A step to return to the gold standard?

Some of you may have seen some news about de-dollarization and rising inflation as the excess greenbacks return home. What's interesting is to see what some states are doing to mitigate potential risks. I'm not here to argue with dollar worshippers. The stats speak for themselves. The fallout is always slow and then suddenly.

I found this article on Bitcoin.com. It would appear the State of Arkansas is making precious metals legal tender. Arkansas is not the first state that has moved in this direction. Oklahoma, Utah (where I live), and Wyoming all have legislations that state as much.

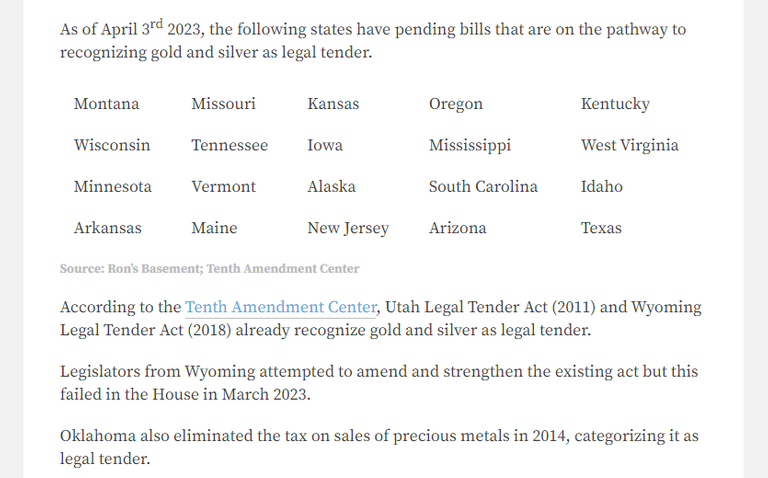

What's more interesting to me was visiting one of the sources cited by Bitcoin.com. The cited article from Invezz showed that similar initiatives exist among 23 states of the US.

As you can see, the 23 states include Oklahoma, Utah, and Wyoming. At a glance, most of the states on the list tend to lean more conservative. I was surprised that Oregon, Maine, and New Jersey have notions of protecting themselves against potential risks.

Some of the more titillating theories include lines of succession from the Union. I wouldn't go that far, but I believe there are sentiments to return to sound money in the US. No, I don't think this means the South will rise again. You can check out the map of the US during its civil war and see that's not the case.

Of course, the Federal Government still controls the monetary policy. At some point, chaos will ensue when the system breaks. For the states that have prepared, they might maintain some degree of legitimacy in their commerce. The more cynical voices claim that this doesn't change anything since states don't have that much power. Time will tell. Don't wait for things to hit mainstream media before you take action.

Again, this is no financial advice, but prepare for potential fallout. Take care.

Posted Using LeoFinance Beta

I have been thinking about this but would that mean that people aren't allowed to own as much gold as they want? I think there were limits on it before.

I have no idea about this limit. At least, not in my state.

Gensler enters the room and declares it a security

That would be pretty funny.

I keep adding silver slowly. I think its important to have some in case of emergency.

!PIZZA

No doubt. I'm with you on that.

$PIZZA slices delivered:

@dkid14(2/20) tipped @enforcer48

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

I've been watching this happen State by State wondering who will be left behind when finances really go from bad to worse.

Posted Using LeoFinance Beta

Would this be musical chairs or hot potato?

Chairs!

And to the Music of Rammstein

Posted Using LeoFinance Beta

That is quite a few states and I wonder if they have much gold in their reserves or not.

Posted Using LeoFinance Beta

We'll have to dig deeper to see. I doubt they will disclose the exact amount.

I definitely think people are getting tired of the government controlling everything. I think we are already seeing a move towards smaller government and hopefully in the end that will also lead to more acceptance of crypto.

I hope so.

Shits getting crazy but it's good to see some states trying to mitigate the risks perhaps they can persuade the federal government but I think we would need to see some more carange for them to take heed

Or, they might not take heed at all.

It might be a good idea to move to one of those states if you stack, I dont think FL. has this yet.

So far, Oklahoma, Utah, Wyoming, and Arkansas have it officially. The other 19 are still in progress.

If silver is recognized as "legal tender" does that make it taxable?

It would not have capital gains tax, but treated as currency.