able to get $1 worth of Hive even if HBD sits at 20 cents. This would mean that HBD would be burnt at a massive rate with an already low supply. If anything there is then a massive incentive to buy HBD as it would be extremely profitable to buy HBD at 20 cents and convert it to Hive for $1... that's the whole point of how HBD gets its stability. The only real risk to HBD is the hair cut rule. Prove me wrong :) @taskmaster4450 made a good post about this a while back

It is indeed risky. Nothing offering 20% APR isn’t.

“ think you are not appreciating the algorithmic part of HBD. We are always guaranteed to get $1 worth of HBD as long as the hair cut rule doesn't come into play. “

Tiis is true today, it doesn’t have to be tomorrow. I love Hive and this community. I’m not pushing back for any reason other then I see people honestly believing there is almost no risk and it’s just not true. The push to put HBD on other/more platforms only increases that risk. It works for on sitevuse fine but once it’s something else it has to follow other rules and it just doesn’t make sense at all that anyone would think it’s safe. I

Tell me more about this “ hair cut rule” ?

Bit regardless you must understand the rate isn’t safe right? It can change anytime. If any semi reliable platform could give 20% wity little risk don’t u think we’d see the his offered everywhere? I again love the Hive community! Im not an enemy here, I’m just using common sense and it’s impossible to claim it’s almost no risk when it’s just a algorithm and no real backing. I also fear in a bad turn the hit Hive will take from pressure in a situation where HBD is crushed and Hive is used to prop it up. I’ve held less Hive then I otherwise would because of this risk and I know I’m not alone. You pay for the pleasure of 20% in some way and it’s likely going to be in Hive price medium term unfortunately. I did luck out and sell a bunch above $2.00 when I was bothered by this so that’s great but I’d rather hold more and not have this he going over my investment.

If HBD is successful is getting onto menu other platforms it will not be good for Hive. It will be a huge risk in general. Nothing is free in this world and we pay the price somewhere.

Now Hive given it’s not a pegged or claimed stable token I’d say should be the one getting high interest instead. We don’t really need HBD anymore with it being so easy to use lightening network directly to Hive to swap. But it could be fine for on platform use only, once the focus is HBD more then Hive it’s not going to be good for us long term. It’s a huge mistake.

you are basing your arguments on what exactly? That 20% interest just isn't possible? ("Nothing is free in this world and we pay the price somewhere.") That might be common sense at first, but it's not a strong argument because we have code. And code is law so to speak. Until you show me that HBD's interest rate isn't sustainable on a fundamental level, your argument is only conjecture. From reading your comments I assume that you haven't really looked into HBD (and the hair cut rule etc.) Maybe you start there and then you'll get a clearer picture. There are only 3 risks to HBD (listed in descending order of severity):

-a disruption to the hive network (e.g. sybil attack)

-hair cut rule (which has always been very temporary so far)

-the reduction of HBD's interest due to the witnesses

It might sound "crazy" that this list is so short, but this is why on Hive we call HBD a low risk investment.

I’m basing it on common sense and facts. I will agree to disagree. Unfortunately we will find out if I’m right. I’d love not to be 👍

no you aren't basing it on facts, but on "common sense", that was my point :)

Time will prove it.

I read all his posts and respect @taskmaster4450 a lot. But I couldn’t disagree more with him on this. I say this as someone who supports his podcast financially.

Not even important? Now this do you really believe? Honestly?

💯 correct!

Good to see some sanity being honest about this! Cheers friend

20% APY and "risk free" do not go well together

This would be amazing to see and it would be the marketing that would break hive into a serious rally on the upside. Unfortunately centralized exchanges are always looking for a win situation on there end and loose for customers. Making it almost impossible for them to consider until the time hive will be on everyone’s faces and it will be too late for them.

The reason HBD isn’t on the big boys is due to risk issues. We should push Hive not HBD on this issue.

But would Hive really rally on this if I am wrong? The risk to Hive is there as the peg puts pressure on Hive if HBD goes lower? I think there will be a day we all choose Hive over HBD and fork HBD outta existence. I wish we would this year. It’s extra risk we don’t need. We will pay one way or another for the 20% gains. Nothing is free in life and it should tell us something u can’t get 20% elsewhere for most part. There is a reason that’s the case obviously.

Hmmmm… interesting thought there folking HBD out of existence. That alone would save hive the algorithmic stable coin regulatory pressure if they ever come.

I kept cash on bittrex until the HDB interest was icreased to 20%. It was just money that I had and was afraid to invest so I see the point. I'm wary of more people knowing about HBD until I have enough and wouldn't mind a lower rate.

Posted Using LeoFinance Beta

Wow! Great thought. But how do they get to know your brillant idea? I hope it reaches to him.

All parties will be good if it happens.😀😀

Robin Hood will not touch HBD. It’s 2 risky and the regulations won’t allow it.

I think there could be some cool things related to reoccurring payments, interest and a few different ways different platforms could go about utilizing HBD. Just imagining that they could loan out x amount, have the HBD interest payouts set up as reoccurring payments in some way. Outside of HBD losing its value or interest rate tanking it’s like a guarantee they would get their money back.

The issue I keep running into is HBD deviates just a bit too much off $1 outside of our internet markets. The markets lose their minds when a stable coin is just 1 cent off in either direction or less.

The other issue is and why I feel many companies will not want to go near HBD is the US requirements for stable coins which is just utter insanity. While many will argue we are a decentralized community and such regulations can’t be enforced on us. Companies do not want to play in the sandbox like that.

People are so fearful of those requirements that I’m starting to see coins in different blockchain games try and register; along with, stay compliant with SEC of all things. At this point is just pure insanity when you just want to play a game and they require tax information about you. If that is the degree games are willing to go I hate to think what a Robinhood would do.

HBD just lacks checking off enough boxes for large companies that have had too many run-ins with the SEC to want to play with.

No one can find %20 interest for an instrument which is almost equal to $1. For this reason, I have kept up with transferring HBD into saving account.

That should tell u something about the risk involved. There is a reason we don’t see 20% APR all over place. It’s risky and don’t let anyone tell u otherwise unless they are paying u the difference in a situation the value dumps.

I compare the interest rate of USD in my country and that of HBD on HIVE.

Learned a lot ❤️😁

There is nothing we invest in that doesn't have it own risk. The risk can just be minimal at some point

3% apr is little or nothing for an establishment with a shakey reputation as Robinhood. I still wonder if people still actually put their funds in there in the first place .

!hivebits

3% APR in this inflated era for real? What a Joke! World really need to see what HBD offers!

!LOL

lolztoken.com

It is slowly coming back to me.

Credit: reddit

@geekgirl, I sent you an $LOLZ on behalf of @idksamad78699

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/1)

The joke unfortunately is people thinking they get 20% with almost no risk. It involves more then minimum risk indeed.

There's is indeed risk and always will be. Can't disagree with it.

Yep. 20% returns are never sustainable. Possible in a high growth market, but eventually things return to modest 3-5% returns.

I was tell people that currently now, HBD offers the best interest return when you consider other stablecoin competition out there

I think they might just do arbitrage on Hive! Although they might be doing that right now... 😅 !LOLZ

Why, earning 20% on HBD, you can even raise your percentage from 3 to 5%... 🤣

lolztoken.com

Because he Neverlands

Credit: reddit

@geekgirl, I sent you an $LOLZ on behalf of @stdd

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(2/4)

Not a chance, way 2 risky and they’d never be able to do that regulation wise. Would actually be horrible for HBD if any outlet like this tried that.

I agree, it's very risky. But I think a lot of people would be willing to take that risk for a lot of money.

!ALIVE

@geneeverett! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @stdd. (8/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

I agree for sure. It’s just odd to me so many claim there’s no risk.

Yes, there is always a risk. I remember so many times when the risk was 1%, and it happened... 😅 !LOLZ

lolztoken.com

I still can't figure out y.

Credit: reddit

@geneeverett, I sent you an $LOLZ on behalf of @stdd

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(1/4)

I think the main reason for Hive/HBD flying under the radar is just the sheer infromational overflow there is currently. So many projects with everyone saying that their is the best project in town... I think if we just continue to exist/persist we should get some traction.

It’s also when some look into it they see very high risk. 20% doesn’t come from things with low risk. Anyone saying otherwise is fooling themselves. Might still be worth it (although I would rather see it for Hive not HBD)

That's a joke 3% is ridiculous. Hive gives many times more !

With more risk but yes definitely more of a great rate 👍

Doing well

I think is a good and cool idea on paper. I doubt a big corporation will come to Hive for implementing and integrating this proposal.

They legally can’t.

I’m team Hive for life 🙌

But this is getting insane how people are claiming the 20% rate is totally safe. It’s not good for the Hive community longterm. Just being honest

Michael Saylor once said:

"If God came down and created perfect gold, he would create 21 million gold coins, put them on a network that you could move at the speed of light if you wanted to, and make it impossible for anyone to create any more gold. He’d make it impossible for a bank to steal your gold. He’d make it impossible for anyone to lie to you about how much gold they had in the vault. He’d make it completely transparent when he gave it to you. That’s what Bitcoin is. It’s digital gold designed with all of the attributes that we love about gold with none of the liabilities.”

Wrong! God already created HBD and it's absolutely risk-free with an APY of 20%!

😂😂😂😂😂😂😂😂😂

Many of your comments say HBD and 20% APR is very risky. I have considered many potential risks, but due to the mechanism how HBD works I tend to believe risks are lower compared to other investment options.

I understand that all investments have some risks. If you know some major risks feel free to share. Just offering 20% APR cannot be the risk. Because witnesses have been closely watching how HBD has been behaving. They will discontinue the APR the moment they see any harm to the Hive blockchain. This can happen in a matter of minutes.

Let the passion for the Hive emblem not confuse us, we have already seen other algorithm-based stablecoins collapse. Let's enjoy 20% and parity while it lasts and hopefully forever.

Regarding RobinHood, I don't know if it will bring prestige to Hive. I think we should look for better ways to do it.

Posted using Proof of Brain

Many investors will really like 3% but will always want it for an uninvested, You are right hive really made it look not attractive but i will speak for myself i like that percentage.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

If it's not double/triple digit ROI's... I don't want it lol

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

PIZZA Holders sent $PIZZA tips in this post's comments:

@torran(4/10) tipped @geekgirl (x1)

You can now send $PIZZA tips in Discord via tip.cc!

definitely would be wild to see HBD hit Robinhood

Posted Using LeoFinance Beta

why the project is so underrated baffles me honestly

😂🤙 yeah, ONLY 3% ROI? does that even keep up with inflation?? we are spoiled and it's great to have HIVE and HBD!

Dear @geekgirl,

May I ask you to review and support the Dev Marketing Proposal (https://peakd.com/me/proposals/232) we presented on Conference Day 1 at HiveFest?

The campaign aims to onboard new application developers to grow our ecosystem. If you missed the presentation, you can watch it on YouTube.

You cast your vote for the proposal on Peakd, Ecency, Hive.blog or using HiveSigner.

Thank you!

This is so informative, if Robinhood has the idea about hive it will benefit them wholesomely, in retaining their users because the 20 APR Is only paid by hive, they will only enjoy the benefit. Hive is great.

Posted Using LeoFinance Beta

Hello @geekgirl.

Really the HIVE world is a wonderful idea, in which we have many benefits, from the saving system to the healing system, taking into consideration what that represents in our accounts, constant income by many ways, and an economic solidity that is the best of all, you just have to trust and invest without fear this is the futuristic project of the Blockchain.

Always super interesting and informative info and content!

Thanks again. And again 😊

@davidjuniormugo - this human's content will interest you immensely since you're keen on learning more about crypto and the investing side of the blockchain.

Well worth following!

@nickydee Awesome! I am definitely going to check it out. 😎

😎