Six-digit ain't what it used to be

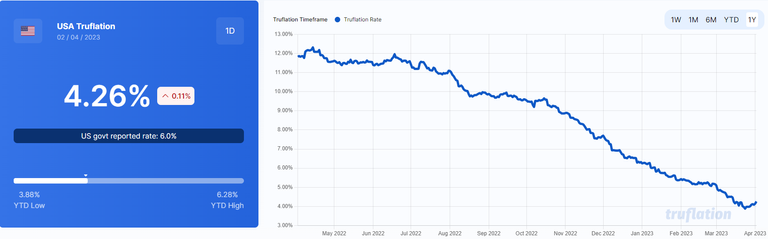

Truflation shows that the CPI is decreasing. Of course, that doesn't mean things are getting cheaper. Things went from a sizable inflationary jump to disinflation (that's still higher than the preferred 2%).

Near the beginning of this year, I came across this article on Bloomberg about people living paycheck to paycheck on over $100K salary in the US. Since I fall into this income category, I had to check it out.

Here's an archived version of the Bloomberg article.

The article cited that about 64% of Americans making over $100K/year lived paycheck-to-paycheck in 2022. This number came from a study done by Pymnts.com and LendingClub. Unfortunately, I could not find the exact definition of paycheck-to-paycheck used in the study through non-paywall options. So, I assumed the surveyors referred to people with little to no disposable income. Furthermore, I'm not sure where the cutoff for over $100K is.

If anyone is interested in diving deeper, you can try signing up for Pymnts' publications. It requires a valid business email. I'm not sure if I am willing to throw mine in there.

Once upon a time, I thought it would be nice to make $100-200K a year and live a comfortable life. Inflation in recent years has proved that to be a pipe dream. Your $100K doesn't have the same purchase power before the Feds printed trillions during the pandemic. Not to mention, I lose almost 40% of my income to taxes, benefits, etc. I live below my means, hence why I can put aside money each money into investments such as crypto, equities, and precious metals.

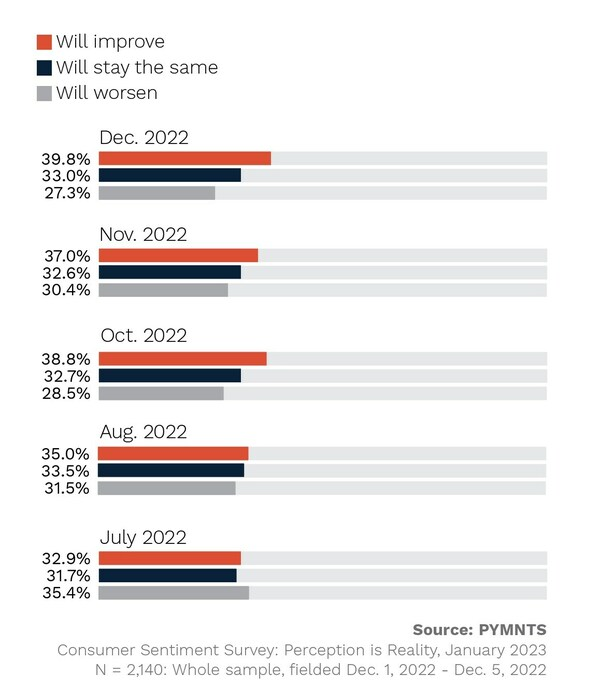

As living expenses become more expensive, I may have to scale back the money I put into assets. It doesn't help that new raises don't take effect until July, which slashes gains by half by default. I consider myself a pessimist. The Pymnt/Lending Club survey showed that the sentiments seemed to lean pessimistic over time.

Looking at recent world financial news, I bet the split is more pessimistic now. I'm a believer in being in control of your wealth. So, I try to self-custody as much as I can. Leave enough fiat to cover costs and emergencies.

Remember, not your keys, not your crypto. If you can't hold it, you don't own it.

Posted Using LeoFinance Beta

View or trade

BEER.Hey @enforcer48, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Add children into the mix and inflation pain is exponential. It's really starting to hurt now too. I often ask myself these days how others in worse situations than me and my family are getting by.

I do have one child, so I get the feeling.

I also legitimately don't know how people are getting by.

I think it will get worse. It's almost like a push to see how far they can take it without us getting onto the streets and burning shit down.

We should just do what the French do.

Off! Viz ze head!

Wages have not been keeping up with costs and I agree that things can only get worst. The politicians are out of their minds and theyaren't doing a great job of keeping faith in the dollar nor do they feel any qualms about spending money like crazy.

Posted Using LeoFinance Beta

Yeah, countries are already moving away from USD when they do bilateral trades with each other.