Bitcoin Falls to Minimum Levels! While Trading Volume Reduces

Bitcoin (BTC) fell to $16,300 on Monday, its lowest price level since last November 29. The decline in the price of the first cryptocurrency coincided with a downward trend in the main shares, amid fears in the market about the continuation of the policies of more expensive credit by central banks.

The first cryptocurrency fell 1.9% on Monday, while ether, the cryptocurrency of Ethereum, fell 2.1% to USD 1,168. The S&P index fell this Monday for the fourth time and has depreciated 6.9% in the last 5 days.

In the last few hours, the bitcoin price recorded a recovery, confirming that the market continues with a significant volatility index. At the time of writing, bitcoin is trading at $16,799.

Following a rebound in the markets last week, following a moderate reduction in the US inflation figure, the latest interest rate hike by the US Federal Reserve pushed the price of bitcoin and equities lower. major stock indices.

Although the rate increase in the US was 0.5%, after four consecutive 0.75% increases, the Fed signaled that it would continue with rate increases at the beginning of 2023, in order to control inflation.

This dynamic of restricting monetary policy to reduce price increases is applied by many of the world's central banks. In Europe, interest rate increases are also being applied to restrict credit, in an anti-inflationary effort.

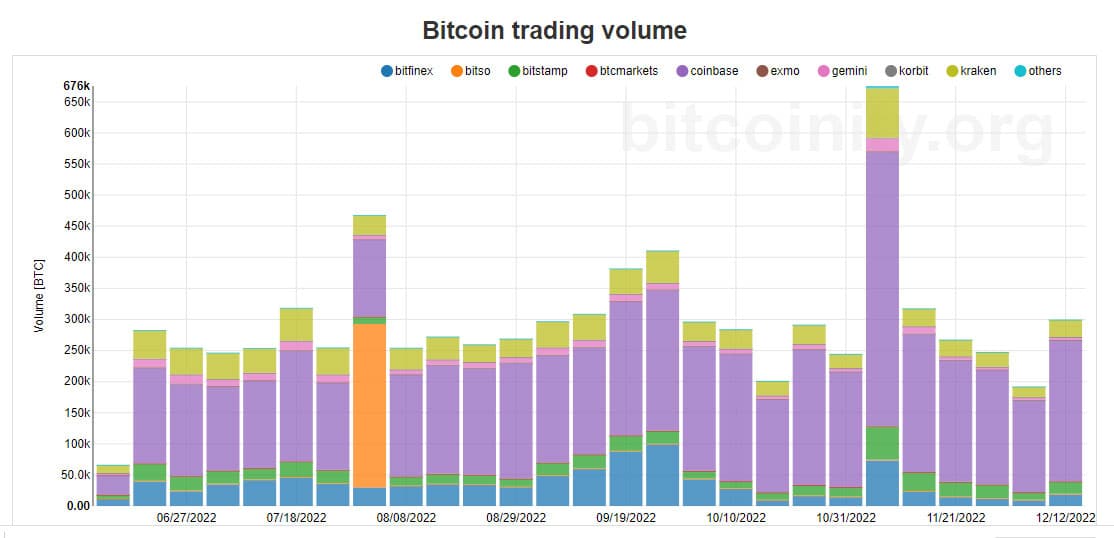

Bitcoin's weekly trading volume registered a notable increase in the second week of November, due to capital movements after the fall of FTX, according to figures from bitcoinity.org. That week, weekly bitcoin volume topped $650 billion, while volumes below $300 billion have dominated in subsequent weeks.

Cryptocurrencies have had a tough 2022. 13 months have passed since bitcoin's all-time high, and the price decline has been accentuated, both by the restrictive policies of central banks, as well as by the implosions of the Terra/Luna ecosystem and the recent FTX exchange debacle.

Analytical firm Ecoinometrics considers two scenarios. In the event that the price bottom has already been touched, the expected range for BTC's price in 2023 is USD 27,000 to USD 33,000. In the assumption that the bottom has not yet been reached, the estimated range is much more modest: $15,000 to $20,000.

Nice one but from your analysis do you suggest the market is controlled or influenced.

Congratulations @endrycelestial! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 4000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

So what?

Bitcoin is dead? Again ?!

Posted Using LeoFinance Beta