Three Peaks to Rule them ALL!

Technical analysis: the most shoddy guesswork ever.

When it comes to crypto, everyone likes to speculate. Why does everyone like to speculate? Ah yes, well, if we speculate goodly we can make millions of dollars within a single cycle, and who doesn't want millions of dollars? Greed is a driving economic force that we can not ignore. Ideally we'd like to see more abundance and generosity, but the world is far from ideal, is it not?

One of the major themes when it comes to crypto predictions is this idea of diminishing returns. As Bitcoin and alts grow in size they become harder to pump, and thus volatility decreases over time. Logistically and rationally this makes sense. This is how we've seen other markets play out so we project that outcome onto blockchain.

But that's the thing about Bitcoin, isn't it?

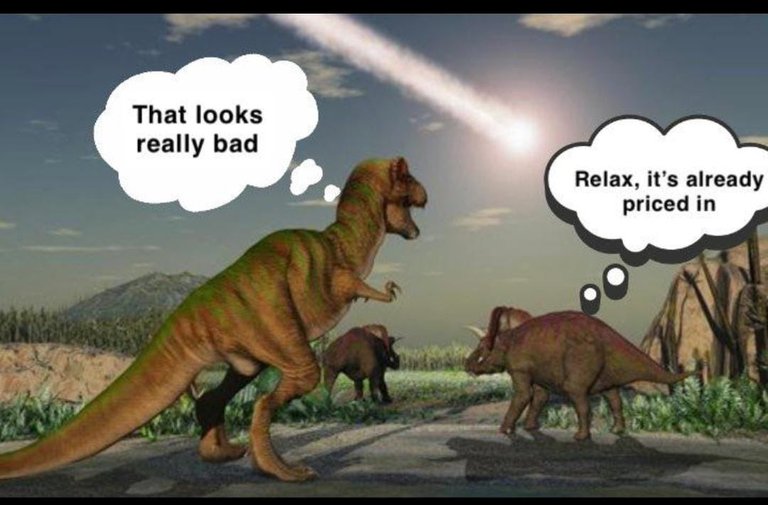

Crypto is a completely irrational unicorn sent from the heavens like an asteroid at the dinosaurs. We can not superimpose our old notions of legacy finance onto it. All attempts at doing so have failed miserably, and yet we keep doing it over and over expecting a different result. How many times does this technology need to throw us a curveball before we finally admit we don't understand it at all? The prideful will never submit. Only the penitent man shall pass.

There are many theories about what Bitcoin will do next, and derived from those theories we expect alts to perform similar movements, but even more exaggerated. In my opinion this is also a mistake; an unneeded abstraction and extra variable mucking up Occam's Razor. If you want to gamble it's better to avoid casting a wide net and instead focus on one or two convictions.

Popular Macro Theories:

- log curve

- stock-to-flow

- power-law

- s-curve

- super-cycle

But how much evidence is there really to support any given theory?

Well actually there's basically no evidence whatsoever. Bitcoin is a very new thing. To a person 15 years might be a long time but as far as history is concerned it's a spec of dust in the wind. There's a massive amount of relativity at play.

Here we have Bitcoin on a log scale going back to 2014.

And what does everyone want to know? Well, they want to know whereabouts the next peak is going to be so they know when to sell and buy whatever stupid thing they are going to buy with it #lambo. More responsible investors would like to take that and reinvest it into the bottom for a massive windfall over the next cycle. Every single macro price model under the sun that degens have dreamed up is derived from this chart, using this data.

Three halving events; Three peaks; Two insights.

So this idea that Bitcoin is slowing down, experiencing diminishing returns, and getting less and less powerful every cycle... where does it come from? It comes from the bare minimum amount of data possible: two. Just enough to connect one dot with another, and many people within the cryptocurrency space blindly accept this as the truth.

Of course I'm not claiming otherwise; just pointing out the obvious. These conclusions couldn't have any less evidence than they do now. There are three peaks, and there are only two differentials between those three peaks.

- 2013 >> 2017

- 2017 >> 2021

This is the basis and foundation of almost every price model and conclusion on a macro level. The model has to fit the data, and the data itself is almost non-existent because it's a 4 year cycle. The first four years don't even count because BTC started at a value of $0. Try to extrapolate that and Bitcoin has gone up infinity percent. It's a divide-by-zero error.

- 2013 peak ~$1000

- 2017 peak ~$20000

- 2021 peak ~$70000

Ah you see it must be true!

2013 to 2017 was an x20 but 2017 to 2021 was only an x3.5. Clearly 2025 will be even lower! Again a lot of people blindly believe this, but what is even the math on that? What will be the peak in 2025? $210k? That's a good x3 from the old peak. More than enough, yeah?

Not many are considering that going from x20 to x3.5 is a wildly volatile swing. They create a model that fits the data and draw a straight line to show this or that peak on the next cycle. But is anyone going to really be that surprised when every model gets destroyed next year and it does something random like an x10 to $700k? You shouldn't be. Just remember that it will always make perfect sense in retrospect and they'll just create another busted model to explain it away and try fail to guess the next top.

This is why trying to guess the top is a bit of a Fool's Errand. It's way to volatile and unpredictable and depends on a bunch of totally unknown variables. It's much easier to predict the bottom but even that can be tricky. To me it was obvious that when FTX collapsed and we only dipped from $20k to $16k that this was the absolute rock bottom... and I still sold a little Bitcoin there because I was forced to as a distressed seller like so many others. These things happen.

The absolute best is when traders try to employ technical analysis on a memecoin. I've gotten a couple calls right on Bitcoin this year and people started asking me to chart this or that random token that booted up yesterday. Are you guys serious? All that matters is if some dude with money randomly decides they are going to ape into the coin or not. The answer isn't in the chart. The secret ingredient: is crime. You can't insider trade the relative strength index.

Conclusion

Every macro price-prediction model for crypto is based on Bitcoin, and Bitcoin has only fully gone through 3 relevant cycles thus far. All these models are based on complete vapor while the people on social media shilling them pretend to be 1000% convinced as to the authenticity of the prediction. Why is that? Because social media rewards their arrogance, hubris, and embarrassing over-confidence. Because people are greedy and will follow their fearless leader off a cliff under the false premise of get-rich-quick. Ask yourself: when has anyone on social media ever made their followers rich in literally any scenario? I'll wait.

Beware the false prophets.

The interesting thing about Bitcoin is that while there are no top or bottom signals in terms of price targets there absolutely are top and bottom signals in terms of time (scarily accurate ones). Green Green Green Red. It's really not that hard if we just stick to the cycle and stop thinking this time is different.

What a hells goin on, told me when you will come to El Salvador and climb the Izalco volcano ehhhhhh.

Well is the harder volcano to climb in our country.

Jaaaaaaaaaaaa nice surprises see the photo jaaaaaaaaaaaaaaaaaa.

Well we hope hive will give to us a big surprises in this new bull run coming soon , we are here only waiting to change a little pennies to get our best played.

Excellent analysis

And then you add in, to our three peaks, that there was a lot of manipulation at that last peak.

Dumping all the Mt. Gox bitcoin to break the back of the bull.

So, we don't really have three peaks, or two points. We have a mess. A lot of messed up data.

I would like to sell high and buy low, but i am more afraid the bottom is going to fall out from under stable coins. Any minute, those things will be shown to be frauds. You literally cannot have that much cash sitting there.

My best guess at the price of bitcoin will be "how much of the previous financial system can get through the door into bitcoin, before the door is slammed shut"

Then, we divide that number by the amount of bitcoin that moves, and viola, price target.

Of course, bitcoin is going to become so valuable, that people will celebrate when their kids achieve their first full satoshi.

Thanks for mentioning this!

What I forgot to say in addition to this is that the 2021 run was also hugely affected by shutting down the entire world economy, and it was even more affected in the bear market via the proxy war/sanctions with Russia, 3AC, UST, and FTX. Using the last cycle as a data point is beyond acceptable.

This is so true and it always blows my mind off seeing so many people blindly following the suggestions of some self-proclaimed "experts", which just a few days before said the complete opposite of what they advertised the next day... it's like people want to believe in something, even if reality is clearly saying otherwise.

That's so true (sadly).

That's really not many data points to be trying to to determine what is going to happen. I'm lucky that my full time job allows me to be a bit aloof about all of this.

Yeah I think the real point I need to emphasize here is that everyone acts like it's a treasure trove of infallible information. The second Power-Law law gets invalidated these people are going to move to the next model and act like it has the exact same relevance as the last busted prediction. Get ready for many shouting "S-curve". "It's never coming back down because Blackrock is buying." ETC

Yeah, I have seen that in the past. It's not just BTC though. I have some people I follow and they are all hyped on some alts. I want to believe them because I hold those alts, but I know they are just grasping at straws as much as anyone else.

A lot of folks acting as btc prophets are just... average folks, maybe with a bit of finance background, but often without any data analysis background. Nobody who deals with large datasets would put a lot of stake into what we currently have, for exactly the reason you and others in the comments have mentioned - even the data we do have is a fucking mess, and unreliable at best.

!PIZZA

$PIZZA slices delivered:

@danzocal(3/10) tipped @edicted

This post is talking to me. Lambo fanboys can eat a dick

Hello edicted!

It's nice to let you know that your article won 🥉 place.

Your post is among the best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by keithtaylor

You and your curator receive 0.0239 Lu (Lucoin) investment token and a 6.42% share of the reward from Daily Report 468. Additionally, you can also receive a unique LUBROWN token for taking 3rd place. All you need to do is reblog this report of the day with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by @szejq

STOPor to resume write a wordSTART