WARNING! FTX is transforming into Celsius 2.0

This started a few days ago. The Whale Alert twitter account flagged a massive transaction of 22,999,999 $FTT, FTX´s own token, being moved in one transaction onto Binance. This of course led to mass speculation and a drop of roughly 10% in value for the $FTT token. It was later revealed by Binance CEO CZ that it was Binance who moved their tokens. But why, why now? Let us see if we can find out.

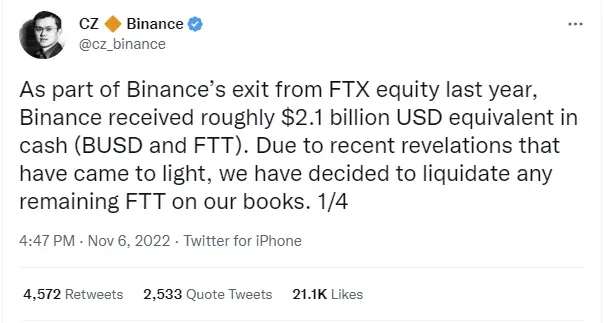

It starts with a tweet

This s the tweet and transaction that was the starting point for this whole thing. And if we simply take a look at the value of the tokens being moved we see it is close to $600 million dollars. And I can only say that people had every right to be pessimistic. That many tokens moved on to an exchange usually only been one of two things. A hard fork is coming and people are looking to cash in on the new token. Like we saw with the Ethereum and EthereumPoW fork that happened with the Merge earlier this year. Or someone is looking to liquify their assets in one big go. This would be why you bring them to an exchange with a big liquidity pool.

A little over a day after the transaction it was revealed that in fact, it was Binance themselves who moved their tokens. But they do plan to liquidate them. CZ also tweeted and said, "We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete".

Recent revelations

But what is this "recent revelation" that he mentioned in his tweet? This really piqued my interest and I started to dig a little deeper. And what popped up was some leaked financial document from Alameda Research one day before the big move of $FTT tokens. These documents showed that a large portion of the net equity or total assets of Alameda Research is made up of the $FTT token in one way or another.

It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token, -Cory Klippsten, CEO of investment platform Swan Bitcoin

In the financial documents, it is shown that the total assets of Alameda Research add up to $14.6 billion. Out of that, the largest single chunk is made up of $3.66 billion of “unlocked FTT”. The third biggest is a $2.16 billion pile of “FTT collateral”, meaning loans against the FTT tokens. Normally this would not raise many eyebrows. But...

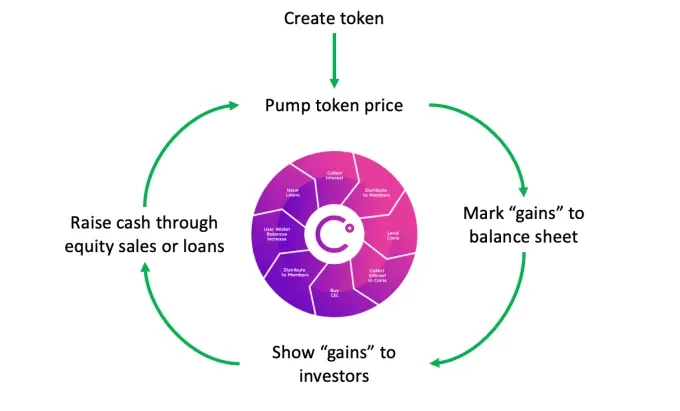

This has then led people to start looking a little deeper. Scratch the surface to see how the facade is looking underneath. What they have found has let them make comparisons to Celsius, in more ways than one. Both their business model and the fact that they might very well be insolvent. The first comparison is to how the Celsius business model worked. The flywheel model as they like to call it.

And when they looked at the $FTT token you will see that 93% of the tokens are held by only 10 addresses. And in my book that is a huge red flag. This means very few dictate and control everything surrounding the $FTT token. And there currently are a total of 197 million FTT tokens worth $5.1 billion in circulation. And now we can start to see the similarity to Celsius and how their business model worked.

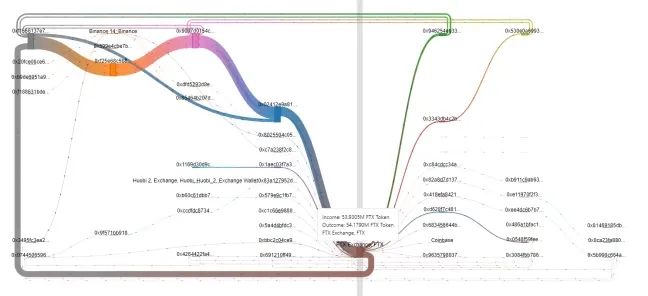

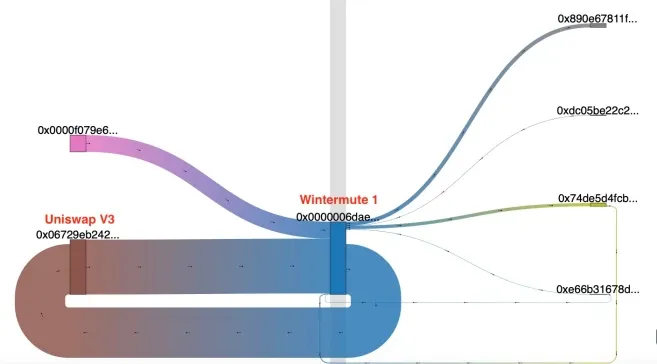

But maybe the $FTT token has a high volume of trade, meaning a lot of people are buying and selling it constantly. Meaning that few tokens are used to do the work of many. Well, good thing that they have taken a look at the $FTT token transaction of the past 30 days. It is looking like this.

That sure does look like most of the tokens are moving in a circle. That is strange. That is not what you would expect if there was a large volume of organic trade and demand. But I do think I have seen something very similar to this. Let me see if I can find it for you. Ah, there we go.

This is the trade pattern of the $CEL token, yes the very same that Celsius issued. It looks very familiar, right? Tokens move in a circle, making it look like there is a large volume of trading going on. If anything it looks like FTX has taken the model to the next step. This is by actually being the very exchange that the trades are taking place on. Meaning those pesky transaction fees just disappears. Man, I am actually getting dizzy trying to follow the trades round and round.

Back to the insolvency. The reason put forth for this is simple. If you control the majority of the thing that you say have a certain value. Do they really have that value? If push came to shove and Alameda Research was forced to cash out their big pile of $FTT tokens who is going to buy them, and for what? And that is the big elephant in the room.

The $FTT tokens go around in a circle, this is then used to show demand for the token to get investors to put money in. Inflating the value of the token. and you take the tokens for a spin again, doing the same thing over and over. Inflating the balloon more and more for every spin. Al while you use the invested money to cash out.

But what, there is more

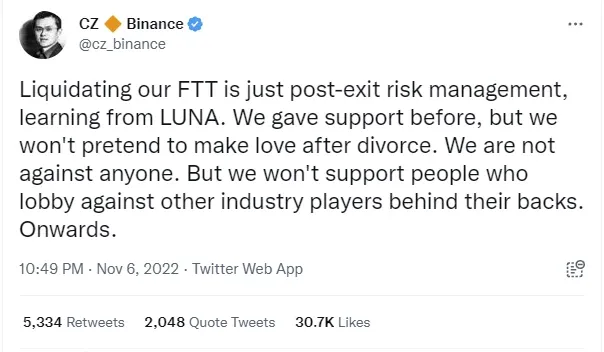

There does however appear to be more to the story than FTX being Celsius 2.0. Even if that is hard to believe. On November 6th CZ tweeted about how this was a precautionary step, a lesson learned from the $LUNA crash. But he then also hints at something more.

To me, this looks like CZ is saying that they do not want to be stuck holding a gigantic bag of useless tokens a second time around when it all comes crashing down. But he also more or less is saying that FTS has been talking crap about Binance to others. Or to be precise, "lobby against other industry players behind their backs". This can of course can mean a myriad of different things.

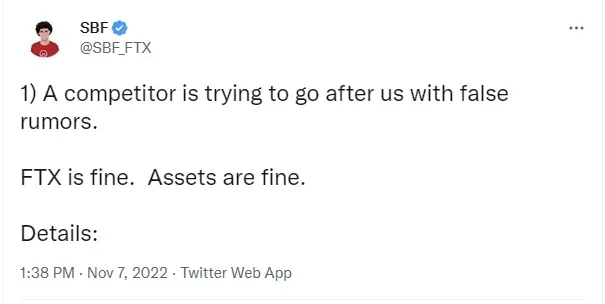

CZ however has tried to downplay Binance's action to some degree. And by the look of things, he is very much equating getting rid of the $FTT tokens to taking out the trash. But on the other side FTX´s CEO, Sam Bankman-Fried is putting on a brave face in a series of tweets. They start off by doing a copypasta of Celsius and Machinskys tweets in the days leading up to the collapse. Raising perhaps one of the biggest red flags.

He then ends the series of tweets by more or less saying sorry CZ can you please come back, because they desperately need that sweet Binance money. At least that is what I read in the last tweet from SBM. "4) I'd love it, @cz_binance, if we could work together for the ecosystem.". Yes, please Binance come back with your money, not because we need it. No, no, but for the good of the ecosystem. Well to me the best thing for the ecosystem is to get rid of the parasites.

I do hope that you do not have your life savings tied up in $FTT tokens or crypto on the FTS platform. If you do I would give that some serious thought. But of course, each to their own, not financial advice and do your own research and all that good stuff. Yes, yes, sorry I had to put it in there, I could not keep myself. =)

I will link to the posts where I got the information if you want to review it in your own time. Links are found below in the order they are used (to the best of my ability at least).

What are your thoughts on this? Do you still have faith in FTX? Or do you think we are in for yet another crash? Or perhaps something different? Please share your thoughts in the comment section down below. If you would like to support me and the content I make, please consider following me, reading my other posts, or why not do both instead.

See you on the interwebs!

Picture provided by: https://pixabay.com/

Resources

- https://twitter.com/whale_alert/status/1588896207795011585

- https://twitter.com/cz_binance/status/1589283421704290306

- https://www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance-sheet/

- https://twitter.com/MikeBurgersburg/status/1588481507412279296

- https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

- https://dirtybubblemedia.substack.com/p/anatomy-of-a-fake-market

- https://twitter.com/cz_binance/status/1589374530413215744

- https://twitter.com/cz_binance/status/1589375382155067393

- https://twitter.com/SBF_FTX/status/1589598289120309248