Bitcoin ETFs, are they the key that unlocks the $1.000.000 Bitcoin price?

What is the likely scenario for Bitcoin after the much-hyped Bitcoin EFTs launch and become open for business? That is the $1.000.000 question on everyone's minds these days. And it seems like with most things, people's opinions on this differ widely. Previously I have written about how trade analyses and their predictions matched the cost-to-mint analyses of a miner. You can read that post here if you missed it. This time I thought I would share the prediction of Samson Mow, CEO of Jan3.

Samson Mow, CEO of Jan3

The company has been inspired by the message left by Satoshi Nakamoto, the creator of Bitcoin, in the Genesis Block: “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks.” and their goal according to their website is as follows: "Our mission is to Accelerate Hyperbitcoinization by building Bitcoin infrastructure and increasing accessibility to Layer 2 technologies like Lightning and Liquid for people all around the world. By onboarding and aligning incentives with a wide range of stakeholders, we can transition more quickly to a Bitcoin Standard, preventing societal strife while facilitating widespread prosperity.". And they see the current time as the opportune time to "act and establish a more equitable, transparent, and efficient economy based on a Bitcoin Standard.".

Make sure to follow Samson Mow and Jan3 on Twitter/X for the latest happening in the exciting world of Bitcoin. Samson Mow´s handle is @Excellion and you will find Jan3 under @JAN3com.

Bitcoins' future after an approved ETF

To get the cat out of the base, as the saying goes, he is predicting a Bitcoin rally that will see the Bitcoin of today rocket up by over 20x. Or to put it bluntly, he predicts we will hit a $1.000.000 Bitcoin in a very short time after the ETFs are approved. And by now you are either scratching your head or checking the hopium container for leaks. But let us take a look at his reasoning, and maybe we can get a better understanding of why he thinks Bitcoin will hit the magic $1.000.000 mark.

Mow talked about his prediction and reasoning in the interview he did with Cointelegraph a few days ago. I recommend watching it as it is an interesting listen.

One of the big factors that would make this possible is the scarcity of Bitcoin. You might wonder what I am talking about, as over 19.5M out of the 21M bitcoins already are minted. How scarce can it be? The truth is that while there are that many Bitcoins in circulation. The vast majority of Bitcoins are in what is known as LTH, or Long Term Holding.

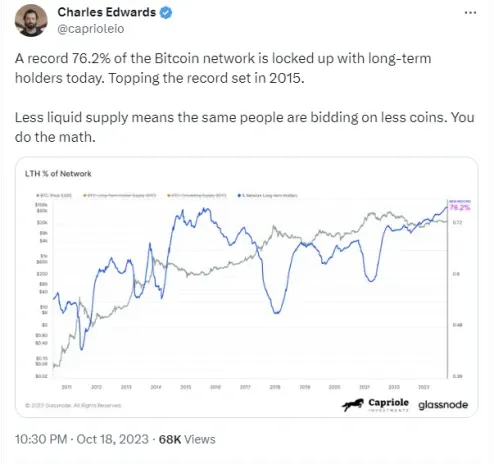

If we take a look at the new record that was recently archived, it shows that a massive 76.2% of all minted Bitcoins currently are in LTH. You are probably wondering how LTH is defined, and the short answer is Bitcoins that have not been moved for 155 days or more. The long and slightly complicated answer can be found here, or below.

That only leaves 23.8% of the 19.5M Bitcoin or roughly 4.6M Bitcoin being held in Short Term Holding. If we then take a look at the amount of Bitcoins that are held by exchanges we see that the actual number of Bitcoins that are readily available to be traded is even smaller, 1.830.727,86. That means that while there are over 19.5M Bitcoins minted, only just over 9% of them are currently available to be traded.

This means that if the supply were to drop or the demand increases the amount of available Bitcoin that is up for trade will decrease. And it will cause the price to go up. And if we now take a look at what will happen when the Bitcoin ETFs get approved, if they get approved that is. Is that out of nowhere, tens of billions of dollars will come in trying to buy as much Bitcoin as they can. And does this sound like it fits with either of the two things that can cause the price to go up? Well yes. It will increase the demand, and unless this demand gets satisfied by new Bitcoin replacing the one being sold. This in turn will cause a decrease in the supply of Bitcoins.

That means that the institutional money that most likely would buy Botcoin after a Bitcoin ETF approval would affect both the supply and the demand. Or as Mow put it "it is basically supply shock multiplied by demand shock and that gives you price shock". Meaning we most likely will see a sharp uptick in price. Historically the supply constraint made by the Halving has been the catalyst for the bull run cycle Bitcoin has had. And what brought on the new all-time high, is the FOMO of Bitcoin increasing in price, people seeing this and not wanting to miss out. These two things over time, have been the main driving forces behind the Bitcoin bull runs previously. I talk about this in more detail in my post here.

I'm ready for the Bitcoin ETF to get approved, are you?

What makes this ETF event special is the fact that a lot of the ETF applications will be processed by the SEC in a very short span of time. As they all applied within days of each other. And it might be that the SEC will choose to give their answers to all of them simultaneously, to try and not give anyone an advantage over its competitors. And that would unlock all the institutional money more or less all at once. This a sentiment that Bryan Armour, director of passive strategies research for North America at Morningstar also echoes, saying; "I would expect them to rule on spot ETFs holistically because most issuers are taking similar approaches ... There are a lot of good signs that the SEC is taking the most recent batch of filings more seriously,". Morningstar, Inc. is an American financial services firm.

Mow also mentions the fact that Bitcoin has previously had rallies of this size. But he also makes a point of saying he does not believe the past will predict the future when asked about Bitcoin's history of less and less increasing with every past market cycle. He is merely saying there is a president of a similar rally happening. Not that it will or will not based on history.

My thoughts on the $1M Bitcoin

While I agree with more or less everything that Samson Mow said. The one thing I have to say I am not sure to what extent the influx of capital will drive up the price. That it will drive up the price I do not think is up for debate. But let us try and see if some numbers can help. Sometimes they do sometimes they do not.

With the current market cap for Bitcoin sitting at $843.197.000.000, we can see that an influx of $20.000.000.000 compared to that is not that big of a deal. But therein lies the tricky part. I would argue that we only really can compare it to the market cap of the Bitcoin that is in the exchanges. So let's do that.

With the 1.830.727,86 Bitcoin currently sitting in exchanges, with a price of $43.000 it will then give us a market cap of $78.721.000.000. I then compare that to the presumed $20 billion we see that with that price they could buy up ~25% of the available Bitcoins in the exchanges. Sadly it is above me and my current ability to figure out how much of an impact that would have on the price. But the smaller and less liquid the market is, the bigger the impact will be.

Then there is also the X factor, also known as The Crypto Multiplier. This is something I have talked about previously in some of my posts. It is not something I fully grasp and am able to compute. But I can at least explain the concept of it. As I am well familiar with that. Normally when you you invest or buy something, this will lead to an equal increase in that thing's value. This however does not hold true for cryptocurrencies. What they have found is that when people hold cryptocurrency as an investment, rather than use it as payment. This leads to a leverage effect being applied to money put in, as well as taken out. In short, to get the full effect of the money that would come with the approval of the ETFs you would have to multiply it with the crypto multiplier. At least that is the idea of it. I will link to the research paper below if you want to read up on it.

In short, I think that what Samson Mow is saying is correct. And he has not even taken the crypto multiplier into account, in support of his belief that Bitcoin will hit $1M, given the approval of the ETFs. But whether he is correct about the exact number I am not sure. But the fact that we might have this ETF rally leading into the halving event in late April, we can be in for a wild ride. And we might enter a new Bitcoin gold rush for the miners as a result. They are already apparently doing very well thanks to the increase in gas prices that has followed in the wake of the Bitcoin Ordinals becoming very popular.

I would really like to hear what your thoughts are on this topic. Do you believe the Bitcoin ETF will impact the price, and if so to what degree? Is $1M just a pipedream and nothing more at the current times? Or perhaps you do not even think the ETFs will get approved? Please sound off in the comment section below.

If you would like to support me and the content I make, please consider following me, reading my other posts, or why not do both instead.

https://medium.com/@bo.daniel.jensen

See you on the interwebs!

Picture provided by: https://pixabay.com/, https://unsplash.com/

Resources

Congratulations @daje10! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 11000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!