The Truth About the Real Crisis

In 2008, the financial world went through a major reset following the subprime mortgage crisis and the collapse of Lehman Brothers. Since then, we have seen the beginning of 4-year financial cycles, which coincide curiously with the US elections and the Bitcoin Halving.

The Truth About the Financial Crisis and How to Protect Your Money

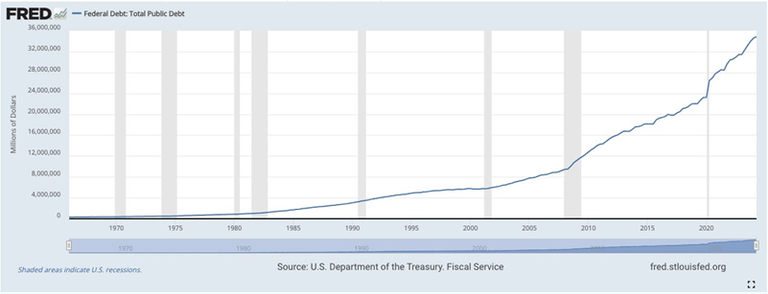

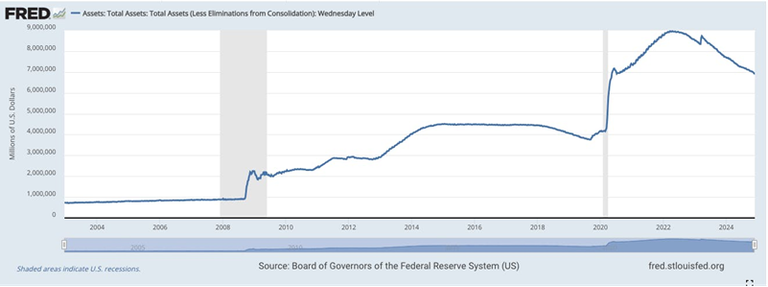

These cycles are the result of a combination of exponential increases in government spending and unconventional monetary policies by central banks. Governments have increased their debts in unprecedented amounts, while central banks have created money “out of thin air” in extraordinary volumes to buy back those same debts. This process, known as Quantitative Easing (QE), is clearly visible in the Fed’s balance sheet.

This phenomenon was not restricted to the US, the largest global economy, but was replicated around the world.

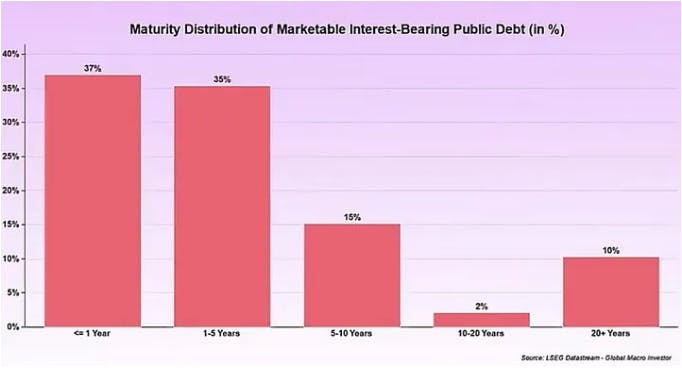

Why 4 year cycles?

This period reflects the average duration of the US public debt, as illustrated below. According to Lyn Alden, "nobody can stop this train" — in other words, the escalation of US public spending is practically inevitable.

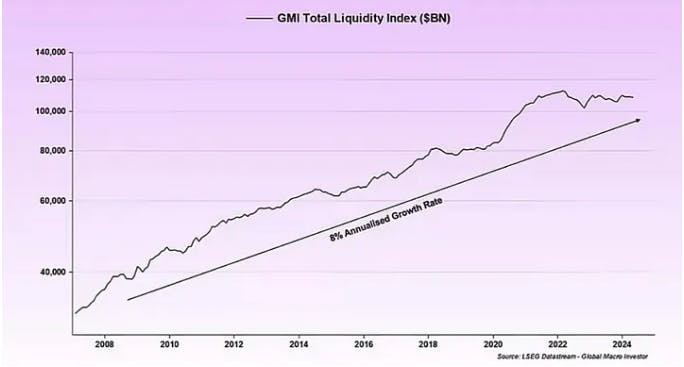

In this scenario of fiscal dominance, interest rates lose relevance compared to the importance of government spending and the purchase of bonds by central banks. Since 2008, the direct result has been the vertiginous growth of global liquidity, driven by the increase in the M2 monetary aggregate, a metric that reflects the creation of money by central and commercial banks in countries such as the US, China, Japan, the UK, the European Union and the BRICS.

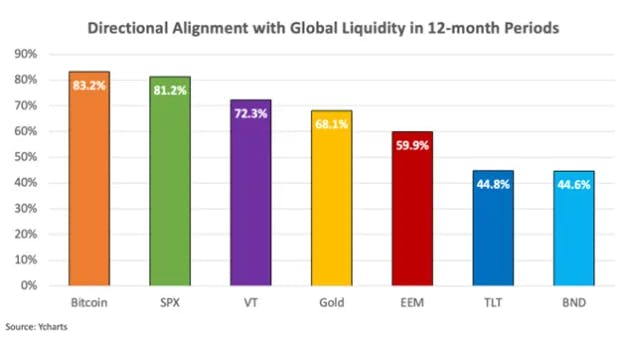

To preserve purchasing power, a dollar portfolio needs to grow at least 11% per year, considering an average inflation rate of 3% (CPI) in the US and the growth of global M2. However, few assets can consistently outperform this level for more than a decade. Among traditional assets, only a few US technology stocks, such as $NVDA, $TSLA, $AAPL, $MSFT, $META, $GOOGL and $AMZN, have outperformed M2. In the cryptocurrency universe, the asset that most correlates with global liquidity is Bitcoin.

Bitcoin and the global scenario

Below we demonstrate the strong correlation between Bitcoin’s price in USD and global M2 liquidity (represented in blue) since 2012. This chart covers the world’s largest central banks, including the US, EU, China, Japan, UK, Brazil, and others.

On the other hand, for those who keep a large part of their assets in R$, the challenges are even greater. Since 2008, the real has lost 75% of its value against the dollar. According to the main ETF of the Brazilian Stock Exchange traded in the USA, our stock exchange lost 73% of its value in dollars in the same period.

Posted Using InLeo Alpha