Ordinals: The Bitcoin Network NFTs

NFTs continue to have considerable volume even during the Bear Market. Therefore, they offer good opportunities for those who are willing to do a lot of research and take some risks. The first collections were released on the Ethereum network, but they soon made their way to most of the other networks out there, including the Bitcoin network.

The first theories about the creation of “NFTs” (is that the name?) on the Bitcoin network were created around 2012, and in 2015 there were already some collections being launched, but never with the great public interest that we saw in recent weeks .

Ordinals - the NFTs of the Bitcoin network

The Bitcoin network has seen a very important increase in its transactions recently, most of them related to the newest trend in the crypto universe: Ordinals, Digital Artifacts, Inscriptions, or just NFTs from the Bitcoin network. But why did they attract so much interest?

We will understand their history, how they work, the differences in relation to the NFTs on the Ethereum network and what are their advantages and specific characteristics. By learning about them you can decide whether or not you want to get involved.

The story behind the Ordinals

Since 2014, it has already been possible to use a function called OP_RETURN to individualize Satoshis (Bitcoin fractions), making them distinguish themselves definitively. This solution was used to create collections such as Rare Pepes and Magic-the-gathering-sort-of cards (Spell of Genesis).

Although it was disruptive at the time, the solution did not generate that much interest, mainly because it depended on a kind of side-chain, a project called Counterparty. So the inscriptions were not inserted into the Bitcoin blockchain, but in parallel, making investors a little suspicious.

The Ordinals protocol

The first time a solution to create non-fungible tokens on the Bitcoin network was proposed was in 2012 at the Blockchain Forum. But it took more than ten years and some network updates for programmer Casey Rodarmor to create a stable and secure protocol that applied the theory raised there.

He prefers not to call the tokens created from his protocol NFTs, but digital artifacts. They were also nicknamed inscriptions, which means inscriptions in Portuguese, for the way they are recorded on the blockchain. But the truth is that the term NFTs (non-fungible tokens) is quite comprehensive and more than enough to describe them.

The tools used

To record the data on the blockchain, the Ordinal protocol uses a tool known as SegWit (segregated witness consensus layer), brought by an update carried out on the network in 2015. It allowed more transactions to be inserted in each block by reducing their size, dividing them in two parts.

In addition, the protocol also took advantage of Bitcoin's Taproot upgrade, which allowed multiple signatures and transactions to be grouped together on the network, making the verification process faster, more private, and more secure in the long run.

How the Ordinals protocol works

To create an NFT, it is necessary to permanently mark a token on the network, giving it a unique identity that individualizes it and ensures that it is not confused with any other token. The Ordinal protocol achieves this by marking a numerical position of a given token within the transaction block.

That's why they are called ordinals. Its identity is directly related to its order within a logic inscribed in the block.

And indexed to the tokens are also recorded all the data referring to that NFT. This is a big differential in relation to the technologies used to create NFTs in other networks.

Combining the two tools, SegWit and Taproot, it was possible to enter a much larger volume of data in a single transaction. So the tokens are not only individualized, but carry with them all the content assigned to them, recorded directly on the network up to a limit of 4MB for each NFT.

Ordinals Explosion

The new technology has fallen in love with NFT degenerates. In a short time, numerous collections were created and some tokens were already sold for amounts in excess of 200,000 dollars. On February 9th alone, over 20,000 Ordinals were mined, breaking the network's record.

And another record was broken a few days later. On February 12th, over $90,000 was paid in network fees just for minting Ordinals tokens. These impressive numbers are catching the attention of more and more investors and the interest in Bitcoin NFTs is only increasing.

Advantages over other NFTs

The popularity of Ordinals has a lot to do with the fact that they are new, of course. In the speculative market of NFTs, new trends are always of great interest, as they reflect opportunities for quick gains. But it is also based on two specific advantages they have over other NFTs.

Low transaction cost

One of the biggest problems for users of the Ethereum network, where the most valuable and popular collections are located, is the very high value that transactions can have. Especially when there is a large volume of transactions, the gas fee charged to mint or transfer an NFT can exceed even the value of the NFT itself.

In the Ordinals protocol this does not happen. Thanks to the optimization of transactions brought about by the updates that made their creation possible, they require the payment of very low fees when compared to those charged on the Ethereum network.

All data on-chain

The other advantage is linked precisely to the fact that all the data of an NFT Ordinal are allocated within the blockchain. The NFTs that are created on the Ethereum network and other networks that use EVM technology, the on-chain information is just an indication of where the data can be found.

It refers to a position in a decentralized database that is not allocated on the blockchain, the IFPS (Interplanetary File System), which is like an external HD where the metadata of an NFT is stored. While this architecture is considered secure, it is not as secure as writing all data within a block on the network.

Criticism and Disadvantages

But there are also criticisms of Ordinals. For various reasons, mainly Bitcoin maximalists are quite dissatisfied with the new trend, and many of them have become fierce critics of the novelty.

Network distortion

First of all, those who are more attentive to the basic principles of Bitcoin brought by Satoshi Nakamoto are against all kinds of NFT. According to them, digital currency should only be used to replace real money, not to create a new category of voluptuous goods.

Increase in fees

Bitcoin users also have a far more practical concern. Although hosting all data on-chain is a very interesting differential of Ordinal NFTs, it causes a significant increase in the size of processed blocks.

This is because, in most cases, transactions do not occupy all of the available 4MB. But that could change with the popularization of NFTs on the Bitcoin network. Inserting more and more information in the blocks can make operations carried out on the network much more expensive and time consuming, which displeases those who want to use Bitcoin as a currency.

Be careful when venturing

Regardless of your position on the criticisms and praise that can be leveled at Ordinals, it is possible that you would be interested in speculating with them. But it is very important that you are very careful. Being a very recent technology, they are still subject to great risks.

At the moment there is no marketplace or platform that makes buying and selling them safer, although several are already being built. To purchase one, you'll need to join a collection's Discord server and make the purchase via an OTC operation, where there's no guarantee and you need to pay for the item first.

Furthermore, if you send the satoshi in which your Ordinal is indexed to another wallet in which there are others of them, there is a high possibility that it will be lost forever. So you need to create a new address for each Ordinal and be very careful with your NFT if you don't want to be without it.

Collections for you to discover

If, with everything you've seen so far, you're still interested in getting to know the NFT Ordinals collections better, let's show you some of the options available. But be very careful! Do not take unnecessary risks and check the information several times before making any transactions.

Ordinal Punks

One of the most unique and popular collections to date is a spin off of the famous Crypto Punks from the Ethereum network. The Ordinal Punks are a collection of 100 NFTs from the Bitcoin network whose values can exceed $300,000. Imagine spending that much money on a collection whose token ownership is tracked in a Google spreadsheet.

Bitcoin Rocks

Another curious derivation is the Bitcoin Rocks collection, which is a version of the famous Ethereum Rocks collection. Some of the stones are listed with values in the tens of millions of dollars.

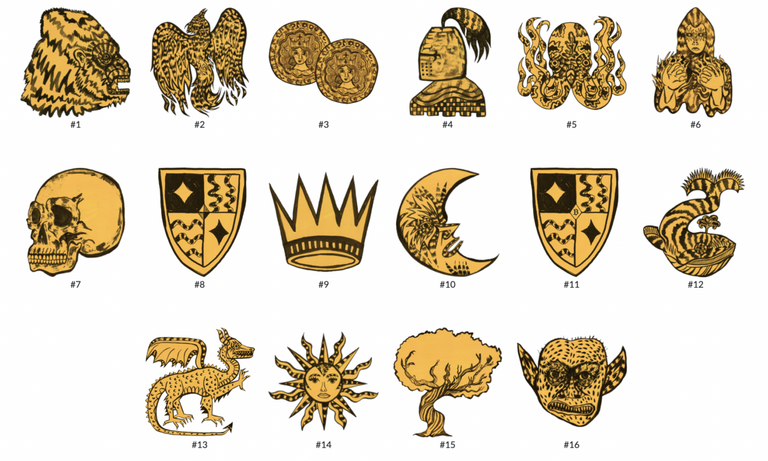

Insignia

Insignia is a collection with no Discord, no website and no way to contact the founders and monitor development other than Twitter. There are only 16 tokens that can only be traded directly with the founders and for that you will need a little patience, as the demand is high.

Keep an eye out but don't take too many risks

The fact is that the collections of Ordinals are moving fortunes. The insecurity and uncertainties about their future have not stopped the boldest investors from buying and selling their tokens in risky operations.

Of course, you can greatly reduce your risk by trading with well-known and reputable agents, within monitored environments, and by taking great care. So you can embark on this new trend, and who knows, make money. But like any investment where there is the possibility of an astronomical appreciation, the risks are very high.

So do your own research, use a fresh wallet and do a lot of research before choosing an Ordinal token to buy.

My opinion

The subject is controversial and there are many differing opinions out there.

I am excited about Ordinals in Bitcoin as they make it easier to enter data into the blockchain.

This is something that was once limited to technically savvy people but is now accessible to everyone.

Ordinals also help to take advantage of space that has often been underutilized on the network, which is good for the ecosystem as a whole.

Game theory dictates that if people are willing to pay more to record and transfer arbitrary data on the blockchain than to make financial transactions, the network will regulate itself. This is also beneficial for miners as they can collect more fees and keep their interest in mining high by increasing network security.

At the end of the day, it's a win-win situation.

Posted Using LeoFinance Beta

https://leofinance.io/threads/@cryptosimplify/re-leothreads-hpwmp

The rewards earned on this comment will go directly to the people ( @cryptosimplify ) sharing the post on LeoThreads.

What an interesting blog , thanks for sharing..

I'm glad that you like it

https://twitter.com/1276003421938692101/status/1628490391824605185

The rewards earned on this comment will go directly to the people( @cryptosimplify ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Bitcoin following the trends!